| News | |||

|

|

|||

TAX FIGURES FOR NOVEMBER, 2016 |

|||

| 9-1-2017 | |||

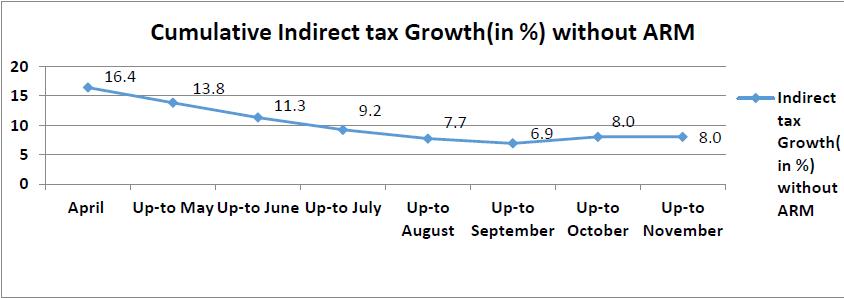

INDIRECT TAX 1. The figures for indirect tax collections (Central Excise, Service Tax and Customs) up to November 2016 show that net revenue collections are at ₹ 5.52 lakh crore, which is 26.2% more than the net collections for the corresponding period last year. Till November 2016, 71.1% of the Budget Estimates of indirect taxes for Financial Year 2016-17 has been achieved. 2. As regards Central Excise, net tax collections stood at ₹ 2.43 lakh crore during April-November, 2016 as compared to ₹ 1.69 lakh crore during the corresponding period in the previous Financial Year, thereby registering a growth of 43.5%. 3. Net Tax collections on account of Service Tax during April-November, 2016 stood at ₹ 1.60 lakh crore as compared to ₹ 1.27 lakh crore during the corresponding period in the previous Financial Year, thereby registering a growth of 25.7%. 4. Net Tax collections on account of Customs during April-November 2016 stood at ₹ 1.48 lakh crore as compared to ₹ 1.40 lakh crore during the same period in the previous Financial Year, thereby registering a growth of 5.6%. 5. During November 2016, the net indirect tax (with ARM) grew at the rate of 23.1% compared to corresponding month last year. The growth rate in net collection for Customs, Central Excise and Service Tax was 16.1%, 33.7% and 15.5% respectively during the month of November, 2016, compared to the corresponding month last year. However, the total indirect tax collection (with ARM) for the month of November 2016 showed a decline of 13.9% over October 2016 figures. 6. The net indirect tax collection up-to November, 2016 shows a growth of 26.2% (with ARM) and 8.0% (without ARM) over the corresponding period of previous year. This growth rate up-to October, 2016 was 26.7% (with ARM) and 8.0 % (without ARM). 7. The month-wise cumulative indirect tax growth trends (without ARM) in FY 2016-17 is shown below.

|

|||