| News | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Service Tax: Draft Guidance Paper “B” Place of Provision of Services Rules, 2012. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 17-3-2012 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

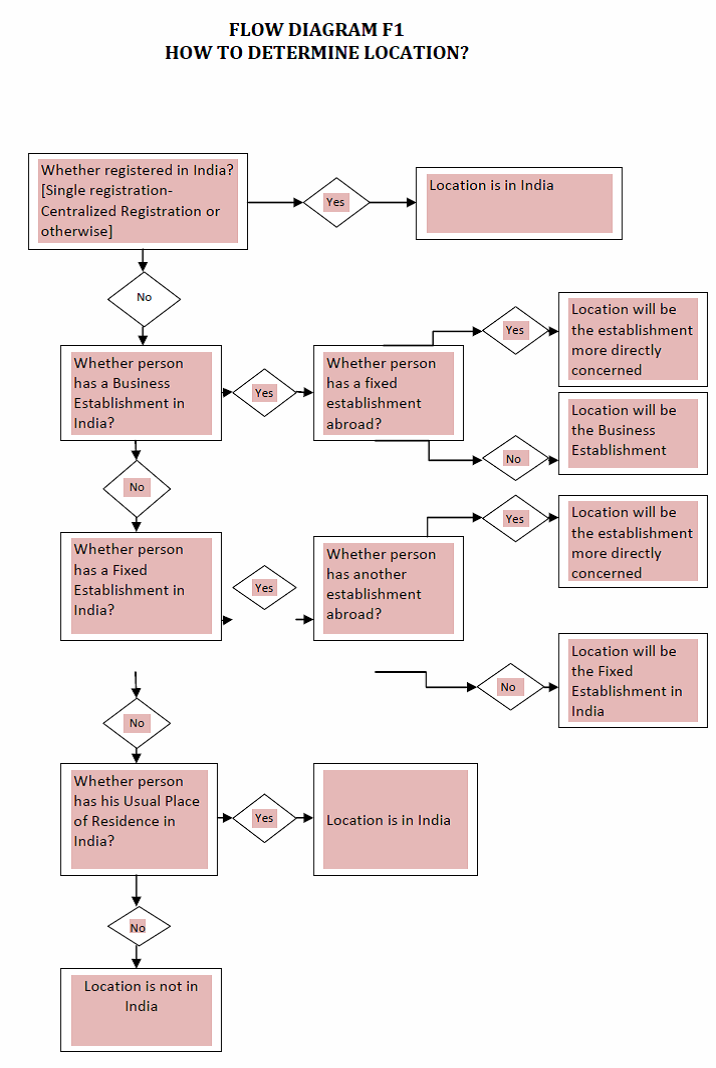

Annexure B Draft Guidance Paper “B” Place of Provision of Services Rules, 2012 TRU, Central Board of Excise & Customs, Department of Revenue, Ministry of Finance March 16, 2012 In this guidance paper 1. Introduction 2. Basic framework 3. Rules & Commentary 4. Exhibit: Draft Place of Provision of Services Rules, 2012 1. Introduction 1.1 Background 1.1.1 The Finance Minister has introduced the Finance Bill, 2012 proposing, inter-alia, taxation of services based on a negative list. This announcement involves a paradigm shift by moving away from taxation of specified description of services to a new system of taxation of all services except those specified in the negative list or otherwise exempted. An important key for its implementation is to identify the taxing jurisdiction for a service. 1.1.2 So far the task of identifying the jurisdiction was largely limited in the context of import or export of services. For this purpose rules were formulated which handled the subject of place of provision of services somewhat indirectly confining to define the circumstances in which a provision of service will constitute import or exports and thus limiting their scope more to their taxability or otherwise of a service. 1.1.3 The new rules will, on the other hand, determine the place where a service shall be deemed to be provided. Its taxability will be determined based on the location of its provision. The ‘Place of Provision of Services Rules, 2012’ will replace the ‘Export of Services, Rules, 2005’ and ‘Taxation of Services (Provided from outside India and received in India) Rules, 2006. 1.1.4 This is a draft guidance mainly to help both the departmental officials and business to understand the new provisions better and to make some of the advance preparations to implement the changes as and when made applicable. In the meanwhile both sides may also provide useful feedback on any aspect of the rules, particularly where the provisions are likely to create situations that may place legitimate business in any disadvantageous position or loss of legitimate revenue for the government. The final guidance will follow when the rules are to be operationalized. 1.1.5 The guidance has been prepared in Q&A form for easy understanding. It is realized that despite every effort made there would be some areas which require greater elaboration or even correction. Team TRU will be highly thankful for free and frank views on any aspect. 1.2 For whom are these rules meant? 1.2.1 These rules are primarily meant for persons who deal in cross border services. They will also be equally applicable for those who have operations with suppliers or customers in the state of Jammu and Kashmir. 1.2.2 Additionally service providers operating within India from multiple locations, without having centralized registration will find them useful in determining the precise taxable jurisdiction applicable to their operations. The rules will be equally relevant for determining services that are wholly consumed within a SEZ to avail the outright exemption. 1.2.3 As a precursor for the eventual roll out of a nation-wide GST, the new rules are also expected to provide a possible backdrop to initiate an honest debate in interested circles so as to fathom all the various issues that may arise in the taxation of inter-state services. 1.3 What is the basic philosophy of these rules? 1.3.1 The essence of indirect taxation is that a service should be taxed in the jurisdiction of its consumption. This principle is more or less universally applied. In terms of this principle, exports are not charged to tax, as the consumption is elsewhere, and services pay tax on their importation into the taxable territory. 1.3.2 However, this determination is not easy. Services could be provided from one location, delivered to a person located at another and yet be actually consumed at a third location or over a larger geographical territory, falling in more than one taxable jurisdiction. For example a person located in Mumbai may buy a ticket on internet from a service provider located outside India for a journey from Delhi to London. On other occasions the exact location of service recipient itself may not be available e.g. services supplied electronically. As a result it is necessary to lay down rules determining the exact place of provision to capture the place of consumption, while ensuring a certain level of harmonization with international practices in order to avoid both the double taxation as well as double non-taxation of services. 1.3.3 It is also a common practice to largely tax services provided by business to other business entities, based on the location of the customers and other services from business to consumers based on the location of the service provider. Since the determination in terms of above principle is not easy, or sometimes not practicable, nearest proxies are adopted to provide specificity in the interpretation as well as application of the law. 2. Basic Framework 2.1 How will I know that I am providing a service that may be taxable? 2.1 How will I know that I am providing a service that may be taxable in India? 2.1.1 The following 2-step process will help to determine this. Step 1: To ascertain the nature of service If you are providing a service, then first you need to check as to whether the service provided is excluded either by the negative list or is otherwise exempted. If it is not so covered, try to capture the nature of the service, if necessary by applying the principles indicated in section 66F. You may refer to the ‘Guidance Paper: A, Guidance Note 7’ for this purpose. Step 2: To determine whether the place of provision of service is in the taxable territory: You need to ask the following questions sequentially, applying these rules:- 1. Which rule applies to my service specifically? In case more than one rules apply equally, which of these come later in the order given in the rules? 2. What is the place of provision in terms of the above rule? 3. Is the place of provision in taxable territory? If yes, tax will be payable. If not, tax will not be payable. 