Seeking release of seized currency - Power u/s 67(2) of GST Act ...

GST

August 28, 2023

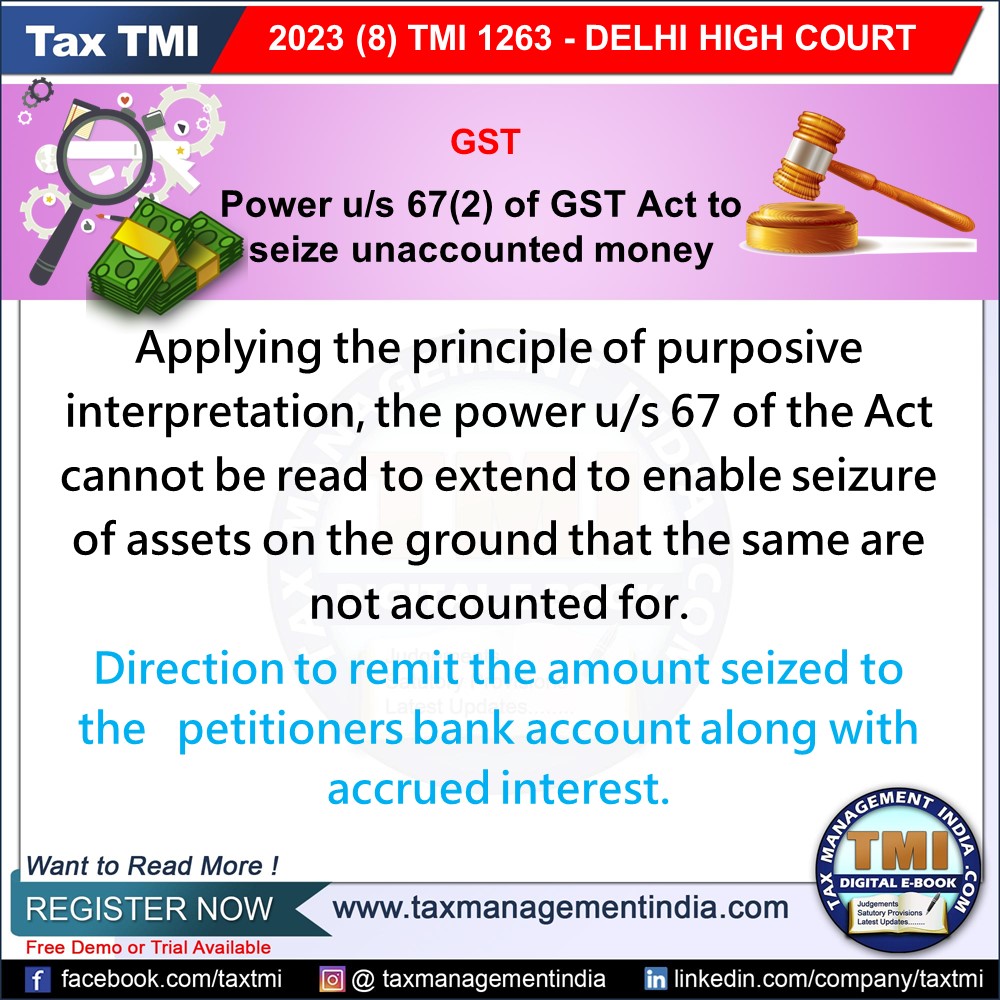

Seeking release of seized currency - Power u/s 67(2) of GST Act to seize unaccounted money - applying the principle of purposive interpretation, the power u/s 67 of the Act cannot be read to extend to enable seizure of assets on the ground that the same are not accounted for. - Money directed to be returned back - HC

View Source