Penalty u/s 271(1)(b) - notice issued but not served - Simply ...

Income Tax

August 9, 2023

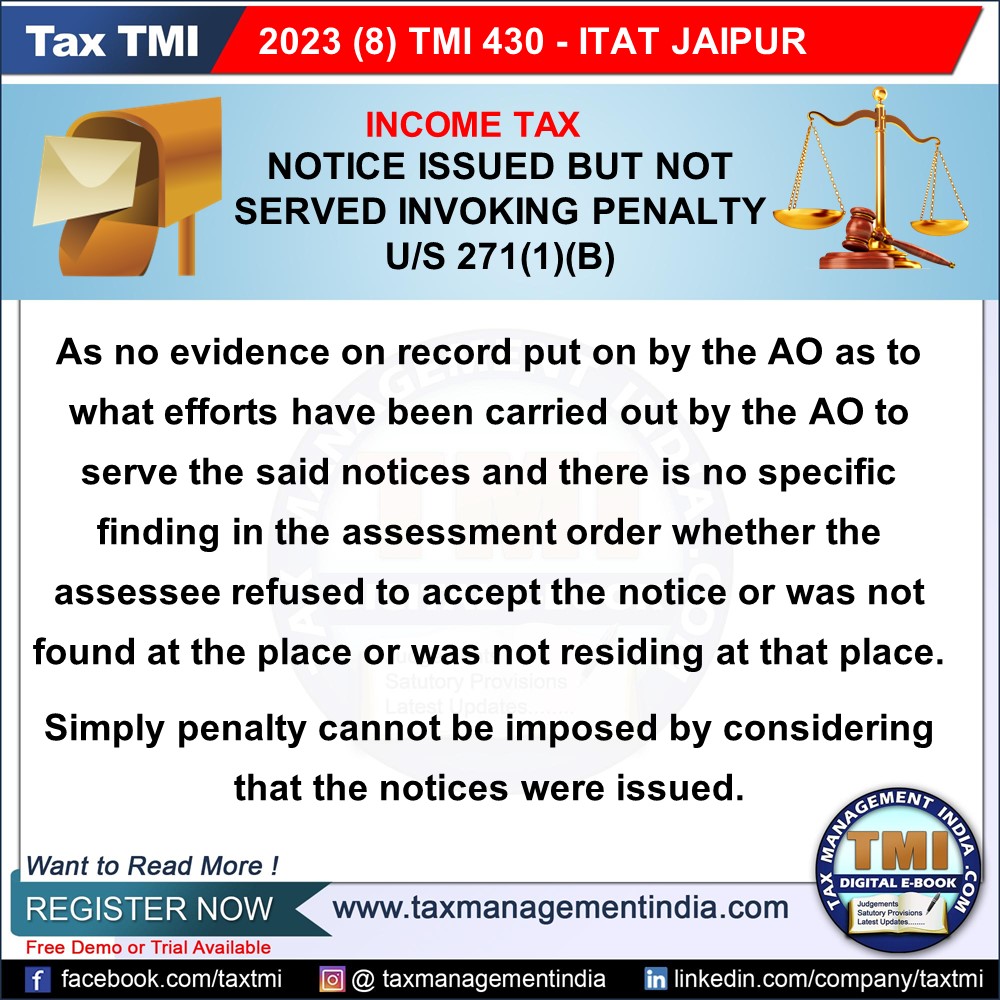

Penalty u/s 271(1)(b) - notice issued but not served - Simply penalty has been imposed by considering that the notices were issued. In our view, service of notice is only a formality and, therefore, no true or genuine efforts were made by the AO to serve the notices. Since there is no proof on the court file with regard to service of notice, therefore, in our view, no penalty is attracted. - AT

View Source