| Article Section | |||||||||||

IMPACT OF AMENDMENT MADE BY FINANCE ACT, 2023 ON NON-RESIDENT/NOT ORDINARILY RESIDENT |

|||||||||||

|

|||||||||||

IMPACT OF AMENDMENT MADE BY FINANCE ACT, 2023 ON NON-RESIDENT/NOT ORDINARILY RESIDENT |

|||||||||||

|

|||||||||||

Non-resident individual- A person is said to be non-resident individual if satisfies any of the following conditions :

Not ordinarily resident- A person is said to not ordinarily resident if such person is :

CHANGES BROUGHT BY FINANCE ACT, 2023

Sec 197 of the Income Tax Act provides an option to the person for make an application to the respective Assessing officer for lower deduction/ Non deduction of tax. Where the assessing officer is satisfied that the existing and estimated tax liability of a person justifies the deduction of tax at lower rate or no deduction of tax, then he may issue certificate u/s 197. Earlier Sec 197 covers only the following income reported under Sec 192, 193, 194, 194A, 194C, 194D, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBB, 194LBC, 194M, 194-O.. Now it has been extended to income referred to in Sec 194LBA of the Act. Existing Provision- Where the income of non-resident person includes any income distributed by a business trust referred to in Sec 115UA of the Income Tax Act being interest, dividend, rental income etc referred to in Sec 10(23FC) or Sec 10(23FCA) of the Act , tax under Sec 194LBA required to be deduced @ 5% or 10% or at the rate in force. Amended Provision- Now the Non-resident person can make an application to the assessing officer u/s 197 for lower deduction of tax/ non-deduction of tax in respect of the aforesaid income reported u/s 194LBA of the Act.

Section 9 of the Income Tax Act provides for income which is deemed to accrue or arise in India. Existing provision- Existing clause (viii) to sub section (1) of Section 9 of the Act provides that where any non-resident received any sum of money or value of property from the resident person, without consideration, the aggregate value of which exceeds Rs. 50,000 that it shall be deemed to be accrue or arise in India in the hands of such non-resident person. Amended Provision- Finance Act, 2023 has amended clause (viii) to sub section (1) of Section 9 of the Act which also now includes any sum of money or value of property received by not ordinarily resident from the resident person without consideration, the aggregate value of which exceeds Rs. 50,000 then it shall be considered as income deemed to accrue or arise in India.

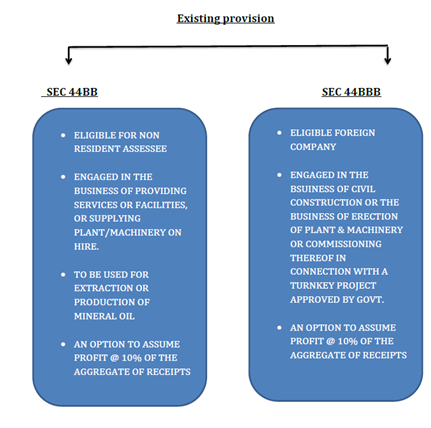

Tax Audit applicability- Both sections provide that an assessee may claim lower profits and gains than the profits and gains specified (i.e lower than 10%) if he keeps and maintains such books of account and other documents as required under sub-section (2) of section 44AA of the Act and gets his accounts audited and furnishes a report of such audit as required under section 44AB of the Act. Issue observed- It is seen that taxpayers opt in and opt out of presumptive scheme in order to avail benefit of both presumptive scheme income and non-presumptive income. In a year when they have loss, they claim actual loss as per the books of account and carry it forward. In a year when they have higher profits, they use presumptive scheme to restrict the profit to 10% and set off the brought forward losses from earlier years. Amendment made Where an assessee declares profits and gains of business for any previous year in accordance with the provisions of presumptive taxation u/s 44BB or Sec 44BBB, no set off of unabsorbed depreciation and brought forward loss shall be allowed to the assessee for such previous year.