4. Are you ‘located’ in the taxable territory? If yes, you will pay the tax. 5. If not, is the service receiver located in taxable territory? If yes, he may be liable to pay tax on reverse charge basis. 6. Is the service receiver an individual or government receiving services for a non-business purpose, or a charity receiving services for a charitable activity? If yes, the same is exempted. 7. If not, he is liable to pay tax. 2.2 What is “taxable territory”? What is its significance? 2.2.1 Taxable territory has been defined in sub-section 52 of section 65B. It means the territory to which the provisions of Chapter V of the Finance Act, 1994 apply i.e. whole of India excluding the state of Jammu and Kashmir. “Non-taxable territory” is defined in sub-section 35 ibid accordingly as the territory other than the taxable territory. 2.2.2 “India” is defined in sub-section 27 of section 65 B, as follows: “India” means— (a) the territory of India as referred to in article 1 of the Constitution; (b) its territorial waters, continental shelf, exclusive economic zone or any other maritime zone as defined in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and Other Maritime Zones Act, 1976(- of 1976); (c) the sea-bed and the subsoil underlying the territorial waters; (d) the air space above its territory and territorial waters; and (e) the installations structures and vessels located in the continental shelf of India and the exclusive economic zone of India, for the purposes of prospecting or extraction or production of mineral oil and natural gas and supply thereof; 2.2.3 The new charging section, section 66B, enables taxation of only such services as are provided in taxable territory. Thus services that are provided in a non-taxable territory are not chargeable to service tax. 2.3 What is the significance of “Location” of a Service Provider or Receiver for determining taxing jurisdiction? 2.3.1 In terms of explanation (2) to sub-section 44 of section 65B, an establishment of a person outside the taxable territory is a person distinct from an establishment in a taxable territory. Thus, services provided from overseas are to be carefully judged whether they are being rendered by the establishment outside the taxable territory or within. 2.3.2 Similarly, from the taxpayer’s perspective, the jurisdiction of the field formation, which is relevant for compliance with registration formalities, filing of returns, refund claims etc. by the person liable to pay tax (provider or receiver as the case may be), will be the “location” as determined in terms of these rules. 2.4 How will such “location” be determined? 2.4.1 The location of a service provider or receiver (as the case may be) is to be determined by applying the following steps sequentially: A. where the service provider or receiver has obtained only one registration, whether centralized or otherwise, the premises for which such registration has been obtained; B. where the service provider or receiver is not covered by A above: i. the location of his business establishment; or ii. where services are provided or received at a place other than the business establishment i.e. a fixed establishment elsewhere, the location of such establishment; iii. where services are provided or received at more than one establishment, whether business or fixed, the establishment most directly concerned with the provision or use of the service; and iv. in the absence of such places, the usual place of residence of the service provider or receiver. 2.4.2 This is indicated in Flow Diagram F1 on page 6 at the end of this section. 2.5 What is the meaning of “business establishment”? 2.5.1 ‘Business establishment’ is the place where the essential decisions concerning the general management of the business are adopted, and where the functions of its central administration are carried out. This could be the Head office, or a factory, or a workshop, or shop/ retail outlet. Most significantly, there is only one business establishment that a service provider or receiver can have. 2.6 What is the meaning of a “fixed establishment”? 2.6.1 A “fixed establishment” is a place (other than the business establishment) which has the permanent presence of human and technical resources to provide or receive a service. Temporary presence of a staff by way of a short visit at a place cannot be called a fixed establishment. 2.7 How will the establishment “most directly concerned with the supply” be determined? 2.7.1 This will depend on the facts and supporting documentation, specific to each case. The documentation will include the following:-

Illustration 1 A business has its headquarters in India, and branches in London, Dubai, Singapore and New York. Its business establishment is in India. Illustration 2 An overseas business house sets up offices with staff in India to provide services to Indian customers. Its fixed establishment is in India. Illustration 3 A company with a business establishment abroad buys a property in India which it leases to a tenant. The property by itself does not create a fixed establishment. If the company sets up an office in India to carry on its business by managing the property, this will create a fixed establishment in India. Illustration 4 A company is incorporated in India, but provides its services entirely from Singapore. The location of this service provider is Singapore, being the place where the establishment most directly concerned with the supply is located. 2.8 What does “usual place of residence” mean? 2.7.1 The usual place of residence, in case of a body corporate, has been specified as the place where it is incorporated or otherwise legally constituted. 2.7.2 The usual place of residence of an individual is the place (country, state etc) where the individual spends most of his time for the period in question. It is likely to be the place where the individual has set up his home, or where he lives with his family and is in full time employment. Individuals are not treated as belonging in a country if they are short term, transitory visitors (for example if they are visiting as tourists, or to receive medical treatment or for a short term language/other course). An individual cannot have more than one place of usual residence.

