Adjustment interest against Refund - Unutilized balance of ITC ...

GST

October 10, 2023

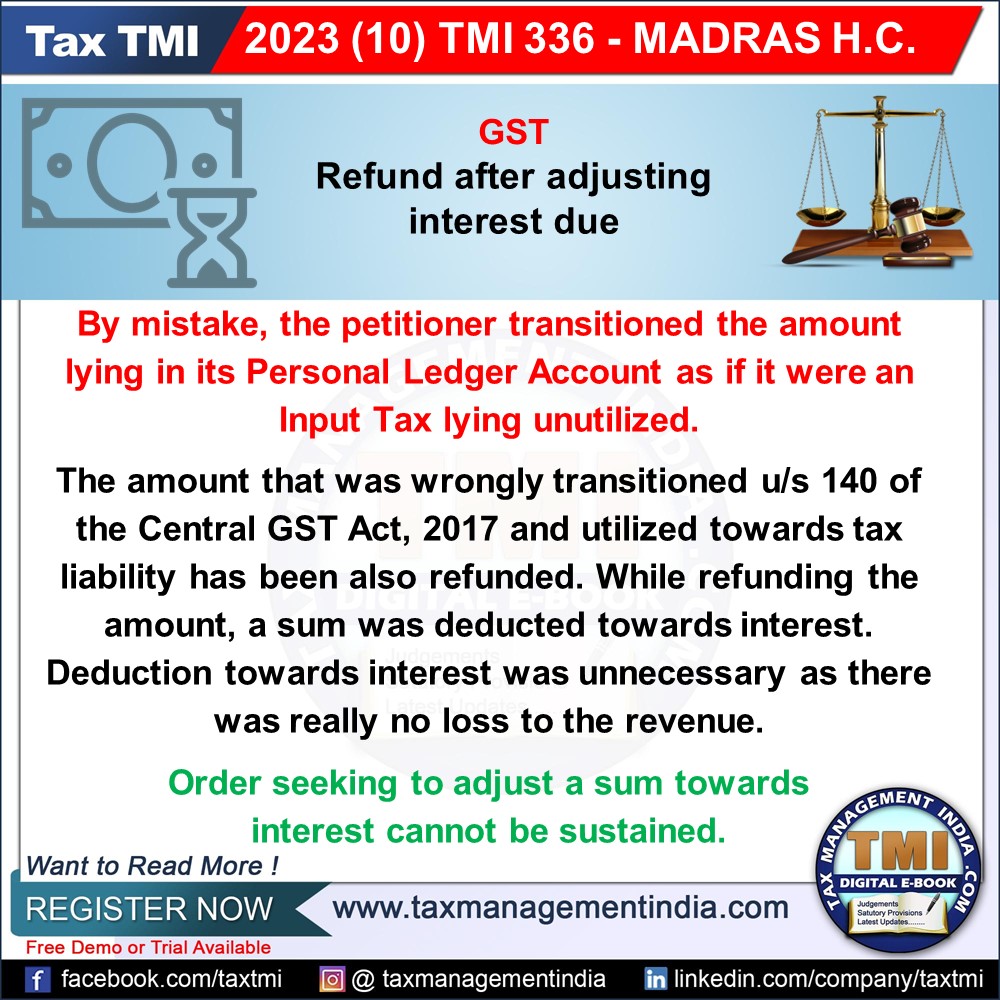

Adjustment interest against Refund - Unutilized balance of ITC was not used for payment of GST by the assessee wrongly - Deduction of an amount towards interest was unnecessary as there was really no loss to the revenue. It would have been different, if tax liability was adjusted earlier out of Input Tax credit availed on State GST borne and was utilized for payment of Central GST by the petitioner under the provisions of the Central Goods and Services Tax Act, 2017. - HC

View Source