| Article Section | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Home |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CPWD-GST COMPENSATION-MISLEADING CIRCULARS BY MIS READING THE LEGAL PROVISIONS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CPWD-GST COMPENSATION-MISLEADING CIRCULARS BY MIS READING THE LEGAL PROVISIONS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

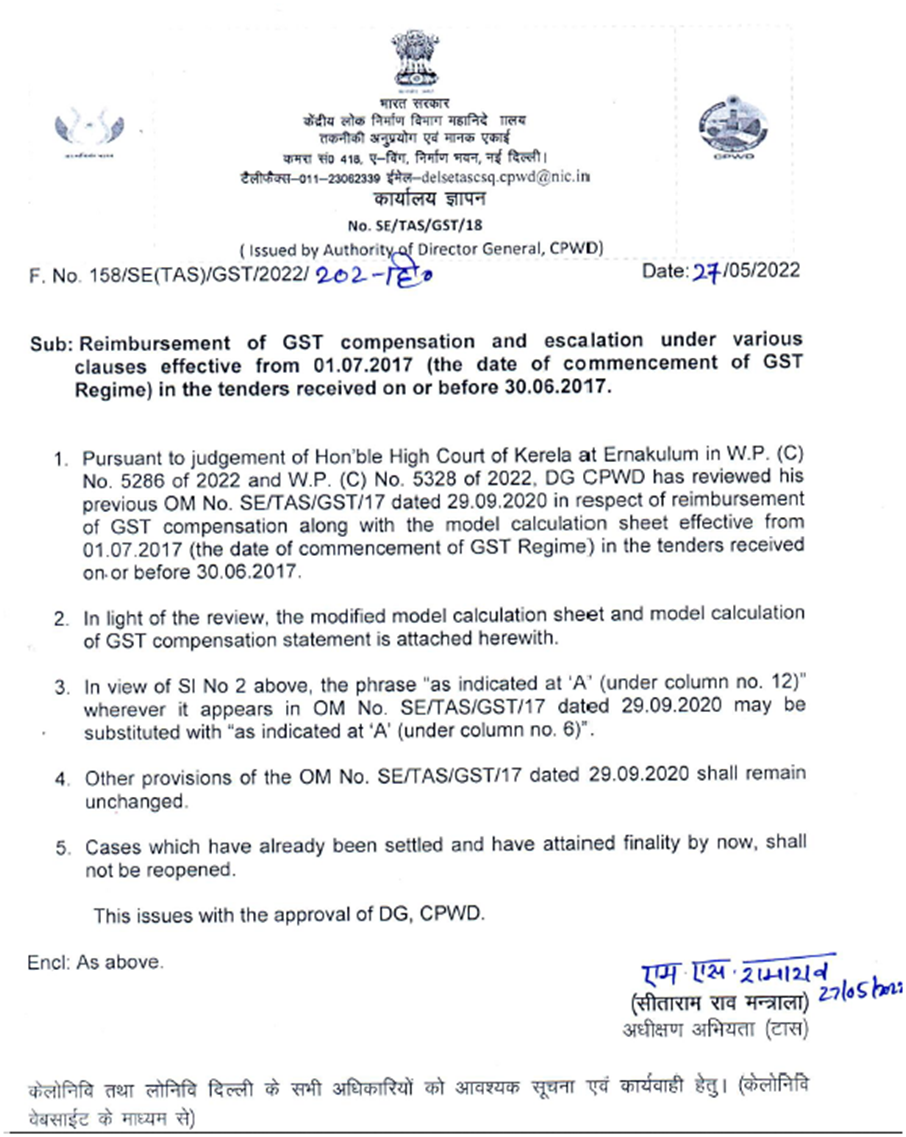

Transition from existing legislations often creates turbulent scenes and the task of attaining stability of the new legal system get delayed and at times force its repeal inter alia due to ignorance of the provisions of the law enacted by those authorities who are supposed to deal with it. The Nation witnessed a paradigm shift in its indirect tax laws by subsuming different existing indirect taxes such as Central Excise Duty, Service Tax, State VAT etc into Goods and Services Tax (GST) w.e.f 1.7.2017. The indirect Tax Board at the Centre and State Commercial Tax Departments together under the aegis of the GST Council is trying its best to resolve the difficulties being faced by the assessee. The advance rulings on different aspect of taxation issued by the authority created in each state helps the assessee who supply goods or services or both and others including Governmental authorities who have to pay the taxes on goods or/ and services received by them. At times some higher authorities interpret the law and issue directions to deal with the changed scenario uniformly in their departments by issuing Circulars. The field formations are bound by such Circulars even though at times it is against the basics of law on the subject matter. This paper is about the existing Circular No.158/SE(TAS)/GST/2022/202-TE dated 27.05.2022 issued with the approval of DG,CPWD on the subject of GST compensation payable to its contractors for tenders received prior to 1.7.2017. This Circular enclosing model calculation sheet and model calculation of GST compensation statement is issued pursuant to the judgment of Hon’ble High Court of Kerala in VRIDDHI INFRATECH INDIA PVT. LTD. VERSUS THE EXECUTIVE ENGINEER CENTRAL PUBLIC WORKS DEPARTMENT (CPWD) , THIRUVANANTHAPURAM AND DIRECTOR GENERAL CENTRAL PUBLIC WORKS DEPARTMENT (CPWD) , NEW DELHI - 2022 (2) TMI 1329 - KERALA HIGH COURT and VRIDDHI INFRATECH INDIA PVT. LTD. VERSUS THE EXECUTIVE ENGINEER CENTRAL PUBLIC WORKS DEPARTMENT (CPWD) , THIRUVANANTHAPURAM AND DIRECTOR GENERAL CENTRAL PUBLIC WORKS DEPARTMENT (CPWD) , NEW DELHI - 2022 (2) TMI 1330 - KERALA HIGH COURT in a case where tender is received few days prior to 1.7.2022 but agreement is entered into after 1.7.2017, i.e. during the GST regime where the inputs and input services obtained were subjected to GST and its credit was available to discharge GST liability of the petitioner. The Circular is reproduced below.

