Cancellation of GST registration of petitioner with ...

GST

August 23, 2023

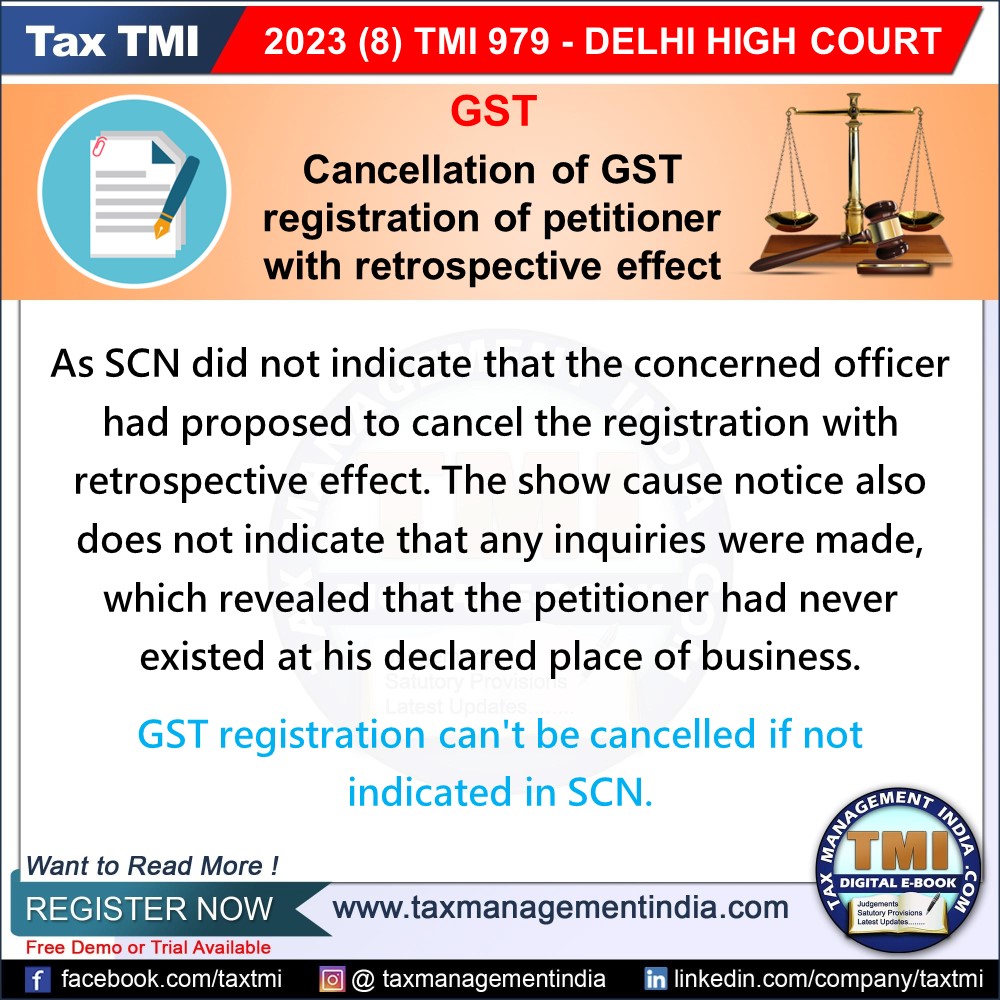

Cancellation of GST registration of petitioner with retrospective effect from 01.07.2017 - Assessee filed the application for cancellation of registration but failed to submit the reply to the Show Cause notice issued - petitioner was not available at the principal place of business after he had ceased to carry on any business - Order of cancellation with retrospective effect is not correct - Direction issued - HC

View Source