3. Rules & Commentary 3.1 Main Rule- Rule 3- Location of the Receiver 3.1.1 What is the implication of this Rule? The main rule or the default rule provides that a service shall be deemed to be provided where the receiver is located. The main rule is applied when none of the other later rules apply (by virtue of rule 14 governing the order of application of rules- see para 3.12 of this guidance paper). In other words, if a service is not covered by an exception under one of the later rules, and is consequently covered under this default rule, then the receiver’s location will determine whether the service is leviable to tax in the taxable territory. The principal effect of the Main Rule is that:- A. Where the location of receiver of a service is in the taxable territory, such service will be deemed to be provided in the taxable territory and service tax will be payable. B. However if the receiver is located outside the taxable territory, no service tax will be payable on the said service. 3.1.2 If the place of provision of a taxable service is the location of service receiver, who is the person liable to pay tax on the transaction? Service tax is required to be paid by the provider of a service, except where he is located outside the taxable territory and the place of provision of service is in the taxable territory. Where the provider of a service is located outside the taxable territory, the person liable to pay service tax is the receiver of the service in the taxable territory, unless of course, the service is otherwise exempted. Following illustration will make this clear:- Illustration

A company ABC provides a service to a receiver PQR, both located in the taxable territory. Since the location of the receiver is in the taxable territory, the service is taxable. Service tax liability will be discharged by ABC, being the service provider and being located in taxable territory. However, if ABC were to supply the same service to a recipient DEF located in non-taxable territory, the provision of such service is not taxable, since the receiver is located outside the taxable territory. If the same service were to be provided to PQR (located in taxable territory) by an overseas provider XYZ (located in non-taxable territory), the service would be taxable, since the recipient is located in the taxable territory. However, since the service provider is located in a non-taxable territory, the tax liability would be discharged by the receiver, under the reverse charge principle (also referred to as “tax shift”). 3.1.3 Who is the service receiver? Normally, the person who receives a service and, therefore, becomes obliged to make payment, is the receiver of a service, whether or not he actually makes the payment or someone else makes the payment on his behalf. Illustration A lady leaves her car at a service station for the purpose of servicing. She asks her chauffer to collect the car from the service station later in the day, after the servicing is over. The chauffer makes the payment on behalf of the lady owner and collects the car. Here the lady is the ‘person obliged to make the payment’ towards servicing charges, and therefore, she is the receiver of the service. 3.1.4 What would be the situation where the payment for a service is made by the headquarters of a business but the actual rendering of the service is elsewhere? Occasionally, a service receiver may be the person liable to make payment for the service provided on his behalf to another person. For instance, the provision of a service may be made at the headquarters of an entity by way of centralized sourcing of services whereas the actual provision is made at various locations. Here, the central office acts only as a facilitator to negotiate the contract on behalf of various geographical establishments. Each of the geographical establishments receives the service and is obligated to make the payment either through headquarters or sometimes directly. When the payment is made directly, there is no confusion. In other situations, where the payment is settled either by cash or through debit and credit note, it is clear that the payment is being made by such geographical location. It should be noted that in terms of proviso to section 66B, the establishments in a taxable and non-taxable territory are to be treated as distinct persons. Illustration The following example illustrates the above, by comparing the place of provision of services rendered under a Global Agreement1 vis-à-vis a Global Framework Agreement2. AAA is a firm with its manufacturing unit and business establishment located in the taxable territory A. It has got two other manufacturing plants located in countries X 1 A ‘Global Contract or Agreement’ is between two parent companies for provision of services from one to the other, where actual provision of services is to be made to subordinate offices of the recipient company in different tax jurisdictions. 2 A ‘Global Framework Agreement’ is between two parent companies for provision of services, but here, the ‘framework agreement’ only specifies the broad terms of the agreement i.e fees, terms and conditions, the list of recipient branches/offices or even the details of provision of services to be made. The subsidiaries in different locations then enter into separate and independent business agreements, for provision of services and payments. A lady leaves her car at a service station for the purpose of servicing. She asks her chauffer to collect the car from the service station later in the day, after the servicing is over. The chauffer makes the payment on behalf of the lady owner and collects the car. Here the lady is the ‘person obliged to make the payment’ towards servicing charges, and therefore, she is the receiver of the service. and Y (say, AAA-X and AAA-Y respectively). AAA wishes to obtain IT services for a new production process for its three manufacturing plants in the region. BBB is an IT firm located in the taxable territory (location of business establishment). BBB Ltd also has fixed establishments (subsidiaries) located in country X (say BBB-X) and in country Y (say, BBB- Y). AAA engages BBB for meeting its IT service requirement. Scenario 1 [See Flow Diagram F 2 below] AAA enters into a Global (centralized purchasing) agreement with BBB for provision of IT services for the whole group. Following are the different transactions under which services are provided:- a) Under the global agreement, some component of IT service is provided by BBB to AAA in country A (say, Transaction 1). b) To meet the requirements of providing IT solutions specific to the plants AAA-X and AAA-Y in countries X and Y, BBB enters into agreements with its subsidiaries BBB-X (in country X) and BBB-Y (in country Y), under which they provide IT services to BBB (say, Transaction 2 and Transaction 3). Though these services are provided by BBB-X and BBB-Y to BBB, these are rendered as under:-

c) AAA enters into separate agreements with AAA-X and AAA-Y, under which AAA Ltd provides IT services to them (transaction 4 and transaction 5). The transactions and provision of service under each are illustrated in the Flow diagram titled ‘Scenario1’ in the following page. Scenario 2 [See Flow Diagram F 3 below] AAA enters into a Framework Agreement with BBB for provision of IT services for the whole group. The Framework agreement covers the broad contours of supply between the two parties, payment milestones, obligations relating to confidentiality, penalty for default, limitations of liability and warranties etc, which would apply as and when group companies enter into separate agreements, in accordance with the terms envisaged in the framework agreement. BBB-X and BBB-Y could then enter into separate and independent business agreements with AAA-X and AAA-Y, in countries X and Y respectively, for provision of IT services. There are four agreements, but only three transactions involving provision of services, as indicated in the Flow diagram- Scenario 2 below. PROVISION OF SERVICES UNDER A ‘GLOBAL AGREEMENT’- Scenario 1 FLOW DIAGRAM F 2

