| News | ||||||||||||||||

|

|

||||||||||||||||

FM: In last three years, the present Government restored the credibility of the Indian Economy and the Government, introduced market mechanism based decision making process and eliminated the Government discretions among others |

||||||||||||||||

| 1-6-2017 | ||||||||||||||||

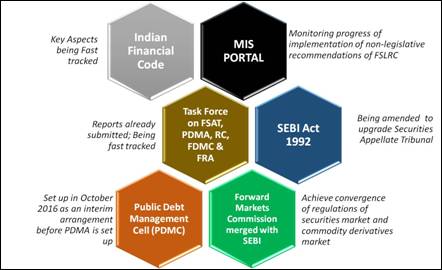

The Union Minster of Finance, Defence and Corporate Affairs, Shri Arun Jaitley said that after the present NDA Government came to power in May, 2014, it has been able to restore the credibility of the Indian Economy and the Government which was at its lowest ebb due to serious charges of corruption and indecisiveness during the earlier UPA regime. The Finance Minster Shri Jaitley further said that the three major achievements of the present NDA Government in the last three years include credibility of taking decisions, even difficult decisions, drastic changes in the earlier Governance system which led to corruption, and making the market mechanism as the basis of the Government decision making and eliminating the Government discretions in the process of decision making and overall governance. The Union Finance Minister Shri Arun Jaitley was making his Opening Remarks at a Press Conference in the national capital today organized to highlight the key initiatives and achievements of the different Departments of the Ministry of Finance & Defence in the last three years i.e. 2014-15 to 2016-17. Speaking further on the occasion, the Finance Minister, Shri Jaitley said that another major contribution of the present Government was clear direction in decision making, creating an atmosphere for the growth of the economy at large so that it is ensured that the benefits of the growth accrue to the poor and underprivileged section of society in particular. Another major achievement of the present Government was Foreign Direct Investment (FDI) Reforms as a result of which India was the largest recipient of FDI in the world, especially in the last two years i.e., 2015-16 and 2016-17. The Finance Minister said that despite the low private investment, FDI along with public investment played an important role in investment cycle. The Finance Minister said that the present Central Government also took special care to strengthen the State Governments by allocating more funds to them as per the recommendations of 14th Finance Commission. The Union Minister of Finance and Derfence, Shri Jaitley further said that the present NDA Government created a federal institution (GST Council) based on federal taxation i.e. Goods and Services Tax (GST) which is now at the last stage of its implementation. Shri Jaitley said that this will be a historical indirect tax reform which will bring transparency, simplicity and efficiency in the tax administration. Shri Jaitley said that the present Government also implemented JAM (Jandhan, Aadhar Mobile) Trinity based financial inclusion system under which a law relating to Aadhar was enacted so that resources are optimally utilised by plugging the leakages and eliminating the underserved category of beneficiaries. Highlighting the major decision of the present Government relating to demonetization, the Finance Minister Shri Jaitley said that it has helped the Government in three ways, i.e., firstly by having greater movement towards digitization of transactions, secondly, helped in widening of the tax payers base which contributed to increase in the revenue collections by more than 18% during 2016-17 and thirdly, sending a strong message that it is no longer safe to deal in cash. The Finance Minister said that demonetization has established a ‘new normal’. Highlighting other achievements of the present Government in the Financial Sector, the Finance Minister Shri Jaitley mentioned about Operation Clean Money, constitution of Monetary Policy Committee (MPC) and enactment of Insolvency and Bankruptcy Code among others, He said that these have brought transformational changes in the Indian economy. Shri Jaitley further said that we are conscious of various challenges including resolution of Public Sector Banks’ NPAs, challenge of how to increase private sector investment and the uncertainty in the global economic situation among others. Shri Jaitley also highlighted the achievements of the present Government in Defence Sector which include implementation of long pending One Rank One Pension (OROP) Scheme for the retired defence personnel, putting New Defence Procurement Policy in place and encouraging Defence Manufacturing within the county, balancing both public and private sector manufacturing in defence sector and Strategic Partnership Policy to supplement FDI among others. Shri Jaitley concluded his Opening Remarks by stating that the manner in which defence acquisitions were cleared during the last three years of the present Government is incomparable to inaction during the previous regime in this regard. Along with the Union Minister for Finance, Defence and Corporate Affairs, Shri Arun Jaitley, the Press Conference was also attended by both the Ministers of State for Finance, Shri Santosh Kumar Gangwar and Shri Arjun Ram Meghwal; Finance Secretary, Shri Ashok Lavasa; Revenue Secretary, Dr. Hasmukh Adhia; Ms. Anjuly Chib Duggal, Secretary (DFS) ; Shri Tapan Ray, Secretary (Economic Affairs & Corporate Affairs), Shri Neeraj Kumar Gupta, Secretary (DIPAM); Shri A.K. Gupta, Secretary, Defence Production; Dr. Arvind Subramanian, Chief Economic Adviser (CEA) and Shri Ravi Kant, Additional Secretary (Defence) among others. Further details with regard to the key initiatives and achievements of the five different Departments under the Ministry of Finance, Government of India during the last three years (2014-15 to 2016-17), are highlighted below: A. Department of Economic Affairs Today, India is one of the bright spots among the major countries in the subdued global economic context. India recorded a growth of 7.1 % in 2016-17, 7.9 per cent in 2015-16, as compared to 7.2 per cent in 2014-15 and 6.5 per cent in 2013-14. Predictions by expert agencies suggest that India’s growth rate is set to improve further in 2017-18. In terms of the Global Competitiveness Index (GCI) prepared by World Economic Forum for 138 countries, India ranked 39 in 2016-17, as compared to India’s rank in GCI of 60 (among 148 countries) in 2013-14. 