Disallowance of Expenditure u/s 57 (iii) - Nexus of expenditure ...

Income Tax

July 10, 2023

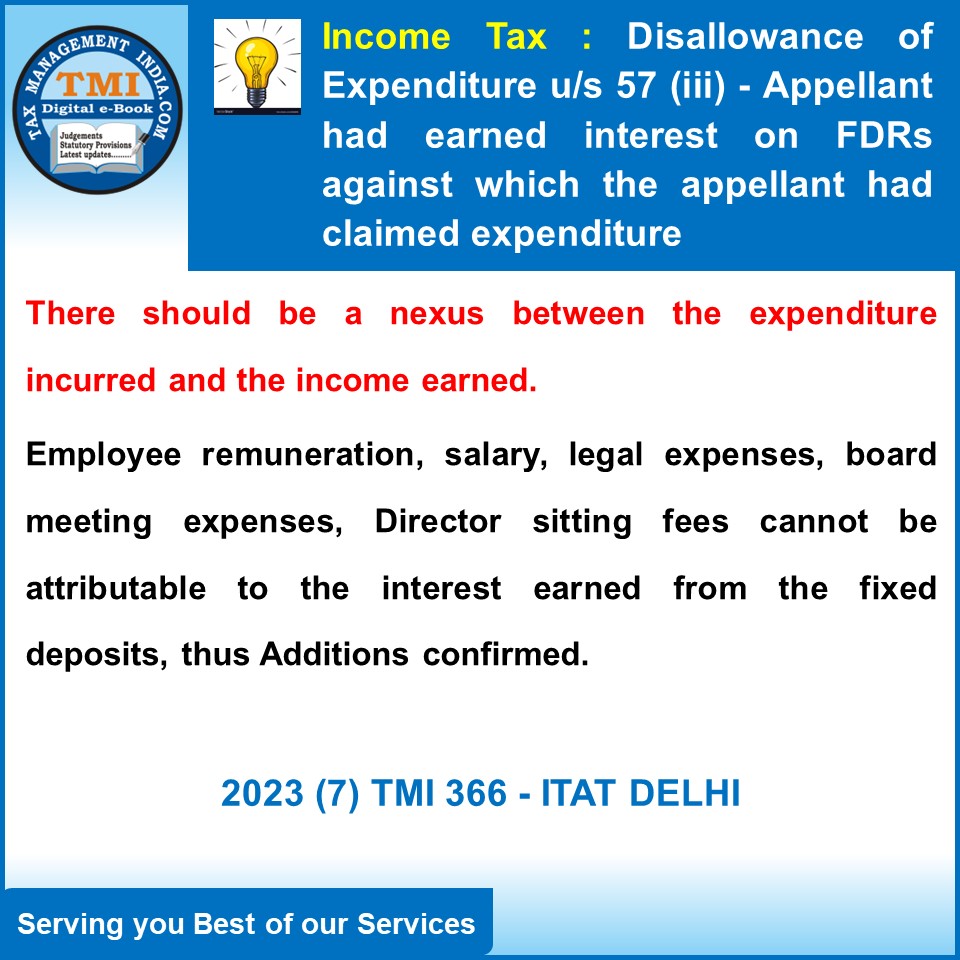

Disallowance of Expenditure u/s 57 (iii) - Nexus of expenditure with Interest Income - Employee remuneration, salary, legal expenses, board meeting expenses, Director sitting fees cannot be attributable to the interest earned from the fixed deposits. - Additions confirmed - AT

View Source