Determination of Tax - Prescribed procedure u/s 75 of CGST Act - ...

GST

June 22, 2023

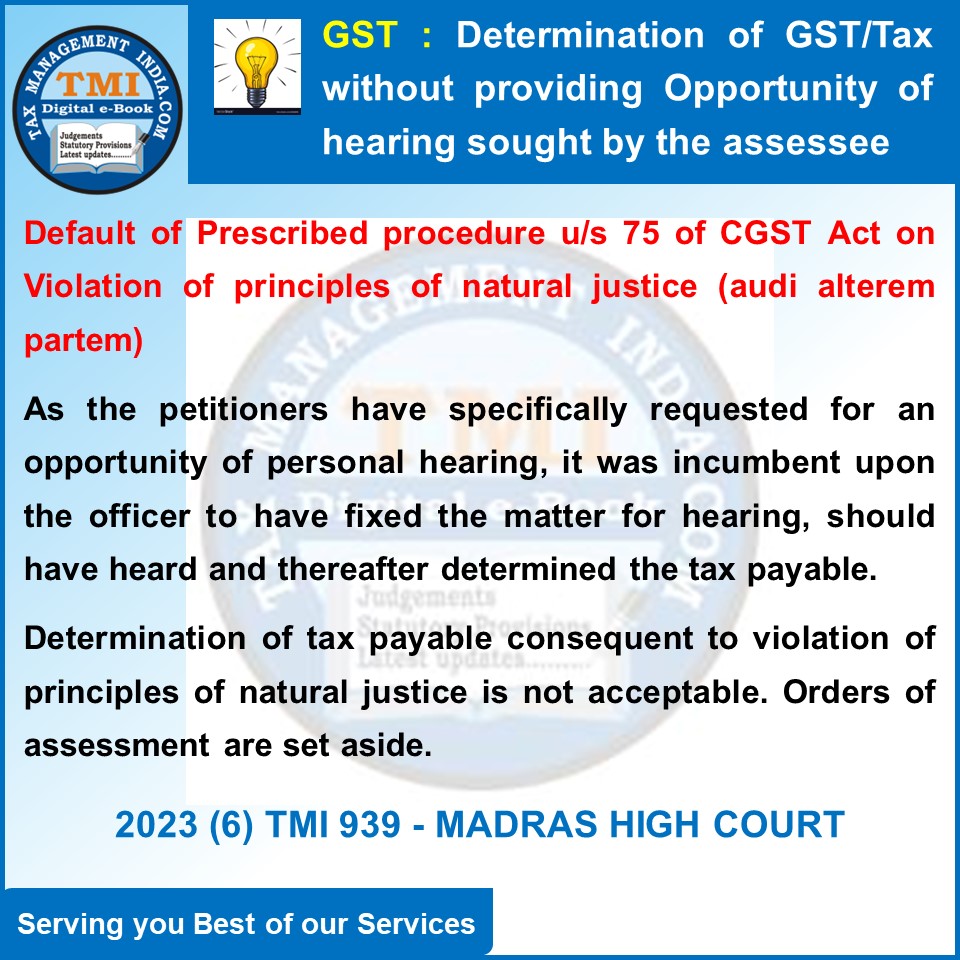

Determination of Tax - Prescribed procedure u/s 75 of CGST Act - Violation of principles of natural justice (audi alterem partem) - Seeing as the petitioners have specifically requested for an opportunity of personal hearing, it was incumbent upon the officer to have fix the matter for hearing, heard the petitioners and thereafter determined the tax payable. - HC

View Source