Penalty levied u/s 271C - bonafide belief - reasonable cause - ...

Income Tax

October 14, 2023

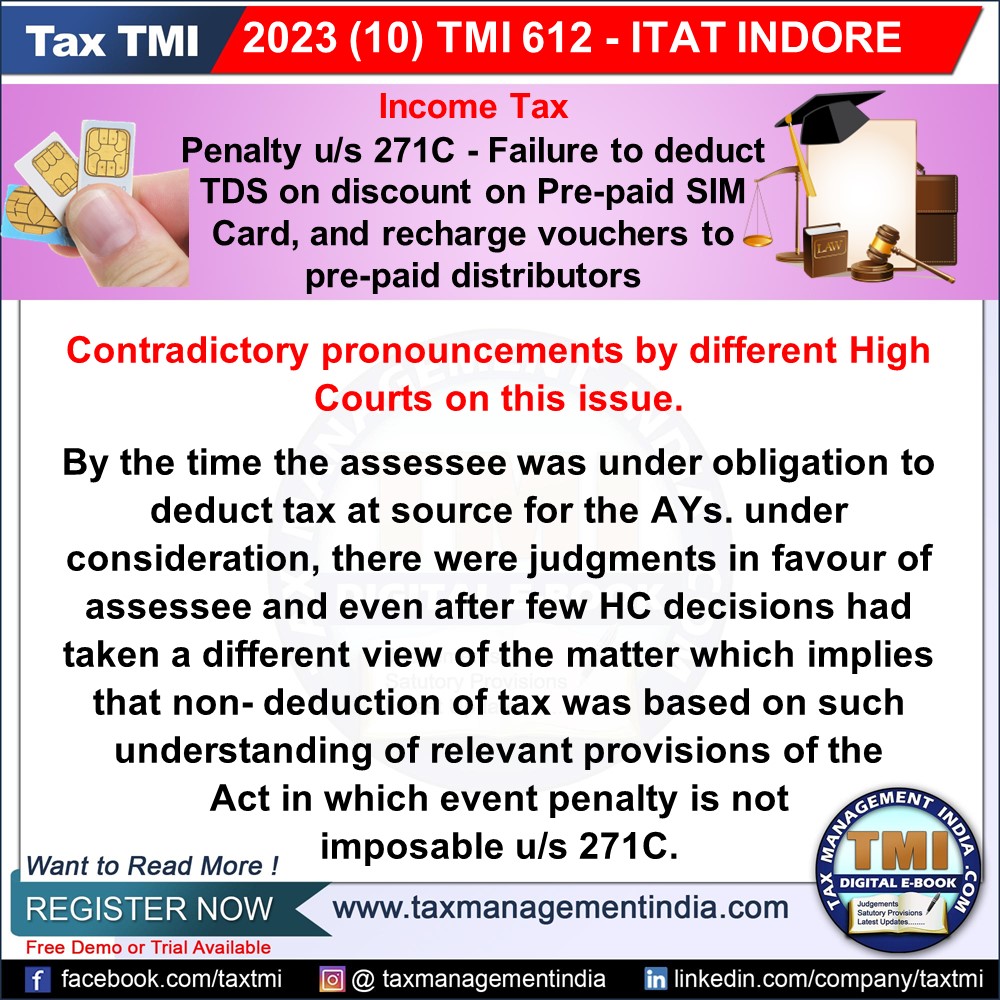

Penalty levied u/s 271C - bonafide belief - reasonable cause - failure to deduct the tax at source (TDS) - By the time the assessee was under obligation to deduct tax at source for the AYS under consideration, there were judgments in favour of assessee - penalty is not imposable u/s 271C - AT

View Source