Place of provision for service 1 is taxable territory Place of provision for service 2 is taxable territory Place of provision for service 3 is taxable territory Place of provision for service 4 is country X Place of provision for service 5 is country Y. PROVISION OF SERVICES UNDER ‘FRAMEWORK AGREEMENT’- Scenario 2 FLOW DIAGRAM F 3

Agreement 1 is not transactional, has no consideration, and does not create a provision of service. Agreement 1 stipulates the terms and conditions which are activated only when the parties (i.e. group subsidiaries on either side enter into separate and independent business agreements, in accordance with the terms specified in the framework agreement. Under Agreement 2, service 1 is provided by BBB Ltd to AAA Ltd, and the place of provision of this service, under the main rule, is the location of the receiver i.e within the taxable territory. Under Agreement 3, service 2 is provided by BBB-X to AAA-X, and the place of provision of this service, under the main rule, is country X i.e outside AAA Parent BBB Parent AAA-X Subsidiary AAA-Y Subsidiary BBB-X Subsidiary BBB-Y Subsidiary the taxable territory. Under Agreement 4, service 3 is provided by BBB-Y to AAA-Y, and the place of provision of this service, again under the main rule, is country Y i.e outside the taxable territory. 3.1.5 What is the place of provision where the location of receiver is not ascertainable in the ordinary course of business? Generally, in case of a service provided to a person who is in business, the provider of the service will be in a position to ascertain the location of the recipient’s registered location, or his business establishment, or his fixed establishment etc, as the case may be. However, in case of certain services (which are not covered by the exceptions to the main rule), the service provider may not be in a position to ascertain the location of the service receiver, in the ordinary course of his business. This will also be the case where a service is provided to an individual customer who comes to the premises of the service provider for availing the service and the provider has to, more often than not, rely on the declared location of the customer. For instance, an individual may go to the office of a Custom House Agent to obtain his services for clearance of imported personal effects, and furnish an address to which the goods are to be delivered. Normally in such cases, the provider will not be expected to make any detailed enquiry from a customer regarding his ‘location’, in the ordinary course of business. In such cases, it will be deemed that the place of provision of the service is the location of the service provider (in the taxable territory). 3.2 Rule 4- Performance based Services In case of certain specified categories of services, the place of provision shall be the place where the services are performed. These are discussed in the following paragraphs. 3.2.1 What are the services that are provided “in respect of goods that are made physically available, by the receiver to the service provider, in order to provide the service”?- sub-rule (1): Services that are related to goods, and which require such goods to be made available to the service provider so that the service can be rendered, are covered here. Examples of such services are repair, reconditioning, or any other work on goods (not amounting to manufacture), storage and warehousing, courier service, cargo handling service (loading, unloading, packing or unpacking of cargo), technical testing/inspection/certification/ analysis of goods, dry cleaning etc. It will not cover services where the supply of goods by the receiver is not material to the rendering of the service e.g. where a consultancy report commissioned by a person is given on a pen drive belonging to the customer. Similarly, provision of a market research service to a manufacturing firm for a consumer product (say, a new detergent) will not fall in this category, even if the market research firm is given say, 1000 nos. of 1 kilogram packets of the product by the manufacturer, to carry for door-to-door surveys. Illustration 1 A foreign music troupe, undertaking a tour in four Indian cities, obtains the services of an Indian cargo handling firm to move its sound and music equipment between the four cities. The place of provision of this service is in the taxable territory, notwithstanding the location of the receiver. Illustration 2 An Electrical engineering firm located in India deputes its engineers to undertake repairs at a hydel power plant in Bhutan (which is owned by say, Govt of Bhutan). Place of provision of this service will be Bhutan i.e outside taxable territory. Illustration 3 An airline company in India gets its aircraft repaired at a hanger at Mumbai airport, by engineers deputed by an overseas firm (say, Airbus, France) who travel from Toulouse, France to Mumbai for the purpose. The place of provision of this service is in the taxable territory, and more specifically, Mumbai. 3.2.2 What is the implication of the proviso to sub-rule (1)? The proviso to this rule states as follows:- “Provided further that where such services are provided from a remote location by way of electronic means, the place of provision shall be the location where goods are situated at the time of provision of service.” In the field of Information Technology, it is not uncommon to provide services in relation to tangible goods located distantly from a remote location. Thus the actual place of performance of the service could be quite different from the actual location of the tangible goods. This proviso requires that the place of provision shall be the actual location of the goods and not the place of performance, which in normal situations is one and the same. Following example will illustrate the implication of this proviso:- An Electrical engineering firm located in India deputes its engineers to undertake repairs at a hydel power plant in Bhutan (which is owned by say, Govt of Bhutan). Place of provision of this service will be Bhutan i.e outside taxable territory. An airline company in India gets its aircraft repaired at a hanger at Mumbai airport, by engineers deputed by an overseas firm (say, Airbus, France) who travel from Toulouse, France to Mumbai for the purpose. The place of provision of this service is in the taxable territory, and more specifically, Mumbai. A foreign music troupe, undertaking a tour in four Indian cities, obtains the services of an Indian cargo handling firm to move its sound and music equipment between the four cities. The place of provision of this service is in the taxable territory, notwithstanding the location of the receiver. Illustration An IT firm located in Bangalore provides repair service in respect of software, to an IT company at its establishment in Singapore by way of electronic means. The place of provision of this service will be Singapore. The position will remain the same even if the service receiving firm has its ‘business establishment’ in India, so long as the ‘location’ as determined under the rules is the Singapore establishment (more directly concerned with receiving service). 3.2.3 What are the services provided in conjunction with a supply of goods under another contract?- sub-rule (2) Examples of such services, when provided under a separate contract are as under:-