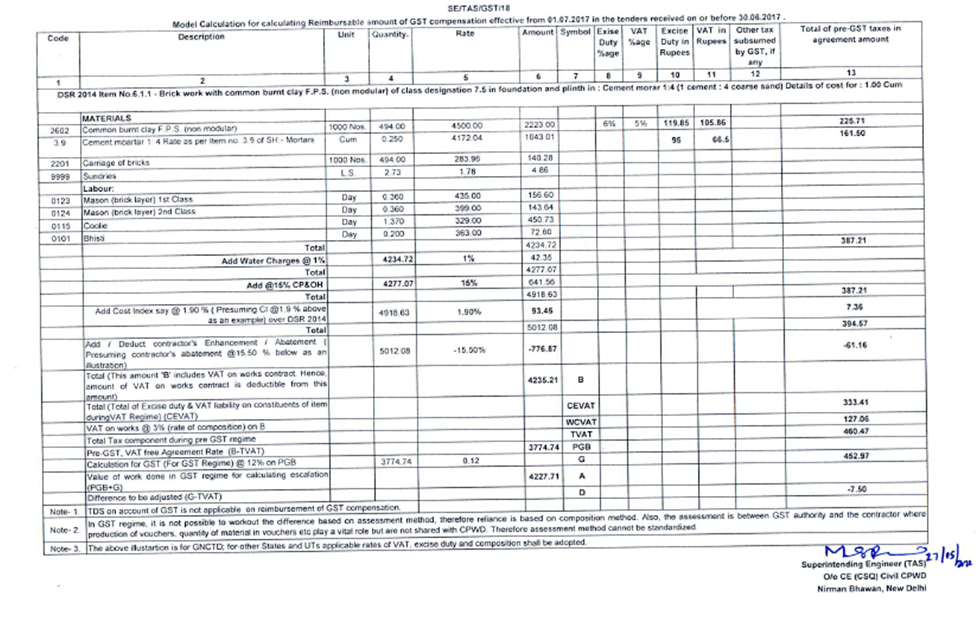

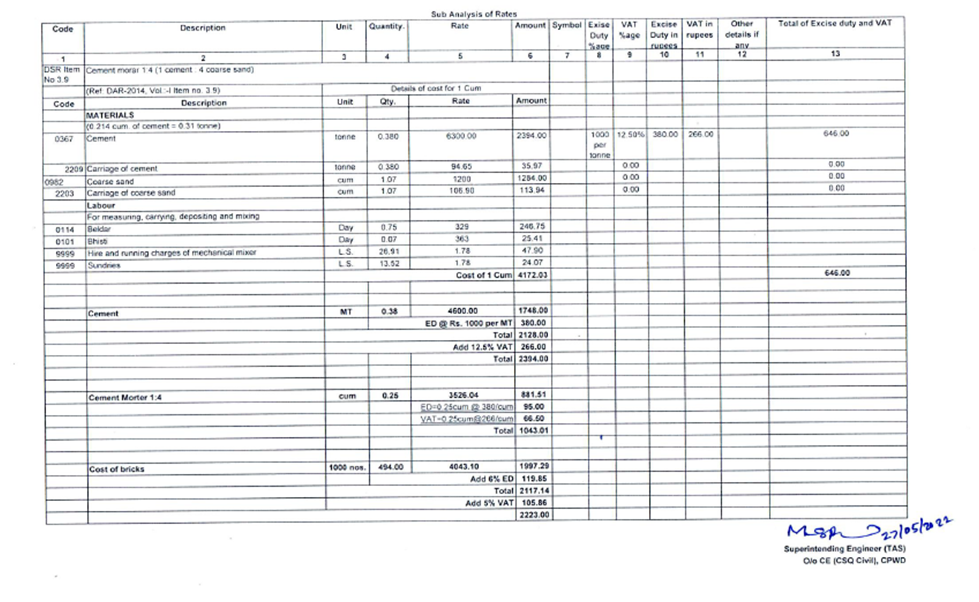

As per model calculation sheet attached to the circular that compute the applicable GST compensation payable for tenders received prior to 1.7.2017, the applicable Central Excise Duty and VAT payable on materials used for construction was deducted from the purchase price for determining the taxable value for computing GST. The pertinent issue in this model calculation adopted by CPWD is that it failed to appreciate the fact that the Central Excise Duty and VAT on materials used for construction activities were cost of contractor and such amounts were not available as credit in the pre GST era for Works Contract. This aspect of non reimbursement of Central Excise Duty, Sales Tax, VAT etc is emphasised vide office Memorandum No DGW/CON/241 dated 28.01. 2009. This OM that amended Clause 37 & 38 and rules of directions of GCC 2008 that allowed reimbursement of Service Tax paid by Contractors reiterated that all indirect taxes paid during pre GST era were cost of contractor. On completion of works or during the period of construction, the applicable indirect taxes to be discharged by the contractor were Service Tax and Works Contract Tax. The Central Excise Duty and VAT borne by the contractor while purchasing materials got subsumed into the cost of contract. In the absence of accrual of the input tax paid on materials for subsequent discharge of tax liability on the part of the contractor, its deduction from purchase price of materials to compute GST compensation is illegal and not sustainable as per law established and based on OM dated 28.01.2009. CPWD tenders during the pre GST era used to be inclusive of works contract tax and service tax will be reimbursed on production of proof of payment of service tax by the contractor. Contractors who pay works contract tax on compounding scheme were also not eligible to avail input credit of VAT. Hence the Central Excise duty and VAT formed part of the value of inputs used for construction activity cannot be vivisected from the contract value to determine a different taxable value for computing GST. The contract value being cum tax value (including works contract Tax), the taxable value is to be determined by adopting computation as follows. Contract value (say X)/ (100+WCT- for Kerala -4%) *100 = X/104*100 will be taxable value. Any amount of credit accrued under Service Tax for the period for which GST is claimed by the Contractor along with GST credit accrued in the input credit ledger for the relevant period attributable to the specified work should be passed on to CPWD by the Contractor. This aspect is not considered by CPWD and if not considered will result in unjust enrichment of the contractor. A model calculation is appended below:-

