Estimation of income on Cash Deposited in Bank Account - Kachha ...

Income Tax

June 14, 2023

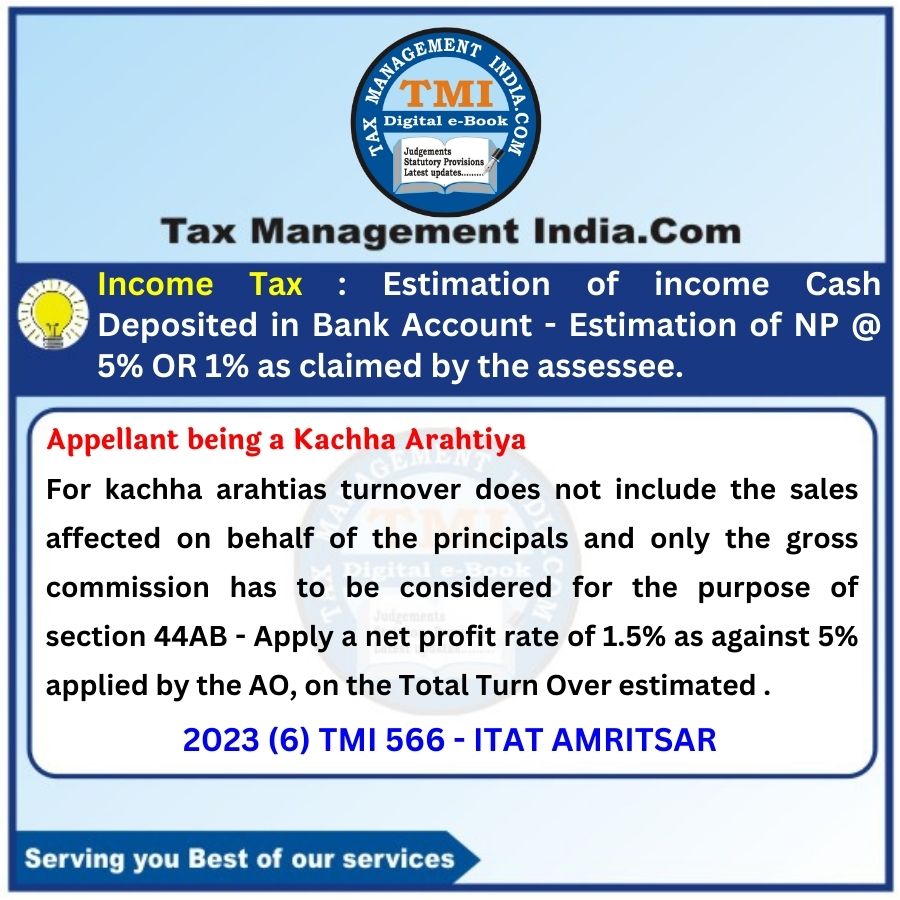

Estimation of income on Cash Deposited in Bank Account - Kachha Arahtiya - Estimation of Net Profit (NP) @ 5% instead of 1% as claimed by the assessee - so far as kachha arahtias are concerned, the turnover does not include the sales affected on behalf of the principals and only the gross commission has to be considered for the purpose of section 44AB - it would be justified to apply a net profit rate of 1.5% as against 5% applied by the AO, on the Total Turn Over estimated - AT

View Source