| Article Section | |||||||||||

China Acts Opportunist |

|||||||||||

|

|||||||||||

China Acts Opportunist |

|||||||||||

|

|||||||||||

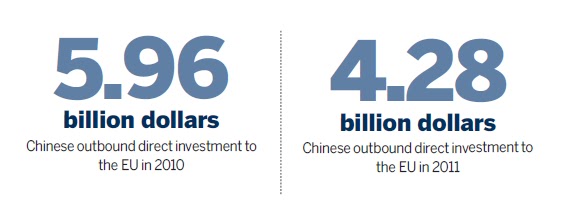

Recession to be treated as opportunity needs visionary eyes to envisage the same. But very few people have such eyes to identify such jewels of opportunities. European recession has been identified as an opportunity for investments by China. Chinese banks are expanding their business and networking in the UK and in Europe and which have made the establishment of a UK subsidiary a priority in their European. Even some big banks of china are opening up their shops in Europe like the Agricultural Bank of China Ltd (ABC), a major commercial lender ranked among the Big Four in China, is about to open its overseas subsidiary in London, a milestone in its history. The London subsidiary will concentrate on wholesale banking, including corporate deposits, syndicated loans, bilateral loans, trade financing, international settlement and foreign exchange settlement and transactions. In last November Bank of Communications (BoCom), China's fifth-largest lender, meanwhile, opened its first overseas subsidiary.

China Construction Bank which has a strong hold in UK which delivers a range of banking products which includes corporate deposit, loan, trade finance, commodity finance/ hedging, and sterling clearance is also expanding into wholesale, retail and investment banking.

The dumping prospect of the European banks has forced to cut bank lending’s which has been picked up as an opportunity by Chinese banking segment. Moreover customer confidence seems to be very strong with Chinese banks since European banks are on the verge of collapse and much benefit are not being expected from their end. Digging further I found that China is beyond an opportunist since its main aim is bigger which aligns with its economic core values. Being the second largest economy in the world Chinese financial system has little connection with the global financial system.

Look into deep we find that China’s international investment portfolio holds a very small percentage of global stocks, where FDI and international portfolio assets and liabilities are a meager percentage less that 3% of the total global stocks. Comparing this with its forex reserves we find it accounts for about 30% of global stocks. This is the prime reason behind china to open up its gates up for international investments and diversification of its resources. This one of the rime reason why Shanghai and Shenzhen, are reaching out to the financial markets of the tow leading centers of Hong Kong and Taipei. This also serves the main reason behind China to covert its renminbi into an international trading currency. The justify the fact I find that the renminbi is now the third most used currency in the Hong Kong market and accounts for about 10 percent of total banking deposits.

China's middle class and the rising number of SMEs development of the bond market and the asset management industry in the internal states of China will open up more opportunities for investments and diversification of resources I find china has adopted two fold strategy to carry ahead toward the next decade, the first is diversification of assets and resources into the international markets and second practice the same strategy within its own economy. For this I find their will be a huge integration between Hong Kong, Taiwan and Chinese Mainland since they are the back bone of the Chinese economy. Without their integration Chinese upcoming visionary goals will not be achievable.

At the same time regulatory aspects will become more stringent in China mainly driven by Hong Kong since its has a well developed regulatory system. Developing the other domestic markets of china will be one of the key growth drivers of the Chinese economy and key source of double digit economic growth. In between Mainland China has huge potentiality to merge within two states like Hong Kong financial markets. The next decade china will be busy in formulation of all these options to derive its economic growth.

Chinese reform policy has every time being mixed with political challenges married with market driven growth strategies. Converting the Renimbi into an international currency and trading too needs more homework like development of the bond market to the interest rate and exchange rate reforms. Once these come into place china will emerge as a huge economic financial power house which will help the world economy to grow showing new path of expansion. Time should not be taken into account since good things takes time and the transition phase of Chinese economy needs slow and gradual steps and not an overnight game plan.

By: INDRANEEL SEN GUPTA - August 24, 2012

Discussions to this article

Dear Sir, Any opinion to Indian Banking and Industrial Sector? Regards, Pradeep Khatri

|

|||||||||||

| |

|||||||||||