Doctrine of mutuality - satisfaction of three tests - Fees for ...

Case Laws Income Tax

October 20, 2023

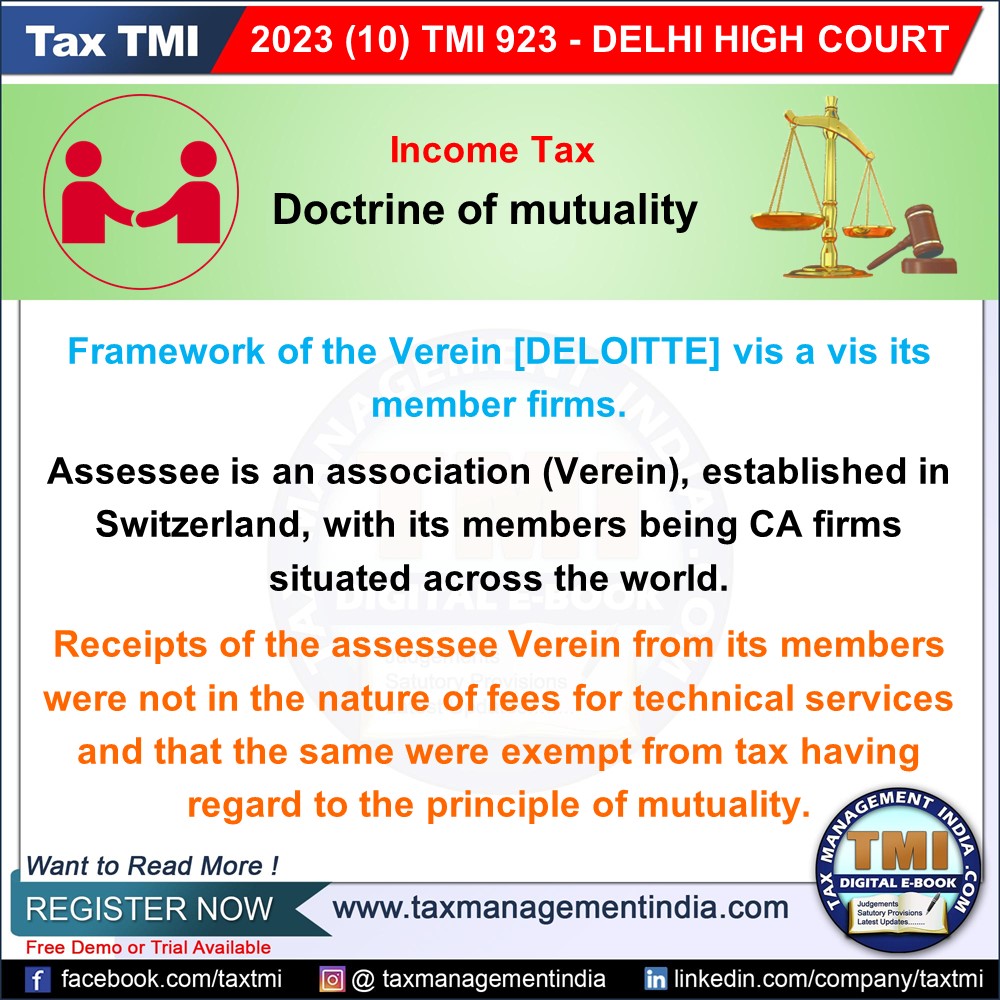

Doctrine of mutuality - satisfaction of three tests - Fees for technical services - assessee is an association (Verein), established in Switzerland, with its members being Chartered Accountant firms situated across the world - All three tests of mutuality having been satisfied as aforesaid, we are of the considered view that the receipts of the respondent/assessee Verein from its members were not in the nature of fees for technical services and that the same were exempt from tax having regard to the principle of mutuality. - HC

View Source