1. Withdrawal of Legal tender character of old currency notes of ₹ 500 and ₹ 1,000: A historic decision of the present NDA Government led by the Prime Minister Shri Narendra Modi was the withdrawal of the legal tender character of old ₹ 500 and ₹ 1,000 currency notes on 8th November, 2016.This resulted in curbing the menace of black money, corruption, bringing informal sector in to formal one resulting in wider tax base and above all, in digitization of economy among others. 2. Micro and Macro Indicators of Indian Economy are becoming stronger & stronger year after year: The fiscal situation of India has become comfortable, with Fiscal Deficit as a ratio of GDP steadily declining from 4.5 per cent in 2013-14. Fiscal deficit of the Government of India as a ratio of GDP was 4.1 per cent in 2014-15, 3.9 per cent in 2015-16 and 3.5 per cent for 2016-17 (Revised Estimate). The fiscal deficit is budgeted to be 3.2 per cent of GDP in 2017-18. The present Government took charge in May 2014 in the backdrop of persistently high Inflation, particularly the food inflation. Astute food management and price monitoring by the Government in the last three years helped control the stubbornly persistent inflation. The average CPI (combined) inflation declined from 9.5 per cent in 2013-14 to 5.9 per cent in 2014-15 and 4.9 per cent in 2015-16. It declined further to 4.6 per cent in the current financial year, upto February 2017 and stood at 3.7 per cent in February 2017 backed by sharp fall in food inflation. Food inflation based on consumer food price index (CFPI) which was in double digits during 2012-2014 declined to 6.4 per cent in 2014-15 and 4.9 per cent in 2015-16. It declined further to 4.4 per cent in the current financial year, upto February 2017 and stood at 2.0 per cent in February 2017. India’s Trade Deficit was highest at US$ 190.3 billion in 2012-13. However, it declined by 13.8 per cent to US$ 118.7 billion in 2015-16 which was lower than the level of US$ 137.7 billion in 2014-15. During 2016-17 (April-February), trade deficit decreased to US$ 95.3 billion as against US$ 114.3 billion in the corresponding period of the previous year. FDI Reforms: FDI upto 49% is allowed on automatic route in Defence Sector. FDI reforms were also undertaken in the Insurance Sector (49% under automatic route instead of earlier up to 26%), Pension Sector (upto 49% under automatic route instead of earlier provision which stipulates up to 26% FDI on automatic route), Pharma (74% FDI is allowed on automatic route and beyond it to 100% on approval route), Civil Aviation (100% FDI is allowed under automatic route in Brownfield Airport projects), Animal Husbandry (FDI in Animal Husbandry (including breeding of dogs), Pisciculture, Aquaculture and Apiculture is allowed under 100% FDI even in uncontrolled conditions), Single Brand Retail Trading (Local sourcing norms has been relaxed for up to 3 years and a relaxed sourcing regime for another five years), Broadcasting Carriage Services (In Cable Networks (with MSOs and other MSOs), Teleports, DTH, Mobile TV, HITS sectors, 100% FDI is allowed on automatic route) and Plantation (FDI upto 100% is allowed on automatic route in Coffee, Rubber, Cardamom, Palm oil tree and Olive Oil Tree Plantations in addition to tea plantations). Inflow of Foreign Direct Investment increased from US$ 43.6 billion 2013-14 to US$ 51.8 billion in 2014-15 and further to US$ 59.5 billion in 2015-16. During 2016-17 (April-December), net FDI was US$ 31.2 billion as compared to US$ 27.2 billion in 2015-16 (April-December).The FDI in India during 2016-17 was highest in the world, even higher than in China. India’s external sector position has been comfortable, with the Current Account Deficit (CAD) progressively contracting from US$ 88.2 billion (4.8 per cent of GDP) in 2012-13 to US$ 22.2 billion (1.1 per cent of GDP) in 2015-16. On a cumulative basis, the CAD narrowed to 0.7 per cent of GDP in April-December 2016 from 1.4 per cent in the corresponding period of 2015-16 on the back of the contraction in the trade deficit. Foreign Exchange Reserves touched an all-time high level of US$ 371.9 billion in end-September 2016. The current position is at a comfortable level to cushion the exchange rate volatility from any international macroeconomic uncertainty. 2. A Monetary Policy Framework Agreement between the Government and the Reserve Bank of India (RBI) was signed on 20.2.2015, providing for flexible inflation targeting. With a view to maintaining price stability, while keeping in mind the objective of growth, the Reserve Bank of India Act, 1934 (RBI Act) has been amended by the Finance Act, 2016, to provide for a statutory and institutionalised framework for a Monetary Policy Committee (MPC). 3. The Insolvency and Bankruptcy Code, 2016 was passed by Parliament on 11th May 2016 and published in the Official Gazette on 28.5.2016. The Code aims to promote entrepreneurship, availability of credit, and balance the interests of all the stakeholders by consolidating and amending the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner and for maximization of value of the assets of such persons and matters connected therewith or incidental thereto. Major benefits include: 1. Early detection of stress in a business; 2. Initiation of the insolvency resolution process by debtor, financial creditor or operational creditor; 3. Timely revival of viable businesses; 4. Liquidation of unviable businesses; 5. Minimization of losses to all stakeholders; and 6. Avoiding destruction of value of failed business 4. Financial Sector Legislative Reforms: Initiatives were taken for speedy implementation of the recommendations. Some achievements are: 1. An MIS software/portal for monitoring progress of implementation of non-legislative recommendations of FSLRC was inaugurated by Finance Minister on 15.5.2015 2. Task Force for creating a sector-neutral Financial Redress Agency (FRA) as announced in Budget Speech 2015-16 that was set up on 5.6.2015 submitted its report on 30.6.2016. 3. The Forward Markets Commission has been merged with Securities and Exchange Board of India (SEBI) with effect from 28.9.2015 to achieve convergence of regulations of securities market and commodity derivatives market. 4. Key aspects of the Indian Financial Code (IFC) are being fast tracked. 5. Government has set up a Public Debt Management Cell (PDMC) on 6th October, 2016, as an interim arrangement before setting up of a full-fledged independent and statutory debt management body, namely, Public Debt Management Agency (PDMA) of India.