3.2.4 What are the services that are provided “entirely or predominantly in the physical presence of an individual (the receiver)”?-sub-rule (3) Certain services like cosmetic or plastic surgery, beauty treatment services, personal security service, health and fitness services, photography service (to individuals), internet café service, classroom teaching, are examples of services that require the presence of the individual receiver for their provision. As would be evident from these examples, the nature of services covered here is such as are rendered in person and in the receiver’s physical presence. Though these are generally rendered at the service provider’s premises (at a cosmetic or plastic surgery clinic, or beauty parlor, or health and fitness center, or internet café), they could also be provided at the customer’s premises, or occasionally while the receiver is on the move (say, a personal security service; or a beauty treatment on board an aircraft). 3.2.5 What is the significance of “..in the physical presence of an individual, whether represented either as the service receiver or a person acting on behalf of the receiver” in this rule? This implies that while a service in this category is capable of being rendered only in the presence of an individual, it will not matter if, in terms of the contractual arrangement between the provider and the receiver (formal or informal, written or oral), the service is actually rendered by the provider to a person other than the receiver, who is acting on behalf of the receiver. Illustration 1 A company contracts with a fitness centre for 10 annual memberships, which are availed by the company’s senior executives. Here is a situation where the company is the receiver of the service, but the service is rendered to the executives, who are receiving the health service on behalf of the modeling agency. Hence, notwithstanding that the modeling agency does not qualify as the individual receiver in whose presence the service is rendered, the nature of the service is such as can be rendered only to an individual, thereby qualifying to be covered under this rule. Illustration 2 A modeling agency contracts with a beauty parlour for beauty treatment of say, 20 models. Here again is a situation where the modeling agency is the receiver of the service, but the service is rendered to the models, who are receiving the beauty treatment service on behalf of the modeling agency. Hence, notwithstanding that the modeling agency does not qualify as the individual receiver in whose presence the service is rendered, the nature of the service is such as can be rendered only to an individual, thereby qualifying to be covered under this rule. 3.3 Rule 5- Location of Immovable Property In the case of a service that is ‘directly in relation to immovable property’, the place of provision is where the immovable property (land or building) is located, irrespective of where the provider or receiver is located. 3.3.1 What is “immovable property”? “Immovable Property” has not been defined in Service Tax law. However, in terms of section 4 of the General Clauses Act, 1897, the definition of immovable provided in sub-section 3 (26) of the General Clauses Act will apply, which states as under: “Immovable Property” shall include land, benefits to arise out of land, and things attached to the earth, or permanently fastened to anything attached to the earth.” 3.3.2 What are the criteria to determine if a service is ‘directly in relation to’ immovable property located in taxable territory? Generally, the following criteria will be used to determine if a service is in respect of immovable property located in the taxable territory: i) the service is physically performed or agreed to be performed on a specific immovable property (e.g. maintenance) or property to come into existence (e.g. construction); ii) the direct object of the service is the immovable property in the sense that the service enhances the value of the property, affects the nature of the property, relates to preparing the property for development or redevelopment or the environment within the limits of the property (e.g. engineering, architectural services, surveying and sub-dividing, management services, security services etc); iii) the purpose of the service is: a) the transfer or conveyance of the property or the proposed transfer or conveyance of the property (e.g., real estate services in relation to the actual or proposed acquisition, lease or rental of property, legal services rendered to the owner or beneficiary or potential owner or beneficiary of property as a result of a will or testament); b) the determination of the title to the property. There must be more than a mere indirect or incidental connection between a service provided in relation to an immovable property, and the underlying immovable property. For example, a legal firm’s general opinion with respect to the capital gains tax liability arising from the sale of a commercial property in India is basically advice on taxation legislation in general even though it relates to the subject of an immovable property. This will not be treated as a service in respect of the immovable property. 3.3.3 Examples of land-related services i) Services supplied in the course of construction, reconstruction, alteration, demolition, repair or maintenance (including painting and decorating) of any building or civil engineering work; ii) Renting of immovable property; iii) Services of real estate agents, auctioneers, architects, engineers and similar experts or professional people, relating to land, buildings or civil engineering works. This includes the management, survey or valuation of property by a solicitor, surveyor or loss adjuster. iv) Services connected with oil/gas/mineral exploration or exploitation relating to specific sites of land or the seabed. v) The surveying (such as seismic, geological or geomagnetic) of land or seabed. vi) Legal services such as dealing with applications for planning permission. vii) Packages of property management services which may include rent collection, arranging repairs and the maintenance of financial accounts. viii) The supply of hotel accommodation or warehouse space. 3.3.4 What if a service is not directly related to immovable property? The place of provision of services rule applies only to services which relate directly to specific sites of land or property. It does not apply if a supply of services has only an indirect connection with the immovable property, or if the service is only an incidental component of a more comprehensive supply of services. For example, the services of an architect contracted to design the landscaping of a particular resort hotel in Goa would be land-related. However, if an interior decorator is engaged by a retail chain to design a common décor for all its stores in India, this service would not be land-related. The default rule i.e. Rule 3 will apply in this case. 3.3.5 Examples of services which are not land-related i) Repair and maintenance of machinery which is not permanently installed. This is a service related to goods. ii) Advice or information relating to land prices or property markets because they do not relate to specific sites. iii) Land or Real Estate Feasibility studies, say in respect of the investment potential of a developing suburb, since this service does not relate to a specific property or site. iv) Services of a Tax Return Preparer in simply calculating a tax return from figures provided by a business in respect of rental income from commercial property. 3.4 Rule 6- Services relating to Events 3.4.1 What is the place of provision of services relating to events? Place of provision of services provided by way of admission to, or organization of, a cultural, artistic, sporting, scientific, educational, entertainment event, or a celebration, conference, fair, exhibition, or any other similar event, and of services ancillary to such admission, shall be the place where the event is held. 3.4.2 What are the services that will be covered in this category? Services in relation to admission as well as organization of events such as conventions, conferences, exhibitions, fairs, seminars, workshops, weddings, sports and cultural events are covered under this Rule. Illustration 1 A management school located in USA intends to organize a road show in Mumbai and New Delhi for prospective students. Any service provided by an event manager, or the right to entry (participation fee for prospective students, say) will be taxable in India. Illustration 2 An Indian fashion design firm hosts a show at Toronto, Canada. The firm receives the services of a Canadian event organizer. The place of provision of this service is the location of the event, which is outside the taxable territory. Any service provided in relation to this event, including the right to entry, will be non-taxable. 