Levy of GST - Credit Card loan - tax charged by the bank on each ...

GST

July 27, 2023

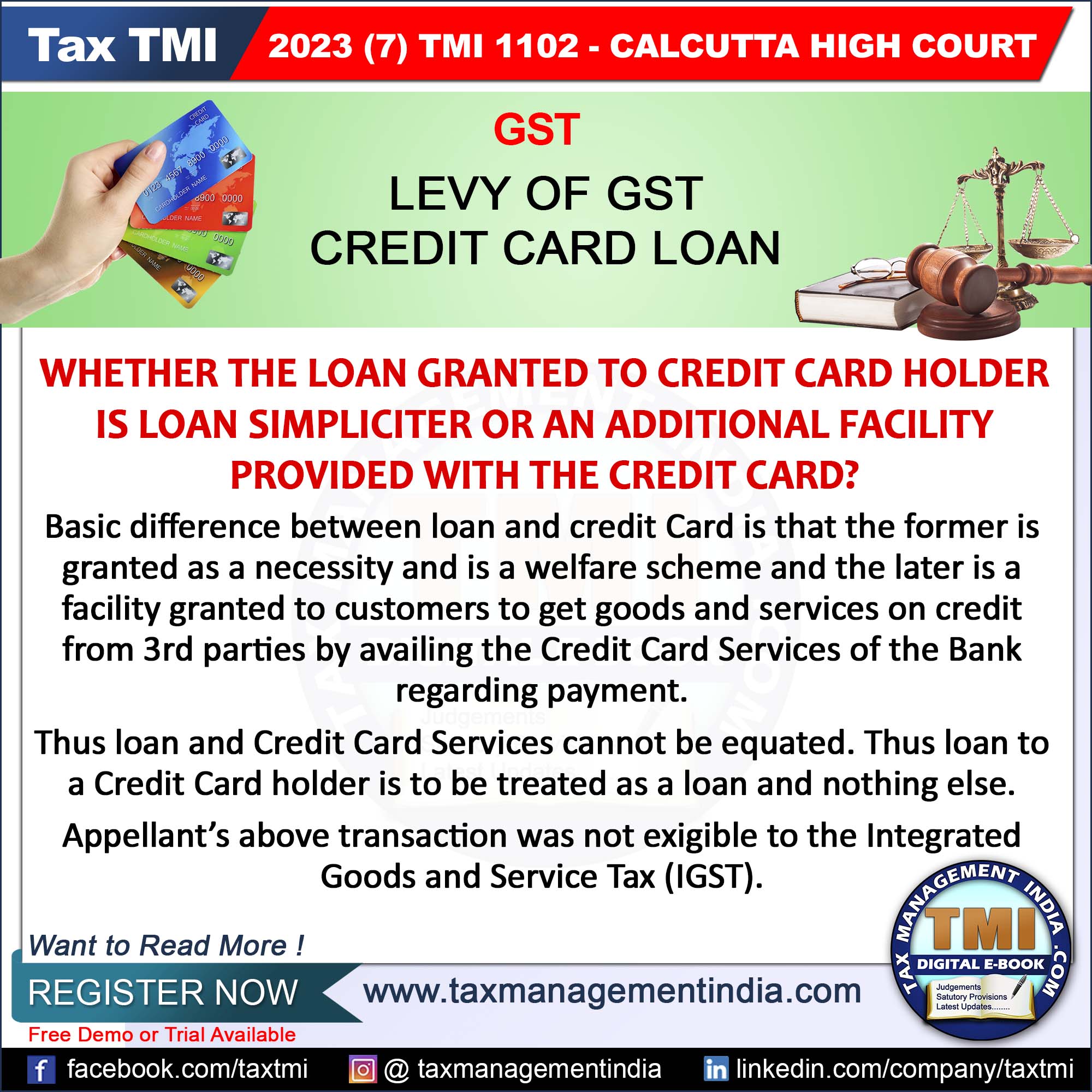

Levy of GST - Credit Card loan - tax charged by the bank on each instalment of interest together with the loan amount paid by the appellant. - the appellant’s above transaction with the bank was a service which could not be termed as a credit card service and was not exigible to the Integrated Goods and Service Tax (IGST) - HC

View Source