Financial Sector Legislative Reforms B. Department of Revenue A. Aggressive steps were taken against the menace of Black Money. Some of the more significant ones include: 1. The very first decision of the Cabinet in May 2014 was the constitution of a Special Investigation Team (SIT) on Black Money 2. The period 2014-17 saw unprecedented enforcement actions in Direct and Indirect Taxes. A total of 23,064 searches and surveys have been conducted detecting more than ₹ 1.37 lakh crore of tax evasion. The Enforcement Directorate (ED) intensified its Anti Money Laundering (AML) actions by registering 519 cases attaching properties worth ₹ 14,933 crore. 3. During the last three financial years (2013-14 to 2015-16), IT investigations led to detection of more than 1155 shell entities involving non-genuine transactions of more than ₹ 13,300 crore. 4. Operation Clean Money a. The Union Minister of Finance, Shri Arun Jaitley, launches Operation Clean Portal; Will enable citizen engagement for creating a tax compliant society and transparent tax administration b. Operation Clean Money Phase I: 18 lakh persons identified; More than 9.72 lakh taxpayers submitted online responses for 13.33 lakh accounts involving cash deposits of around ₹ 2.89 lakh crore c. 5.68 lakh new cases identified for e-verification process. 5. One Time Compliance Window: There was a one-time compliance window of 3 months providing an opportunity to taxpayers to make declarations of their undisclosed foreign assets. 648 declarants filed declarations upto 30.09.2015 disclosing undisclosed foreign assets worth ₹ 4164 crores. An amount of about ₹ 2476 crore has been collected as tax and penalty in such cases. 6. Benami Transactions (Prohibition) Act: 17.92 lakh persons identified as of mid-Feb 2017 Achievements under Benami Transactions (Prohibition) Amendment Act, 2016