3.4.3 What is a service ancillary to admission? A service of hiring a specific equipment to enjoy the event at the venue (against a charge that is not included in the price of entry ticket) is an example of a service that is ancillary to admission. For example, the service of providing facility of golf carts (with attendant/driver) to elderly persons, to facilitate their movement within the golf course, during a golf tournament. 3.4.4 What are event-related services that would be treated as not ancillary to admission to an event? A service of courier agency used for distribution of entry tickets for an event is a service that is not ancillary to admission to the event. 3.5 Rule 7- Part performance of a service at different locations 3.5.1 What does this Rule imply? This Rule covers situations where the actual performance of a service is at more than one location, and occasionally one (or more) such locations may be outside the taxable territory. This Rule states as follows:- “Where any service stated in rules 4, 5, or 6 is provided at more than one location, including a location in the taxable territory, its place of provision shall be the location in the taxable territory where the greatest proportion of the service is provided”. The following example illustrates the application of this Rule:- An Indian fashion design firm hosts a show at Toronto, Canada. The firm receives the services of a Canadian event organizer. The place of provision of this service is the location of the event, which is outside the taxable territory. Any service provided in relation to this event, including the right to entry, will be non-taxable. Illustration 1 An Indian firm provides a ‘technical inspection and certification service’ for a newly developed product of an overseas firm (say, for a newly launched motorbike which has to meet emission standards in different states or countries). Say, the testing is carried out in Maharashtra (20%), Kerala (25%), and an international location (say, Colombo 55%). Notwithstanding the fact that the greatest proportion of service is outside the taxable territory, the place of provision will be the place in the taxable territory where the greatest proportion of service is provided, in this case Kerala. 3.6 Rule 8- Services where the Provider as well as Receiver is located in Taxable Territory 3.6.1 What is the place of provision of a service where the location of the service provider and that of the service receiver is in the taxable territory? The place of provision of a service, which is provided by a provider located in the taxable territory to a receiver who is also in the taxable territory, will be the location of the receiver. 3.6.2 What is the implication of this Rule? This Rule covers situations where the place of provision of a service provided in the taxable territory may be determinable to be outside the taxable territory, in terms of the application of one of the earlier Rules i.e. Rule 4 to 6, but the service provider, as well as the service receiver, are located in the taxable territory. The implication of this Rule is that in all such cases, the place of provision will be deemed to be in the taxable territory, notwithstanding the earlier rules. The presence of both the service provider and the service receiver in the taxable territory indicates that the place of consumption of the service is in the taxable territory. Moreover, it is not possible for any other taxing jurisdiction to be able to tax the provision of such services in the ordinary course. Similarly, in case of services rendered, where both the provider and receiver of the service are located outside the taxable territory, there is no mechanism to collect tax. An Indian firm provides a ‘technical inspection and certification service’ for a newly developed product of an overseas firm (say, for a newly launched motorbike which has to meet emission standards in different states or countries). Say, the testing is carried out in Maharashtra (20%), Kerala (25%), and an international location (say, Colombo 55%). Notwithstanding the fact that the greatest proportion of service is outside the taxable territory, the place of provision will be the place in the taxable territory where the greatest proportion of service is provided, in this case Kerala. Illustration A helicopter of Pawan Hans Ltd (India based) develops a technical snag in Nepal. Say, engineers are deputed by Hindustan Aeronautics Ltd, Bangalore, to undertake repairs at the site in Nepal. But for this rule, Rule 4, sub-rule (1) would apply in this case, and the place of provision would be Nepal i.e outside the taxable territory. However, by application of Rule 7, since the service provider, as well as the receiver, are located in the taxable territory, the place of provision of this service will be within the taxable territory. 3.7 Rule 9- Specified services- Place of provision is location of the service provider 3.7.1 What are the specified services where the place of provision is the location of the service provider? Following are the specified services where the place of provision is the location of the service provider:- i) Services provided by a banking company, or a financial company, or a non-banking financial company to account holders; ii) Telecommunication services provided to subscribers; iii) Online information and database access or retrieval services; iv) Intermediary services; v) Service consisting of hiring of means of transport, up to a period of one month. 3.7.2 What is the meaning of “account holder”? Which accounts are not covered by this rule? “Account” has been defined in the rules to mean an account which bears an interest to the depositor. Services provided to holders of demand deposits, term deposits, NRE (non-resident external) accounts and NRO (non-resident ordinary) accounts will be covered under this rule. Banking services provided to persons other than account holders will be covered under the main rule (Rule 3- location of receiver). 3.7.3 What are the services that are provided by a banking company to an account holder (holder of an account bearing interest to the depositor)? Following are examples of services that are provided by a banking company or financial institution to an “account holder”, in the ordinary course of business:- i) services linked to or requiring opening and operation of bank accounts such as lending, deposits, safe deposit locker etc; ii) transfer of money including telegraphic transfer, mail transfer, electronic transfer etc. 3.7.4 What are the services that are not provided by a banking company or financial institution to an account holder, in the ordinary course of business, and will consequently be covered under another Rule? Following are examples of services that are generally NOT provided by a banking company or financial institution to an account holder (holder of a deposit account bearing interest), in the ordinary course of business:- i) financial leasing services including equipment leasing and hire-purchase; ii) merchant banking services; iii) Securities and foreign exchange (forex) broking, and purchase or sale of foreign currency, including money changing; iv) asset management including portfolio management, all forms of fund management, pension fund management, custodial, depository and trust services; v) advisory and other auxiliary financial services including investment and portfolio research and advice, advice on mergers and acquisitions and advice on corporate restructuring and strategy; vi) banker to an issue service. In the case of any service which does not qualify as a service provided to an account holder, the place of provision will be determined under the default rule i.e the Main Rule 3. Thus, it will be the location of the service receiver where it is known (ascertainable in the ordinary course of business), and the location of the service provider otherwise. 