Addition u/s 69 - the income surrendered during the course of ...

Income Tax

August 3, 2023

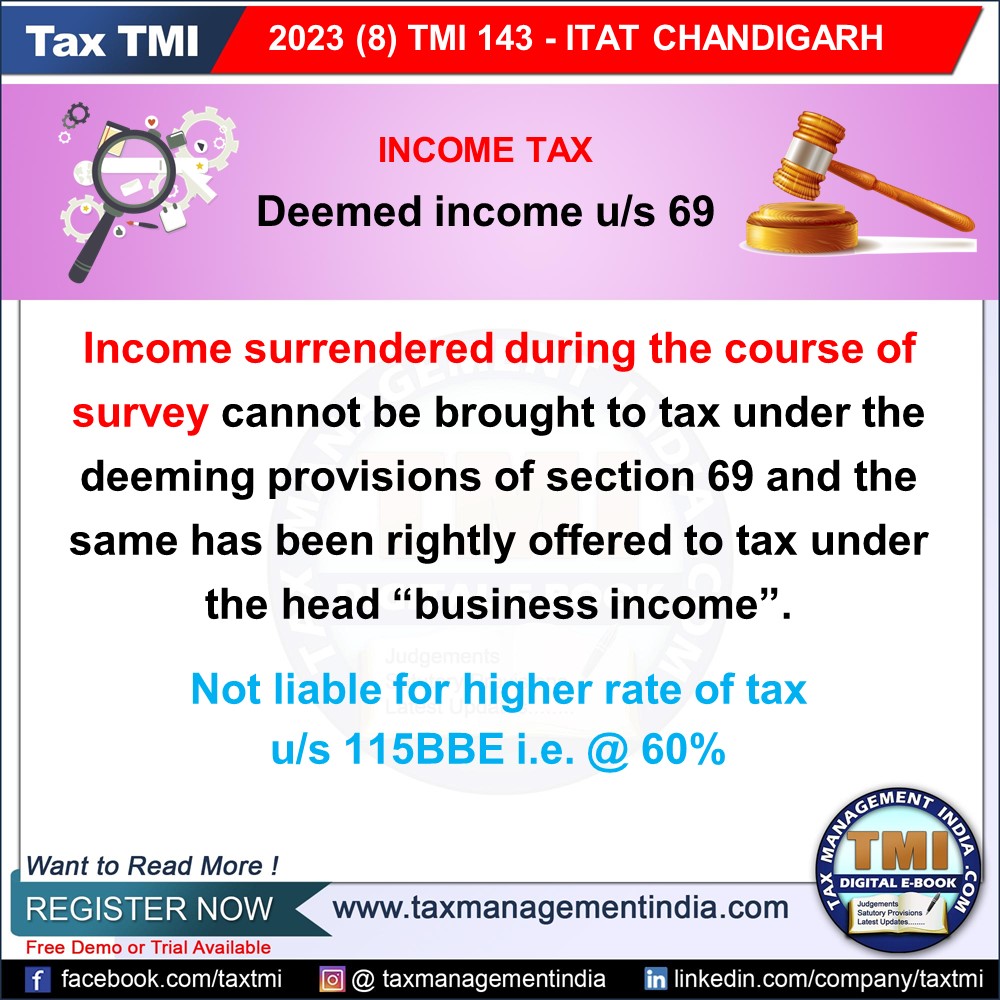

Addition u/s 69 - the income surrendered during the course of survey cannot be brought to tax under the deeming provisions of section 69 and the same has been rightly offered to tax under the head “business income”. - Not liable for higher rate of tax u/s 115BBE i.e. @ 60% - AT

View Source