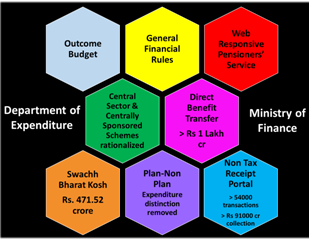

*As of mid-February, 2017 7. Black Money Act a. In order to curb the flow of black money stashed abroad, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (the Black Money Act) has been enacted. b. The Black Money Act has stringent provisions, which inter-alia include that an offence of willful attempt to evade tax shall be a predicate offence under the Prevention of Money Laundering Act, 2002. c. A total of 648 declarations involving undisclosed foreign assets worth ₹ 4164 crore were filed under the one-time compliance window provided under Chapter VI of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (the Black Money Act) 8. The Income Declaration Scheme, 2016 a. The Income Declaration Scheme, 2016 (the Scheme) was an important step by the Government to rein in undisclosed income & assets. The Scheme commenced on 1.6.2016 and was open for declarations up to 30.9.2016. b. The Scheme has been a major success as it resulted in declaration of ₹ 67,382 crore by 71,726 declarants. 9. Pradhan Mantri Garib Kalyan Yojana a. In the wake of declaring specified bank notes as not legal tender, and in order to discourage people from finding illegal ways of converting their black money into black again, vide the Taxation Laws (second Amendment) Act, 2016, the Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016 (the Scheme) has been introduced. b. The Scheme commenced on 17.12.2016 and was open for declaration upto 31.03.2017. Goods and Services Tax (GST) – rollout from July 01: The 14th GST Council Meeting held in Srinagar on 18th and 19th May, 2017, approved the rates for Goods and Services. As on mid-May 2017, 60.5 lakh taxpayers out of 84 lakh have been already enrolled. Enrollment would be re-opened for 15 days from 01st June, 2017. Out of 62,937 tax officials, 24,668 tax officials have been given hands-on training; remaining to be trained by 15th June, 2017. 3200 taxpayers from Centre, States and UTs to get hands-on experience of GST System software in a pilot from 02nd to 16th May, 2017. The major benefits of the this historic reform in the history of Indirect Taxes include a. Decrease in Inflation due to Reduction in Cascading effect of Taxes and an Overall Reduction in Prices b. Ease of Doing Business due to Common National Market as well as Benefits to Small Taxpayers c. Decrease in “Black” Transactions due to Self-Regulating on line Tax System and GST been designed as a Non-Intrusive and transparent Tax System d. More informed consumer due to a more Simplified Tax Regime as well as Reduction in Multiplicity of Taxes e. Poorer States to gain due to GST being a destination based Tax and Abolition of CST f. Make in India boost through Zero Rated Exports and Protection of Domestic Industry - IGST The Centralized Processing Center (CPC) of Income Tax Department has processed over 4.19 Cr Income Tax returns and issued over 1.62 Cr refunds till 10th February 2017. This can be compared to 4.14 Cr Income Tax returns and 1.61 Cr refunds for the full year in FY 2015-16. The amount of Refunds issued till 10th February 2017 was ₹ 1.42 Lakh Cr which is 41.5% higher as compared to the same period last year. Taxpayers also reposed faith in CBDT’s e-filing program by filing a whopping 4.01 Cr e-Income Tax returns in till 10th February 2017 representing an increase of over 20% over the previous year. In addition, over 60.05 lakh other online forms were filed with an increase of nearly 41% compared to the previous year. The figures for indirect tax collections (Central Excise, Service Tax and Customs) up to February 2017 show that net revenue collections are at Rs 7.72 lakh crore, which is 22.2% more than the net collections for the corresponding period last year. Till February 2017, about 90.9% of the Revised Estimates (RE) of indirect taxes for Financial Year 2016-17 has been achieved. As regards Central Excise, net tax collections stood at ₹ 3.45 lakh crore during April-February, 2016-17 as compared to ₹ 2.53 lakh crore during the corresponding period in the previous Financial Year, thereby registering a growth of 36.2%. Net Tax collections on account of Service Tax during April-February, 2016-17 stood at ₹ 2.21 lakh crore as compared to ₹ 1.83 lakh crore during the corresponding period in the previous Financial Year, thereby registering a growth of 20.8%. Net Tax collections on account of Customs during April-February 2016-17 stood at ₹ 2.05 lakh crore as compared to ₹ 1.94 lakh crore during the same period in the previous Financial Year, thereby registering a growth of 5.2%. During February 2017, the net indirect tax grew at the rate of 8.4% compared to corresponding month last year. The growth rate in net collection for Customs, Central Excise and Service Tax was 10.9%, 7.4% and 7.6% respectively during the month of February 2017, compared to the corresponding month last year. C. Department of Expenditure Under Direct Benefit Transfer (DBT), an amount of ₹ 1,02,786.77 crore has been paid using Public Financial Management System (PFMS) in various programmes of Government viz. MGNREGA, NHM and food subsidy etc. till February 2017 for more effective and transparent utilisation of resources. General Financial Rules (GFRs), 2017 were released by the Union Finance Minister Shri Arun Jaitley on 7th March, 2017 to enable an improved, efficient and effective framework of fiscal management while providing the necessary flexibility to facilitate timely delivery of services. The distinction between plan and non-plan expenditure has been done away with and consequently the appraisal of non-plan expenditure through Committee of Non Plan Expenditure (CNE) has been done away with.