3.7.5 What is the place of provision of telecommunication services? The place of provision of telecommunication services provided to subscribers is the location of the service provider. Thus, a provider of telecommunication services, who is located in India, will be liable to pay tax on any service provided to a subscriber. For services provided to persons other than subscribers e.g. telecommunication services provided to another provider of telecommunication services, the place of provision will be determined in terms of the main rule i.e. the location of the receiver, the obvious implication being that if such receiver is not located in the taxable territory, the service will not be taxable. 3.7.6 What are “Online information and database access or retrieval services”? “Online information and database access or retrieval services” are services in relation to on-line information and database access or retrieval or both, in electronic form through computer network, in any manner. Thus, these services are essentially delivered over the internet or an electronic network which relies on the internet or similar network for their provision. The other important feature of these services is that they are completely automated, and require minimal human intervention. Examples of such services are:- i) online information generated automatically by software from specific data input by the customer, such as web-based services providing trade statistics, legal and financial data, matrimonial services, social networking sites; ii) digitized content of books and other electronic publications, subscription of online newspapers and journals, online news, flight information and weather reports; iii) Web-based services providing access or download of digital content. The following services will not be treated as “online information and database access or retrieval services”:- i) Sale or purchase of goods, articles etc over the internet; ii) Telecommunication services provided over the internet, including fax, telephony, audio conferencing, and videoconferencing; iii) A service which is rendered over the internet, such as an architectural drawing, or management consultancy through e-mail; iv) Repair of software, or of hardware, through the internet, from a remote location; v) Internet backbone services, and internet access services. 3.7.7 What are “Intermediary Services”? An “intermediary” is a person who arranges or facilitates a supply of goods, or a provision of service, or both, between two persons, without material alteration or further processing. Thus, an intermediary is involved with two supplies at any one time: i) the supply between the principal and the third party; and ii) the supply of his own service (agency service) to his principal, for which a fee or commission is usually charged. For the purpose of this rule, an intermediary in respect of goods (commission agent i.e a buying or selling agent) is excluded by definition. In order to determine whether a person is acting as an intermediary or not, the following factors need to be considered:- Nature and value: An intermediary cannot alter the nature or value of the service, the supply of which he facilitates on behalf of his principal, although the principal may authorize the intermediary to negotiate a different price. Also, the principal must know the exact value at which the service is supplied (or obtained) on his behalf, and any discounts that the intermediary obtains must be passed back to the principal. Separation of value: The value of an intermediary’s service is invariably identifiable from the main supply of service that he is arranging. It can be based on an agreed percentage of the sale or purchase price. Generally, the amount charged by an agent from his principal is referred to as “commission”. Identity and title: The service provided by the intermediary on behalf of the principal are clearly identifiable. In accordance with the above guiding principles, services provided by the following persons will qualify as ‘intermediary services’:- i) Travel Agent (any mode of travel) ii) Tour Operator iii) Stockbroker iv) Commission agent [an agent for buying or selling of goods is excluded] v) Recovery Agent Even in other cases, wherever a provider of any service acts as an agent for another person, as identified by the guiding principles outlined above, this rule will apply. 3.7.8 What is a service consisting of “hiring of means of transport”? The services of providing a hire or lease, without the transfer of right to use (explained in Guidance Paper A- point 5.6) of any of the following will constitute a service consisting of hiring of means of transport:- i) Land vehicles such as motorcars, buses, trucks; ii) Vessels; iii) Aircraft; iv) Vehicles designed specifically for the transport of sick or injured persons; v) Mechanically or electronically propelled invalid carriages; vi) Trailers, semi-trailers and railway wagons. The following are not ‘means of transport’:- i) Racing cars; ii) Containers used to store or carry goods while being transported; iii) Dredgers, or the like. 3.7.9 What if I provide a service of hiring of a fleet of cars to a company on an annual contract? What will be place of provision of my service if my business establishment is located in New Delhi, and the company is located in Faridabad (Haryana)? This Rule covers a situation where the hiring is for a period of upto one month. Since hiring period is more than one month, this sub-rule cannot be applied to the situation. The place of provision of your service will be determined in terms of the default rule i.e Rule 3 i.e. receiver location, which in this case is Faridabad (Haryana). 3.8 Rule 10- Place of Provision of a service of transportation of goods 3.8.1 What are the services covered under this Rule? Any service of transportation of goods, by any mode of transport (air, vessel, rail or by a goods transportation agency), is covered here. However, transportation of goods by courier or mail is not covered here. 3.8.2 What is the place of provision of a service of transportation of goods? Place of provision of a service of transportation of goods is the place of destination of goods, except in the case of services provided by a Goods Transportation Agency for transportation of goods by road, in which case the place of provision is the location of the person liable to pay tax (as determined in terms of rule 2(1)(d) of Service Tax Rules, 1994. Illustration A consignment of cut flowers is consigned from Chennai to Amsterdam. The place of provision of goods transportation service will be Amsterdam (outside India, hence not liable to service tax). Conversely, if a consignment of crystal ware is consigned from Paris to New Delhi, the place of provision will be New Delhi. 