| News | |||||||||||||||||||||||||||||||||||||||||

|

Home |

|||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||

Year End Review: Highlights of the Major Acheivements of the Department of Financial Services (DFS), Ministry of Finance |

|||||||||||||||||||||||||||||||||||||||||

| 15-12-2015 | |||||||||||||||||||||||||||||||||||||||||

Department of Financial Services (DFS), Ministry of Finance is a nodal department as far as banking and insurance sector in the country is concerned. In the current fiscal, Department of Financial Services has taken various initiatives and launched different Financial Inclusion & Social Security related Schemes in its pursuit of achieving the goal of Universal Financial Inclusion. The major achievements of the Department during the Current Fiscal are as follows : 1. PRADHAN MANTRI JAN DHAN YOJANA (PMJDY) : "Mera Khata - Bhagya Vidhaata"

The biggest financial inclusion initiative in the world was announced by the Prime Minister on 15th August 2014 and Mega launch was done by him on 28th August 2014 across the country. This National Mission on Financial Inclusion has an ambitious objective of covering all households in the country with banking facilities and having a bank account for each household. It has been emphasized by the Prime Minister that this is important for including people left-out into the mainstream of the financial system. The Government started the PMJDY to provide 'universal access to banking facilities' starting with "Basic Saving Bank Account" with an overdraft upto ₹ 5000 subject to satisfactory operation in the account for six months and RuPay Debit card with inbuilt accident insurance cover of ₹ 1 lakh . Achievements

Pradhan Mantri Jan - Dhan Yojana

|

|||||||||||||||||||||||||||||||||||||||||

|

Bank Name |

RURAL |

URBAN |

TOTAL |

NO OF RUPAY CARDS |

AADHAAR SEEDED |

BALANCE IN ACCOUNTS |

% OF ZERO-BALANCE-ACCOUNTS |

|---|---|---|---|---|---|---|---|

|

Public Sector Bank |

8.39 |

6.80 |

15.20 |

13.46 |

7.03 |

21450.31 |

34.54 |

|

Regional Rural Bank |

2.99 |

0.50 |

3.49 |

2.51 |

0.98 |

4683.38 |

32.09 |

|

Private Banks |

0.44 |

0.29 |

0.73 |

0.64 |

0.23 |

1149.36 |

41.10 |

|

Total |

11.82 |

7.60 |

19.41 |

16.61 |

8.24 |

27283.06 |

34.31 |

2. PRADHAN MANTRI MUDRA YOJANA (PMMY) : “ FUND THE UNFUNDED”

In the Union Budget 2015-16, the Finance Minister proposed to create a Micro Units Development Refinance Agency (MUDRA) Bank. Pradhan Mantri Mudra Yojana (PMMY) has been launched by the Prime Minister on 8th April, 2015 to provide formal access to credit for Non –Corporate Small Business Sector. Any Indian Citizen who has a business plan for a non-farm sector income generating activity such as manufacturing, processing, trading or service sector and whose credit need is less than10 lakh can approach either a Bank, MFI, or NBFC for availing of MUDRA loans under Pradhan Mantri Mudra Yojana (PMMY).

Categories of loans:

- Loans upto ₹ 50,000 - Shishu

- Loans above ₹ 50, 000 and upto ₹ 5.0 lakh - Kishore

- Loans above ₹ 5.0 lakh and upto ₹ 10 lakh - Tarun

MUDRA Card is an innovative credit product wherein the borrower can avail of credit in a hassle free and flexible manner. Public Sector Banks have been allocated a total target of ₹ 70,000 crore, and private sector/ Foreign Banks a target of ₹ 30000 cr. The RRBs were given a target of ₹ 22000 crore. All together, the target for loan disbursement under PMMY for F.Y 2015-16 is fixed at 1,22,000 crore.

Achievements

- Total Amount disbursed under PMMY- ₹ 45948.28 crore as on 25.11.2015.