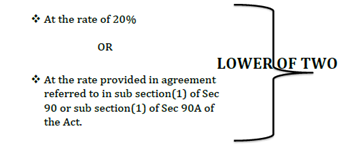

Existing provision- Sec 196A of the act provides that where any income in respect of the units of the Mutual fund specified u/s 10(23D) or a company referred to in clause 10(35) of the Act paid to the non-resident person, then TDS @ 20% shall be deducted at the time of credit of such income to the account of payee or at the time of payment whichever is earlier. Amended Provision- In order to provide tax treaty relief to the taxpayer, it is proposed that TDS u/s 196A would be at rate lower of:

Provided that non resident person has furnished the tax residency certificate referred to in sub-section (4) of section 90 or sub-section (4) of section 90A of the Act.

Existing Provision- Sec 206AB & 206CCA of the Act provides for higher deduction/ collection of tax for “Specified person”. Specified person- A person who has not furnished the return of income for the assessment year relevant to the previous year immediately preceding the financial year in which tax is required to be deducted or collected (as the case may be)- (i) for which the time limit for furnishing the return of income under sub-section (1) of section 139 has expired; and (ii) the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in the said previous year. Exclusion- However, the provision of this section excludes non-resident who doesn’t have a permanent establishment in India. (Permanent establishment , here a place of business which is fixed and where business is carried on wholly or partially) Issue observed- Since this provision only excludes non-resident who doesn’t have a permanent establishment in India, this would bring a genuine hardship for all those person who are not required to file ITR on account of:

Amended Provision- Finance Act, 2023 has widened the scope of exclusion i.e. the provision of Sec 206AB & 206CCA will not apply for the following category of persons:

Existing provision Section 56(2)(viib) of the Act, inter alia, provides that where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person being a resident, any consideration for issue of shares that exceeds the face value of such shares. Then the aggregate consideration received for such shares as exceeds the fair market value of the shares shall be chargeable to income-tax under the head ‘Income from other sources’. Rule 11UA of the Income-tax Rules provides the formula for computation of the fair market value of unquoted equity shares for the purposes of the Section 56(2) (viib) of the Act. Issue Observed- Since this provision includes the consideration received from any resident person only hence this will bring disparity where such sum is received from non-resident investor which will not be taxable in the hands of the company. Hence to remove this disparity, the scope of Sec 56(2)(viib) has been extended to Non-resident also. Amended Provision Now Sec 56(2)(viib) will apply where company, not being a company in which the public are substantially interested, receives, in any previous year, from any person irrespective of residential status, any consideration for issue of shares that exceeds the face value of such shares. Then the aggregate consideration received for such shares as exceeds the fair market value of the shares shall be chargeable to income-tax under the head ‘Income from other sources’.

Existing Provision Sec 10(4E) of the Act provides that any income of non-resident from the transfer of non-deliverable forward contracts (i.e. Offshore derivative instruments) entered into with an offshore banking unit of an International Financial Services Centre as referred to in sub-section (1A) of section 80LA, which fulfils such conditions as may be prescribed shall be exempt u/s 10(4E) of the Act. (A non-deliverable forward (NDF) is an FX exchange contract, where two parties agree to, on a date in the future, exchange currencies for the prevailing spot rate. This means that counterparties settle the difference between contracted NDF price and the prevailing spot price. The profit or loss is calculated on the notional amount of the agreement by taking the difference between the agreed-upon rate and the spot rate at the time of settlement.) Issue Observed Under the ODI contract, the IFSC Banking Unit (IBU) makes the investments in permissible Indian Securities. Income earned by the IBU on such investments is taxed as capital gains, interest, dividend under section 115AD of the Act. After the payment of tax, the IBU passes such income to the ODI holders. Presently, the exemption is provided only on the transfer of ODIs and not on the distribution of income to the non-resident ODI, hence this distributed income is taxed twice in India i.e. first when received by the IBU and second, when the same income is distributed to non-resident ODI holders. Amended Provision It is proposed to amend clause (4E) of section 10 of the Act, to also provide exemption to any income distributed on the offshore derivative instruments, entered into with an offshore banking unit of an International Financial Services Centre as referred to in sub-section (1A) of section 80LA, which fulfils such conditions as may be prescribed. It has also been provided that such exempted income shall include only that amount which has been charged to tax in the hands of the IFSC Banking Unit under section 115AD.

By: GEETANJALI PANDEY - April 20, 2023

|

|||||||||||

| |

|||||||||||