Professional Misconduct - Chartered Accountant (CA) - Lapses in ...

Companies Law

October 26, 2023

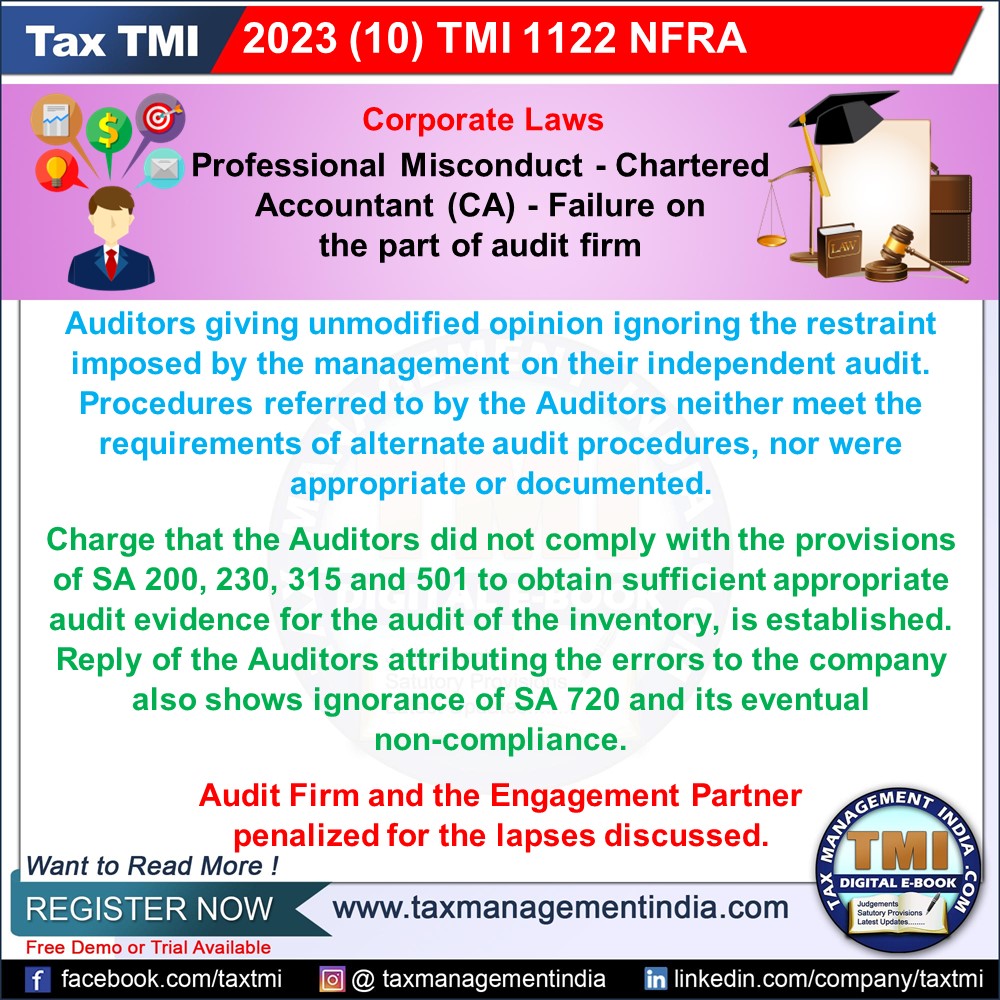

Professional Misconduct - Chartered Accountant (CA) - Lapses in evaluation of writing-back of liabilities - Failure in evaluation and attendance at physical verification of Inventory - The contention that they are a small audit firm, cannot be accepted as auditors are duty bound to comply with the requirements of the statutes to safeguard the interest of public. Therefore, in addition to the EP, we hold the Audit Firm also responsible for the lapses discussed. - NFRA

View Source