Levy of GST - Providing canteen services to employees - recovery ...

GST

July 13, 2023

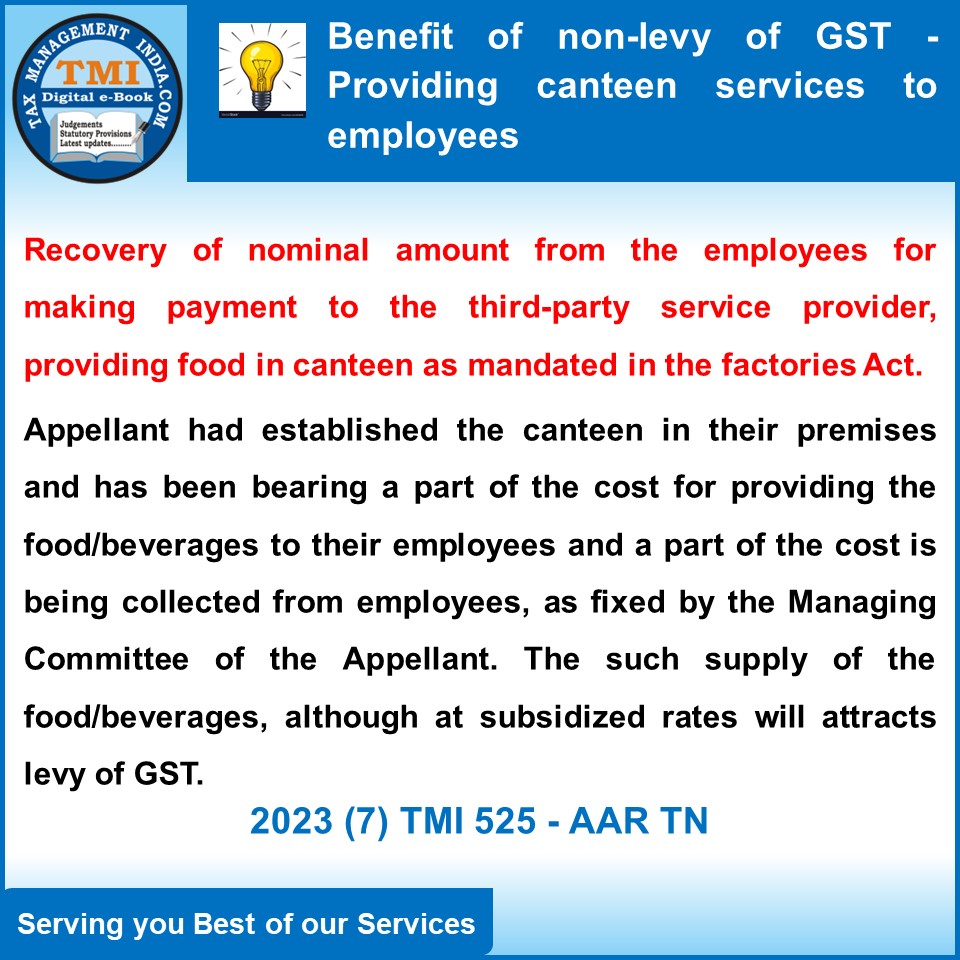

Levy of GST - Providing canteen services to employees - recovery of nominal amount from the employees for making payment to the third-party service provider, providing food in canteen as mandated in the factories Act, 1948 - The supply of the food/beverages, although at subsidized rates, by the Appellant/employer to their employees is certainly an activity amounting to supply of service and attracts levy of GST on that part of the consideration being charged for such supply. - AAAR

View Source