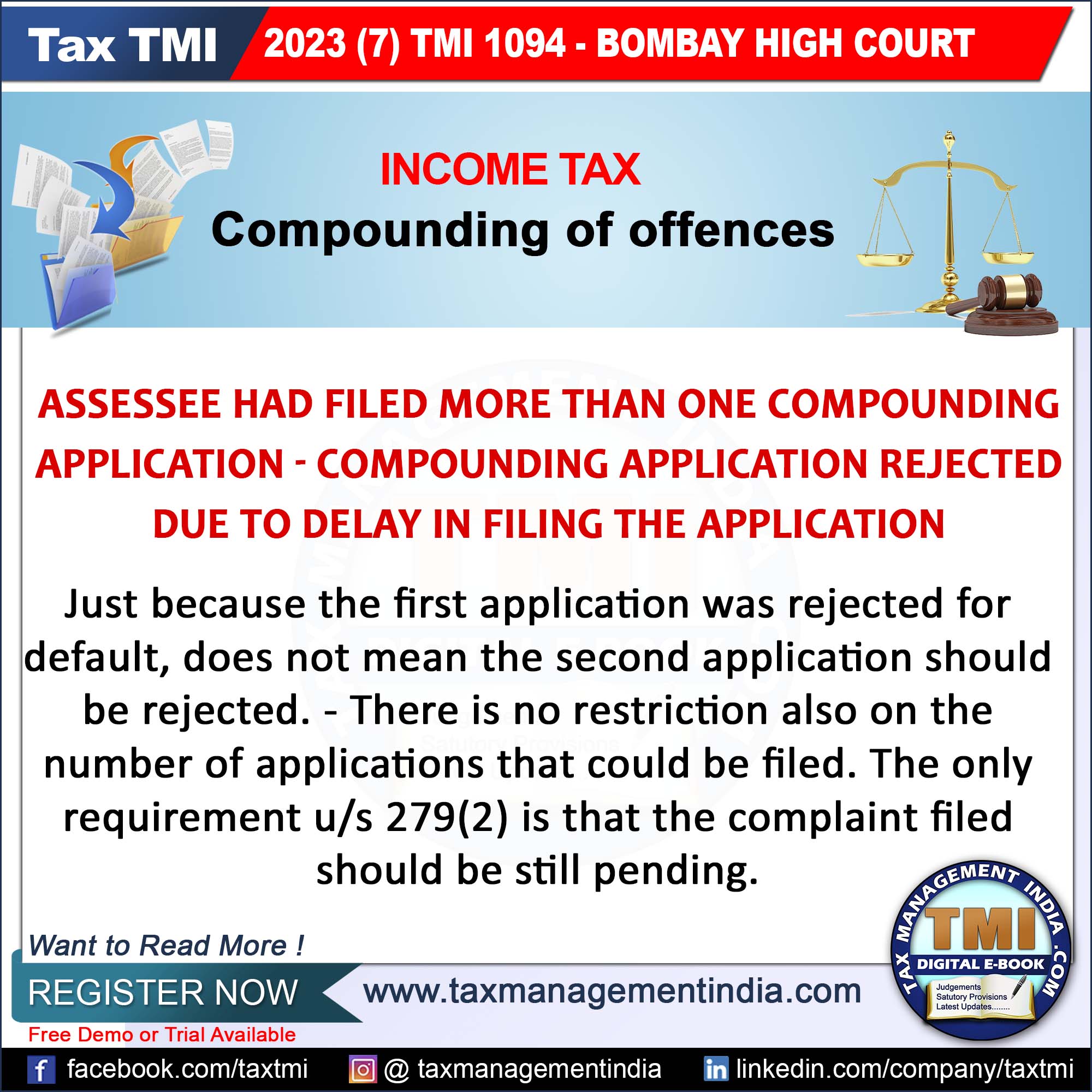

Compounding of offences - compounding application rejected due ...

Income Tax

July 27, 2023

Compounding of offences - compounding application rejected due to delay in filing the application - just because the first application was rejected for default, does not mean the second application should be rejected. - There is no restriction also on the number of applications that could be filed. The only requirement u/s 279(2) is that the complaint filed should be still pending - HC

View Source