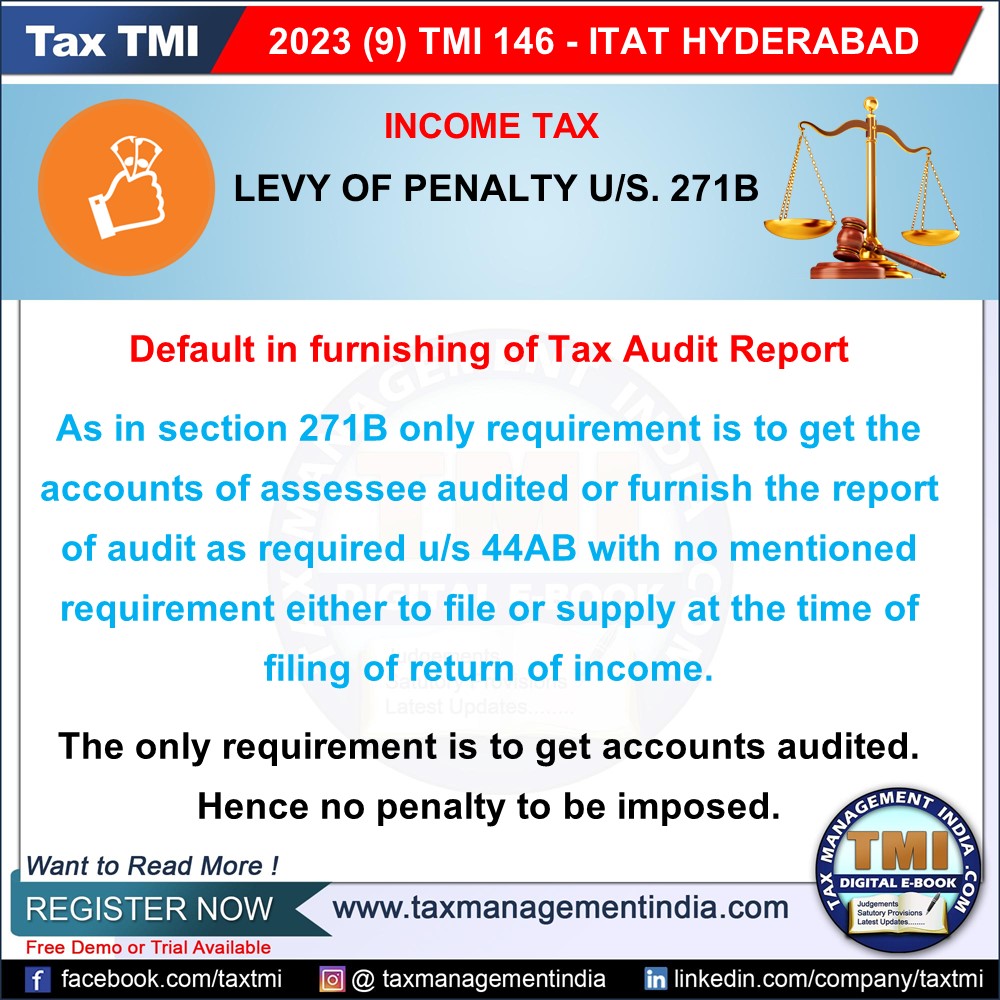

Levy of penalty u/s. 271B - default in furnishing of Tax Audit ...

Income Tax

September 4, 2023

Levy of penalty u/s. 271B - default in furnishing of Tax Audit Report - In section 271B of the Act, the only requirement is to get the accounts of assessee audited or furnish the report of audit as required u/s 44AB of the Act. There is no requirement either to file or supply at the time of filing of return of income. The only requirement is to get accounts audited. - Assessee had filed the proof of furnishing the audit report before AO - No penalty - AT

View Source