Jurisdiction - proper officer to issue summons and conduct ...

GST

October 19, 2023

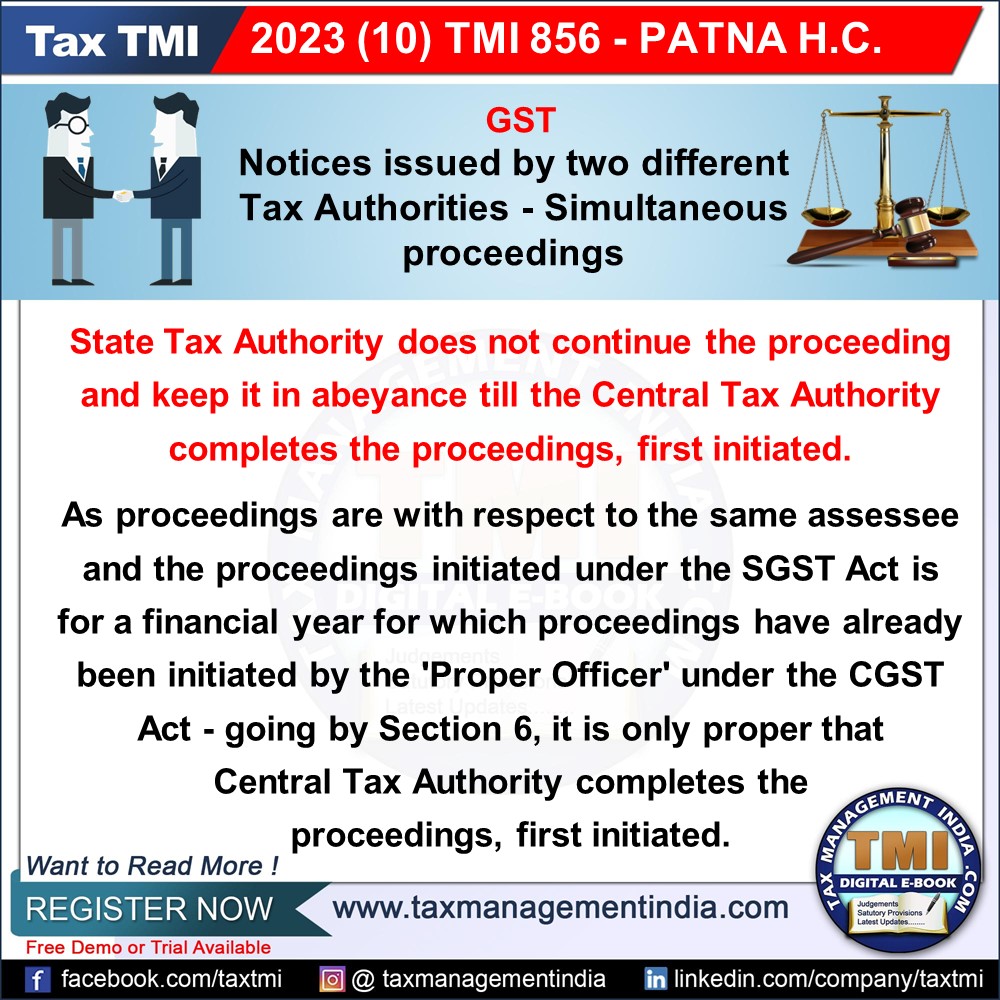

Jurisdiction - proper officer to issue summons and conduct inquiry - Investigation / Enquiry proceedings initiation by different authorities of state and central GST - The proceedings as initiated against Annexure-1 dated 04.02.2022 by the State Tax Authority, is at the notice stage and with respect to one of the years on which the Central Tax Authority has already initiated proceedings. Annexure-1, hence, shall be kept in abeyance. - HC

View Source