3.8.3 What does the proviso to this Rule imply? The proviso to this Rule states as under:- “Provided that the place of provision of services of transportation of goods by goods transportation agency shall be the location of the person liable to pay tax.” Sub-rule 2(1)(d) of Service Tax Rules, 1994 provides that where a service of transportation of goods is provided by a ‘goods transportation agency’, and the consignor or consignee is covered under any of the specified categories prescribed therein , the person liable to tax is the person who pays, or is liable to pay freight (either himself or through his agent) for the transportation of goods by road in a goods carriage. If such person is located in non-taxable territory, then the person liable to pay tax shall be the service provider. The proviso to Rule 10 of these rules A consignment of cut flowers is consigned from Chennai to Amsterdam. The place of provision of goods transportation service will be Amsterdam (outside India, hence not liable to service tax). Conversely, if a consignment of crystal ware is consigned from Paris to New Delhi, the place of provision will be New Delhi. specifies that in the case where services of transportation of goods is provided by a goods transportation agency, the place of provision of such service will be the place where the person liable to pay tax, as determined in accordance with sub-rule 2(1)(d) of Service Tax Rules, 1994, is located. The implication is that the tax will be liable to be paid by the service provider, and consequently the place of provision will also be the location of the service provider. Illustration 1 A goods transportation agency ABC located in Delhi transports a consignment of new motorcycles from the factory of XYZ in Gurgaon (Haryana), to the premises of a dealer in Bhopal, Madhya Pradesh. Say, XYZ is a registered assessee and is also the person liable to pay freight and hence person liable to pay tax, in this case. Here, the place of provision of the service of transportation of goods will be the location of XYZ i.e Haryana. Illustration 2 A goods transportation agency ABC located in Delhi transports a consignment of new motorcycles from the factory of XYZ in Gurgaon (Haryana), to the premises of a dealer in Jammu (non-taxable territory). Say, as per mutually agreed terms between ABC and XYZ, the dealer in Jammu is the person liable to pay freight. Here, in terms of amended provisions of rule 2(1)(d), since the person liable to pay freight is located in non-taxable territory, the person liable to pay tax will be ABC. Accordingly, the place of provision of the service of transportation of goods will be the location of ABC i.e. Delhi. 3.9 Rule 11- Passenger Transportation Services 3.9.1 What is the place of provision of passenger transportation services? The place of provision of a passenger transportation service is the place where the passenger embarks on the conveyance for a continuous journey. 3.9.2 What does a “continuous journey” mean? A “continuous journey” means a journey for which:- (i) a single ticket has been issued for the entire journey; or (ii) more than one ticket or invoice has been issued for the journey, by one service provider, or by an agent on behalf of more than one service providers, at the same time, and there is no scheduled stopover in the journey 3.9.3 What is a “stopover”? “Stopover” means a place where a passenger disembarks from the conveyance. 3.9.4 The Table below contains illustrations which explain the principle enunciated in this Rule. Illustrations

3.10 Rule 12- Services provided on board conveyances 3.10.1 What are services provided on board conveyances? Any service provided on board a conveyance (aircraft, vessel, rail, or roadways bus) will be covered here. Some examples are on-board service of movies/music/video/ software games on demand, beauty treatment etc, albeit only when provided against a specific charge, and not supplied as part of the fare. 3.10.2 What is the place of provision of services provided on board conveyances? The place of provision of services provided on board a conveyance during the course of a passenger transport operation is the first scheduled point of departure of that conveyance for the journey. Illustration A video game or a movie-on-demand is provided as on-board entertainment during the Kolkata-Delhi leg of a Bangkok-Kolkata-Delhi flight. The place of provision of this service will be Bangkok (outside taxable territory, hence not liable to tax). If the above service is provided on a Delhi-Kolkata-Bangkok-Jakarta flight during the Bangkok-Jakarta leg, then the place of provision will be Delhi (in the taxable territory, hence liable to tax). 3.11 Rule 13- Power to notify services or circumstances 3.11.1 What is the implication of this Rule? This Rule states as follows:- “In order to prevent double taxation or non-taxation of the provision of a service, or for the uniform application of rules, the Central Government shall have the power to notify any description of service or circumstances in which the place of provision shall be the place of effective use and enjoyment of a service.” The rule is an enabling power to correct any injustice being met due to the applicability of rules in a foreign territory in a manner which is inconsistent with these rules leading to double taxation or double non-taxation. Due to the cross border nature of many services it is also possible in certain situations to set up businesses in a non-taxable territory while the effective enjoyment, or in other words consumption, may be in taxable territory. This rule is also meant as an anti-avoidance measure where the intent of the law is sought to be defeated through ingenious practices unknown to the ordinary ways of conducting business. 3.12 Rule 14- Order of application of Rules 3.12.1 What is the implication of this Rule? Rule 14 provides that where the provision of a service is, prima facie, determinable in terms of more than one rule, it shall be determined in accordance with the rule that occurs later among the rules that merit equal consideration. This Rule covers situations where the nature of a service, or the business activities of the service provider, may be such that two or more rules may appear equally applicable. Following illustrations will make the implications of this Rule clear:- A video game or a movie-on-demand is provided as on-board entertainment during the Kolkata-Delhi leg of a Bangkok-Kolkata-Delhi flight. The place of provision of this service will be Bangkok (outside taxable territory, hence not liable to tax). If the above service is provided on a Delhi-Kolkata-Bangkok-Jakarta flight during the Bangkok-Jakarta leg, then the place of provision will be Delhi (in the taxable territory, hence liable to tax). Illustration 1 An architect based in Mumbai provides his service to an Indian Hotel Chain (which has business establishment in New Delhi) for its newly acquired property in Dubai. If Rule 5 (Property rule) were to be applied, the place of provision would be the location of the property i.e Dubai (outside the taxable territory). With this result, the service would not be taxable in India. Whereas, by application of Rule 8, since both the provider and the receiver are located in taxable territory, the place of provision would be the location of the service receiver i.e New Delhi. Place of provision being in the taxable territory, the service tax would be taxable in India. By application of Rule 14, the later of the Rules i.e Rule 8 would be applied to determine the place of provision. Illustration 2 For the Ms Universe Contest planned to be held in South Africa, the Indian pageant (say, located in Mumbai) avails the services of Indian beauticians, fashion designers, videographers, and photographers. The service providers travel as part of the Indian pageant’s entourage to South Africa. Some of these services are in the nature of personalized services, for which the place of provision would normally be the location where performed (Performance rule-Rule 4), while for others, under the main rule (Receiver location) the place of provision would be the location of receiver. Whereas, by application of Rule 8, since both the provider and the receiver are located in taxable territory, the place of provision would be the location of the service receiver i.e New Delhi. Place of provision being in the taxable territory, the service tax would be taxable in India. By application of Rule 15, the later of the Rules i.e Rule 8 would be applied to determine the place of provision. ***** |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||