Hearing of the appeal out of turn - grievance of very ...

Income Tax

May 25, 2023

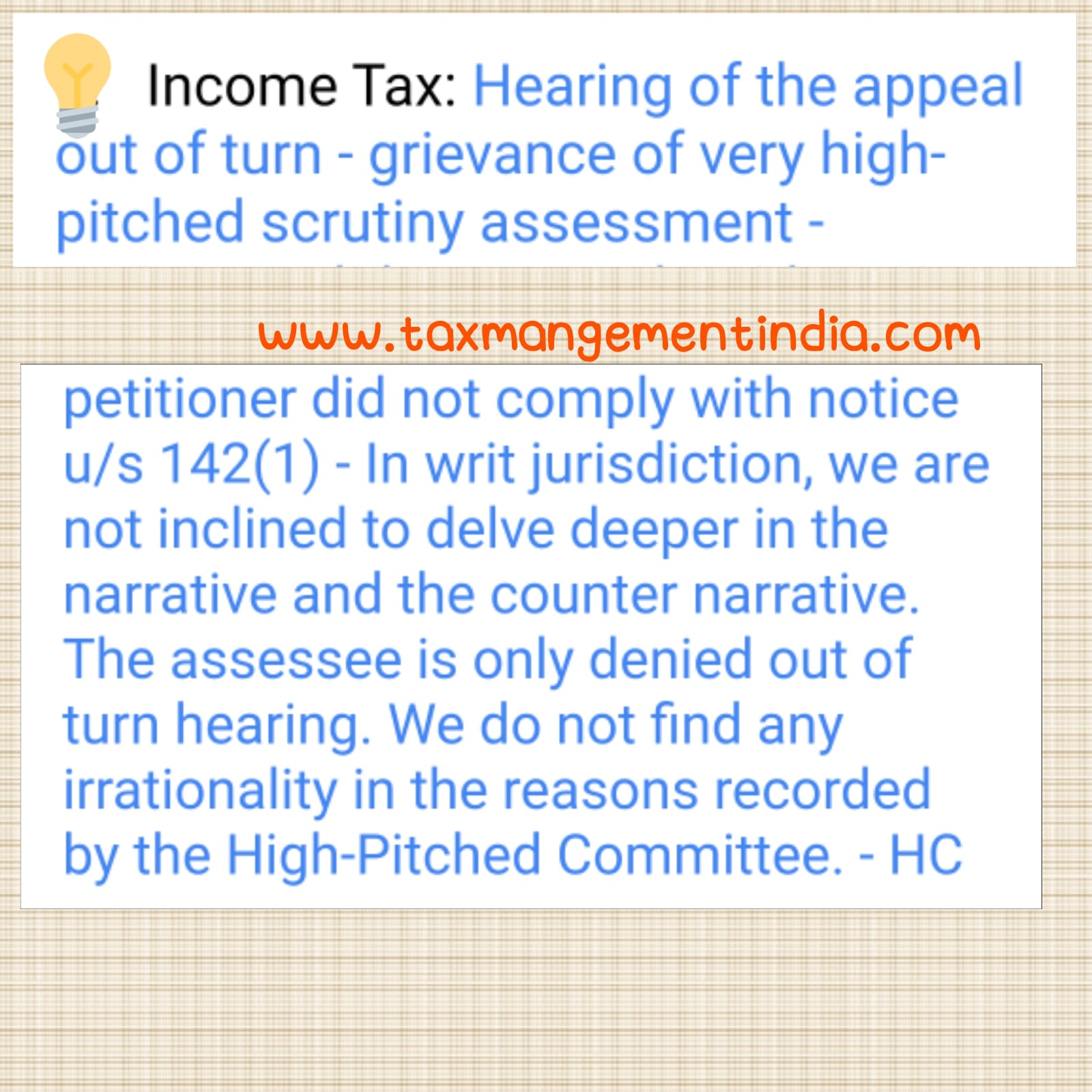

Hearing of the appeal out of turn - grievance of very high-pitched scrutiny assessment - petitioner did not comply with notice u/s 142(1) - In writ jurisdiction, we are not inclined to delve deeper in the narrative and the counter narrative. The assessee is only denied out of turn hearing. We do not find any irrationality in the reasons recorded by the High-Pitched Committee. - HC

View Source