Income Taxable in India - Salary - foreign assignment allowance ...

Income Tax

July 1, 2023

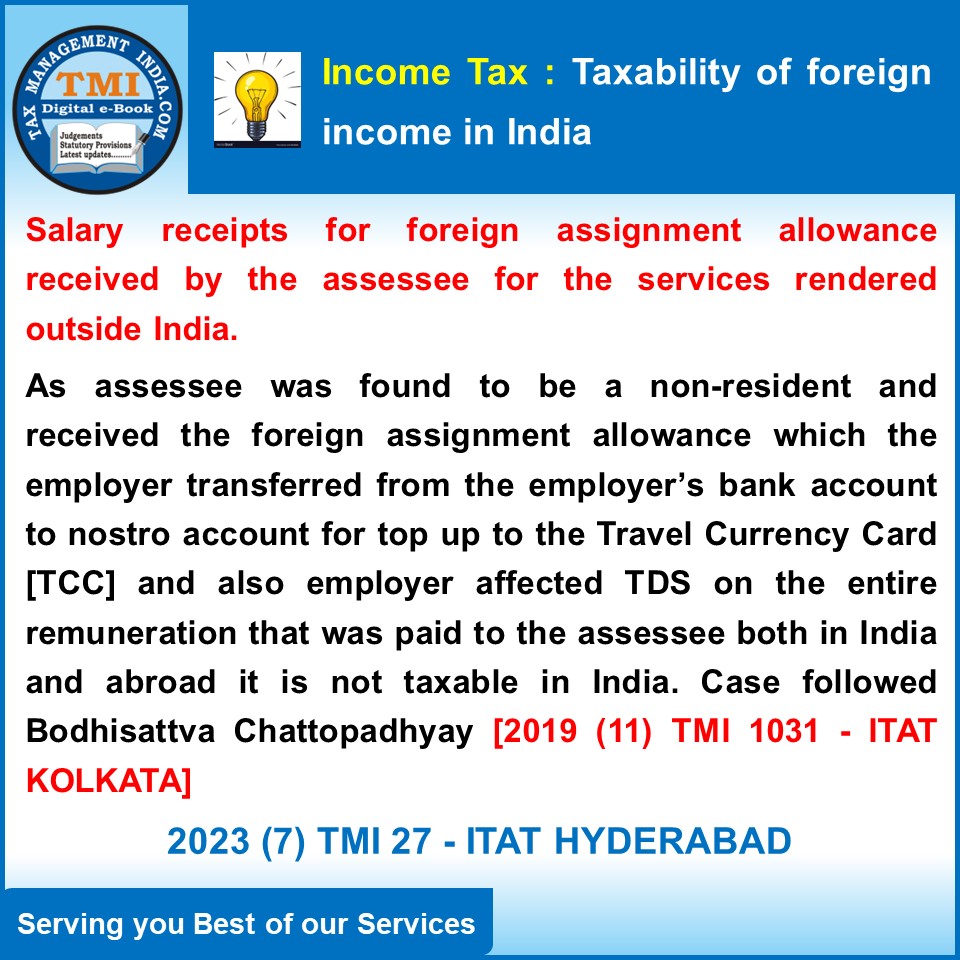

Income Taxable in India - Salary - foreign assignment allowance received by the assessee for the services rendered outside India - the foreign assignment allowance that was topped up to the TCC of the assessee, though it was transferred by the employer from their bank account in India to the Axis bank’s nostro accounts, is not taxable in India. - AT

View Source