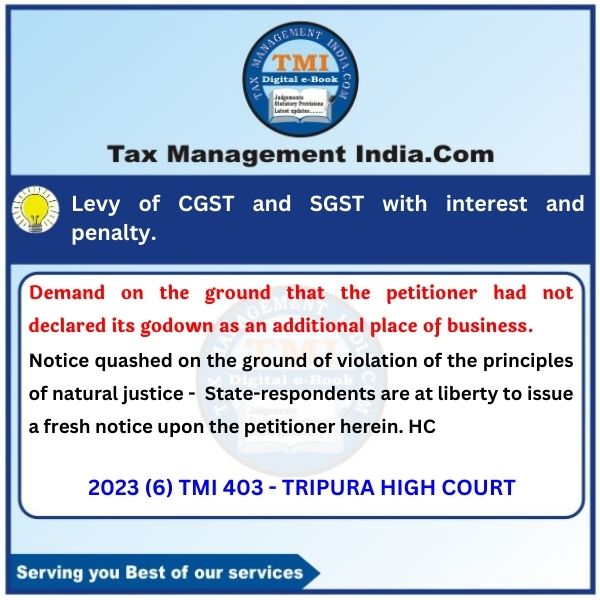

Levy of CGST and SGST with interest and penalty - demand on the ...

GST

June 9, 2023

Levy of CGST and SGST with interest and penalty - demand on the ground that the petitioner had not declared its godown as an additional place of business - HC quashed the notice on the ground of violation of the principles of natural justice - However, the State-respondents are at liberty to issue a fresh notice upon the petitioner herein.

View Source