- Total No of borrowers-66,00,241

- Women borrowers-23,50,542

- New Entrepreneurs- 3286094

- SC/ST/OBC borrowers- 2201944

- Total Mudra Card issued - 198499

- No of Shishu Loans have nearly gone-up nearly six fold (from 7.2 lac to 47 Lac) and the amount disbursed shows a 283% hike. (from ₹ 1835 Cr. to ₹ 7046 Cr.)

- In the Kishore loan category, disbursements have increased by 91% (from ₹ 8156 Cr. to ₹ 15704 Cr.)

- In the Tarun Loan category, disbursements have increased by 21% (from ₹ 7851 Cr. to ₹ 9501 Cr.)

JAN DHAN SE JAN SURAKSHA

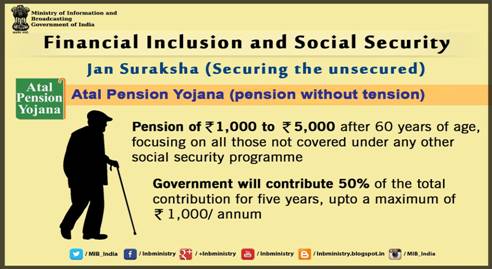

3. ATAL PENSION YOJANA (APY)

The Government of India has introduced a pension scheme called the Atal Pension Yojana (APY), with effect from 1st June, 2015, pursuant to the announcement in the Budget for 2015-16 on creating a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector. APY is being administered by the Pension Fund Regulatory and Development Authority (PFRDA) under the overall administrative and institutional architecture of the National Pension System (NPS).

APY is being operationalised through CBS enabled Banks. Public Sector Banks, Private Sector Banks, Regional Rural Banks, Apex Cooperative Banks and District Central Cooperative Banks have already started the process of mobilization and registration of the subscribers’ under Atal Pension Yojana.

Achievements:

A total of 10.35 lakh subscribers have been enrolled under the Scheme as on 24.11.2015.

4. PRADHAN MANTRI SURAKSHA BIMA YOJANA (PMSBY)

The Pradhan Mantri Suraksha BimaYojana (PMSBY) is a one year personal accident insurance scheme, annually renewable offering coverage of Rs. two lakh for death or permanent total disability and Rs. one lakh for permanent partial disability due to an accident. It is available to people in the age group of 18 to 70 years.

- —Subscription material made available in all regional languages.

- —An exclusive website www.jansuraksha.gov.in created by DFS with all relevant material / information, including forms, FAQs etc.

- —State wise toll free numbers allotted to respond to queries of the customers.

Achievements

- Gross enrolment reported by Banks is 9.16 crore under PMSBY as on 24.11.2015.

- —Under PMSBY the share of Public Sector Banks (including RRBs) is 93.2%.

- As on 23.11.2015, 1491Claims were registered under PMSBY, 740 have been disbursed.

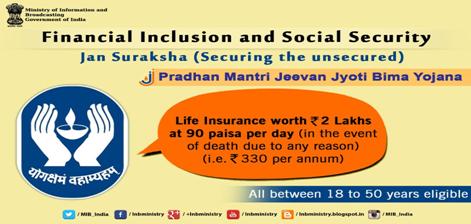

5. PRADHAN MANTRI JEEVAN JYOTI BIMA YOJANA (PMJJBY)

The Pradhan Mantri Jeevan Jyoti BimaYojana (PMJJBY) is a one year life insurance scheme, annually renewable offering coverage of Rs. two lakh for death due to any reason and is available to people in the age group of 18 to 50 years (life cover up to age 55 on payment of premium after enrolment up to age 50 years).

- — Subscription material made available in all regional languages.

- — An exclusive website www.jansuraksha.gov.in created by DFS with all relevant material / information, including forms, FAQs etc.

- — State wise toll free numbers allotted to respond to queries of the customers.

Achievements

- —Gross enrolment reported by Banks is 2.86 crore under PJJSBY as on 24.11.2015.

- —Under PMJJBY the share of Public Sector Banks (including RRBs) is 91%.

- As on 23.11.2015, 8558 were registered under PMJJBY, 5955 have been disbursed.