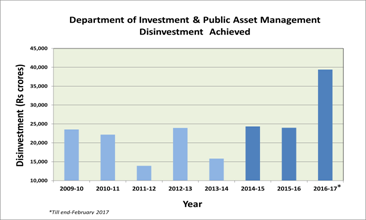

The number of Central Sector Schemes (CSS) was brought down to 300 from around 1500 earlier, and the number of Centrally Sponsored Schemes was brought down to 28 from 66 earlier. This has enabled us to better allocate our existing resources and improve the efficiency of government programmes. In order to ensure faster realization of Government revenue, other than Direct & Indirect Tax receipts, a Non-Tax Receipt Portal was inaugurated by the Union Finance Minister, to provide a one stop window to citizens, corporates and other users for making online payments of Non-Tax Revenue payable to Govt. of India. So far more than 54,000 transactions have been done using this portal, leading to a collection of ₹ 91,017 Crores. D. Department Of Investment and Public Asset Management (DIPAM) Disinvestment Performance: The total disinvestment achieved in the last three years (2014-15 to 2016-2017) was ₹ 87,714 crore as against ₹ 53,670 crore in the previous three-year period. The average yearly realization of ₹ 29,238 crores during the period between 2014-15 to 2016-17 (last 3 years) vis-à-vis ₹ 19,873 crore for the period between 2009-10 to 2013-14 (5 years) represents an increase of 47%.

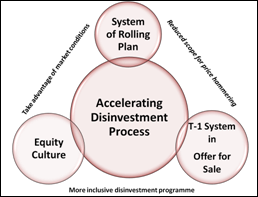

A system of Rolling Plan has been brought-in, replacing the earlier system of annual plans, wherein shares are readily available for transactions, to take advantage of the market conditions without any loss of time and with an element of surprise for the market players. This helps in minimizing the price hammering during disinvestment of CPSEs.