One may hope that the authorities will realise the folly in arriving at a negative value to compute GST when the Contractor was eligible for reimbursement of 6% of contract value as Service Tax in addition to the contract value and the contractor absolved 4% of VAT, totalling 10% of indirect taxes in the pre GST period. Due to statutory changes when the contractor is liable to pay the new tax which exceeded the existing tax, no amount of imagination can permit deduction from amount paid earlier by presuming and assuming credit of taxes on materials eligible as input credit. Hope a learned intervention of judiciary will address this issue. Regarding tenders received, say, in the last week of June, 2017, but agreements entered into after 1.7.2017, the deduction of input tax on materials to arrive at taxable value as done in the model calculation is enriching the contractor in as much as the contractor is eligible for all input taxes during the GST period and the model calculation restricted input tax credit deduction only in respect of bricks and cement. It appears that the credit available for cement bricks (model calculation) is 28% where as the percentage of input tax deducted is 11% only. (6% CED+5% VAT). An approximate estimation of pre GST input tax percentage for Cement is around 24 to 25% where as the eligible credit under GST is 28%. Input credit available for steel used for concrete works has not formed part of the model calculation and it further enhances the windfall to the contractor. The contractors who entered into agreements after 1.7.2017 but tenders received before 1.7.2017 may restrict their objections towards deduction of VAT on materials and further reduction of WCT. Notwithstanding the submission that for such category of tenders received prior to 1.7.2017, no input tax deduction on materials used for construction is permissible for reasons submitted above, if the same is accepted by contractor then taxable value arrived at is to be treated as cum VAT value and the applicable WCT is to be reduced. That is deduction of VAT on materials and WCT on contract value arrived at is to be enforced. CPWD may revisit the model calculation to avoid wind fall gain to the class of contractors cited above to avoid C& AG objections.

By: Jayaprakash Gopinathan - January 7, 2023

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||