Exemption u/s 54B - LTCG was invested in the purchase of another ...

Income Tax

July 6, 2023

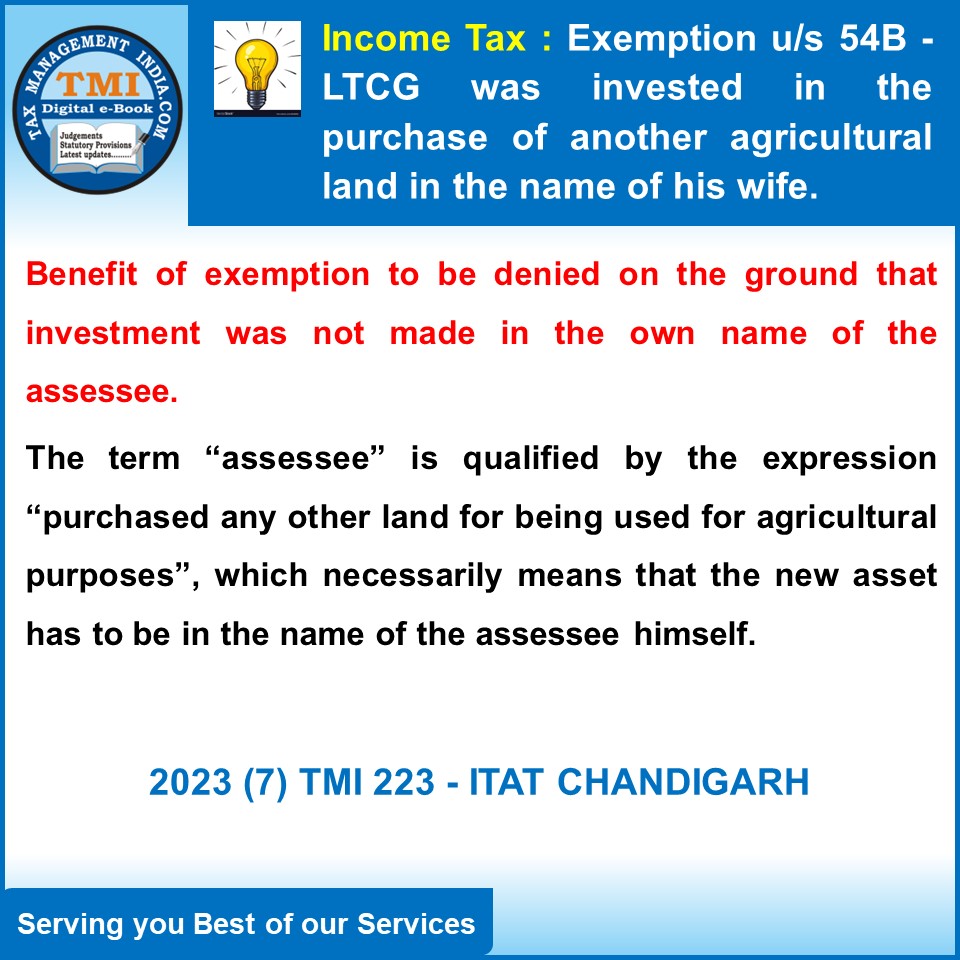

Exemption u/s 54B - LTCG was invested in the purchase of another agricultural land in the name of his wife - The term “assessee” is qualified by the expression “purchased any other land for being used for agricultural purposes”, which necessarily means that the new asset has to be in the name of the assessee himself; that therefore, purchase of agricultural land by the assessee in the name of his son or grandson etc. does not qualify for exemption u/s 54B. - AT

View Source