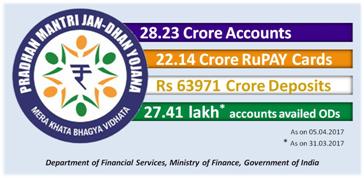

Central Public Sector Enterprises (CPSE) Exchange Traded Fund (ETF): The Government launched a Further Fund Offer (FFO) of the CPSE ETF Scheme. Overall, the issue got oversubscribed by 2.30 times – ₹ 13,802 crore worth of applications were received as against the maximum issue size of ₹ 6,000 crore. The number of Retail applications was 2,70,712 (approx. 7 times the Retail applications received during first tranche held in March 2014), with corresponding value of ₹ 2,465 crore. This was one of the largest retail offering (Government / Private) in capital market in last few years. The Government realized an amount to the tune of ₹ 6000 crore through this offer. Time-bound listing of CPSEs on Stock Exchanges: DIPAM has issued circular dated 17.02.2017 on the mechanism and procedure, along with a list of activities with indicative timelines, for time bound listing of CPSEs by all the Administrative Ministries/Departments. This will enable unlocking the true value of the company and promote ‘people’s ownership’ by encouraging public participation in CPSEs, making them accountable to its shareholders. E. Department of Financial Services (DFS) Banking Regulation (Amendment) Ordinance, 2017: The promulgation of Banking Regulation (Amendment) Ordinance, 2017 will lead to effective resolution of stressed assets, particularly in consortium or multiple banking arrangements. The Ordinance enables the Union Government to authorize the Reserve Bank of India (RBI) to direct banking companies to resolve specific stressed assets. The RBI has also been empowered to issue other directions for resolution, and appoint or approve for appointment, authorities or committees to advise banking companies for stressed asset resolution. Merger of SBI Associates with SBI: Cabinet in its meeting on 15.02.2017 has approved the proposal for merger of 5 State Bank associates with State Bank of India (SBI) and the same has been notified in the Gazette of India on 22.02.2017. This will lead to better management of high-value credit exposures common to SBI and Associate Banks, as there would be single, more focused oversight and control over cash flows of large corporate borrowing entities instead of separate and independent monitoring and more effective management of stressed or Non-Performing Assets (NPAs). The Government infused a sum of ₹ 25000 crore in 19 Public Sector Banks during financial year 2015-16. Further, With the approval of Hon’ble FM, the capital allocation plan for FY 2016-17 was finalized in which capital of ₹ 22915 crore was allocated to 13 PSBs, out of which 75 % (Rs. 16414 crore) was infused upfront. An amount of ₹ 10,000 crore has been proposed for Re-capitalization of PSBs for the Financial Year 2017-18. Pradhan Mantri Jan Dhan Yojana (PMJDY): The deposit base of PMJDY accounts has expanded over time. As on 05.04.2017, the deposit balance in PMJDY accounts was ₹ 63,971 crore in 28.23 crore accounts. The average deposit per account has more than doubled from ₹ 1,064 in March 2015 to ₹ 2,235 in March 2017. 22.14 crore RuPay cards have been issued under PMJDY. The average number of transactions per Bank Mitra, on the Aadhaar Enabled Payment System operated by Bank Mitras, has risen by over eightyfold, from 52 transactions in 2014-15 to 4,291 transactions in 2016-17.

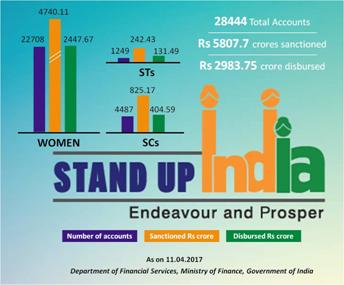

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): As on 29th March, 2017, Cumulative Gross enrolment reported by Banks subject to verification of eligibility, etc. is over 3.09 Crore under PMJJBY. A total of 62006 Claims were registered under PMJJBY of which 58805 have been disbursed. Pradhan Mantri Suraksha Bima Yojana (PMSBY): As on 29th March, 2017, Cumulative Gross enrolment reported by Banks subject to verification of eligibility, etc. is over 9.94 Crore under PMSBY. A total of 12488 Claims were registered under PMSBY of which 9364 have been disbursed. Atal Pension Yojana (APY): As on 21st March, 2017, a total of 46.80 lakh subscribers have been enrolled under APY with a total pension wealth of ₹ 1713.214 crores. Pradhan Mantri Mudra Yojana: As per latest data, loans extended under the Pradhan Mantri Mudra Yojana (PMMY) during 2016-17 have crossed the target of ₹ 1,80,000 crore for 2016-17. Sanctions currently stand at ₹ 1,80,528 crore. Of this amount, about ₹ 1,23,000 crore was lent by banks while non-banking institutions lent about ₹ 57,000 crore. Data compiled so far indicates that the number of borrowers this year were about 4 crore, of which over 70% were women borrowers. About 18% of the borrowers were from the Scheduled Caste Category, 4.5% from the Scheduled Tribe Category, while Other Backward Classes accounted for almost 34% of the borrowers. Stand-Up India Scheme: As on 11th April, 2017, ₹ 5807.7 crore has been sanctioned in 28444 accounts. Of these, women hold 22708 accounts with sanctioned loan of ₹ 4740.11 crore, Scheduled Caste persons hold 4487 accounts with sanctioned amount of ₹ 825.17 crore while Scheduled Tribe persons hold 1249 accounts with a sanctioned amount of ₹ 242.43 crore.

|

||||||||||||||||