Liquidation of the past tax litigation can streamline the resources of the tax administration, shore up public revenues, and clean up the tax payer‘s slate.

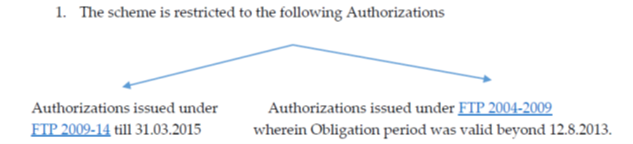

The DGFT has issued a Public Notice ( 2/2023 dated 1st April 2023) and a Policy Circular ( 1/2023-24-DGFT dated 17th April, 2023) pitching a scheme, christened as an Amnesty Scheme, for one time settlement of default in export obligation by Advance and EPCG authorization holders. The scheme is applicable for all variants of these ‘Authorizations’ that were issued within a time frame.

A. What is the Scheme?

The scheme, basically, is a facility that allows regularization of defaults in specified Export Obligations:

1. On payment of all customs duties that were exempted, in proportion to unfulfilled Export Obligation, along with payment of interest;

2. the interest however is reduced and capped as below;

(i) No interest will be payable on the portion of Additional Customs Duty and Special Additional Customs Duty;

(ii) The interest on remaining duty is further capped at 100% of such duties. (Public Notice No. 2/2023 dated 1st April 2023, as amended vide Public Notice 7/2023 dated 18.04.2023)

The scheme thus softens the compliance by bringing down the interest liability.

B. Which Authorizations are covered/ eligible?

2. Cases which have already been adjudicated ( or pending adjudication) , either originally or under appeal can also be regularized under the scheme ( Clause (ix) of para II of the Public Notice).

3. Cases under investigation or cases adjudicated for fraud, misdeclaration or unauthorized diversion of material and/or capital goods will be excluded from the coverage (Clause (x) of Para II of the Public Notice)

4. Cases where duty along with applicable interest has already been deposited in full will not be eligible for coverage. (Clause (xii) of Para II of the Public Notice)

C. Procedure

1. Interested authorization holders shall register themselves in website: https://www.dgft.gov.in in a separate application form provided for this purpose.

2. Thereafter, if the entire authorization is under default, the applicants can pay the Customs duty plus the interest with jurisdictional Customs authorities and submit proof thereof to the concerned Regional Authority of the DGFT.

3. If the default is partial, the RA of the DGFT, on the basis of specific request of the applicant, and on the basis of application of EODC filed with necessary documents, shall intimate to the applicant the Customs duty and interest payable.

For the above purposes, the Policy Circular prescribes that:

4. On the DGFT Website, the Applicant has to navigate to Services –> Advance Authorisation/DFIA –> Closure of Advance Authorisation. For EPCG the Applicant has to navigate to Services –> EPCG –> Closure of EPCG.

5. The applicant shall select the checkbox for ‘Amnesty scheme for one-time settlement of default in export obligation’ and proceed to file application for closure against the concerned EPCG or AA authorisation as per the online proforma.

6. The applicant, as per their calculations, shall indicate the duty and interest values to be paid under the ‘Redemption Matrix’ tab and submit their application online.

7. On receipt of online application, the RA concerned shall examine and confirm the shortfall through an online letter.

8. Applicant shall make the required payment of duty and interest to the Jurisdictional Customs Authority and provide the proof of payment in response to the said letter online.

9. Based on the evidence of payments and other relevant documents prescribed, concerned RA may examine and consider granting Export Obligation Discharge Certificate (EODC) online.

D. Time Limit for availing the Scheme

For availing the benefit, the registration process on the DGFT website is to be completed before 30.06.2023, and the payment of customs duties is to be completed by 30.09.2023.

E. Further procedure in respect of pending adjudication, pending appeal, or adjudicated but appeal not filed cases.

It is pertinent to mention here that though the Authorisations have been issued by DGFT officers and EODC is also to be issued by the DGFT officers, the Customs duty liability, in the event failure to discharge export obligation, is recovered by Customs. As such, in the cases pending at adjudication/ appellate stage before customs authorities, the firm will produce a copy of the closure letter from RA of DGFT before the adjudicated authority/ appellate authority in customs. On submission of such closure letter, the adjudicating authority/ appellate authority will decide on closure of such case/ appeal and will inform the same to the applicant and RA. It is apposite to mention here that the Ministry of Finance has also issued a Notification No. 32/2023 –Customs dated 26.04.2023, amending the earlier customs notification and making provision for regularisation of default by paying reduced interest as per the DGFT Public Notice 02/2023, dated the 1st April, 2023.

F. Some ‘Grey’ matter

One question that remains is the status of penalties, if any imposed by the adjudicating authorities, more so if appeal has not been filed against the adjudication orders. Prima facie, regularisation of payment with interest makes does not warrant any penalty, fine etc. It would have been preferable, had the government put this aspect in black and white. It would be useful here to mention here that in case of MAHINDRA & MAHINDRA LTD. (AUTOMOTIVE SECTOR) , VERSUS THE UNION OF INDIA, THE SETTLEMENT COMMISSION, ADDITIONAL BENCH, CUSTOMS & CENTRAL EXCISE, MUMBAI, THE COMMISSIONER OF CUSTOMS (IMPORT) , MUMBAI, THE ADDITIONAL DIRECTOR GENERAL, DGCEI, MUMBAI - 2022 (10) TMI 212 - BOMBAY HIGH COURT, Hon’ble Bombay High Court held that “There is no provision under Section 3 for additional duty or Section 3A for special additional duty under the Customs Tariff Act, 1975 or Section 90 of the Finance Act, 2000 that creates a charge in the nature of penalty or interest”; and that “In the absence of specific provision relating to levy of interest in the respective legislation, interest cannot be recovered by taking recourse to machinery relating to recovery of duty..”.

Another question is that the examples given under the Public Notice refer to CIF Value, whereas prior to amendment of Customs Valuation Rules, 2007 vide Notification 91/2017-Customs dated 26.09.2017, there was a provision of 1% marking of loading, unloading and handling charges under clause (ii) of the Rule 9 (2)(b) of these Rules. This provision for fixed mark-up charges was struck down by the Hon’ble Supreme Court in WIPRO LTD. VERSUS ASSISTANT COLLECTOR OF CUSTOMS & OTHERS - 2015 (4) TMI 643 - SUPREME COURT. So in cases the importer wants to assert that the actual handling charges were less than 1% of the CIF value, would this benefit be allowed at this stage.

G. Conclusion

Overall the scheme is structured in a way that it will not cause much hard feelings to the genuine tax payers who have either discharged their export obligations or else have already paid the customs duties along with interest for non-fulfillment of export obligations. Basically, the customs duty is already determined at the time of import, and this duty is exempted subject to condition of making stipulated exports, failing which the duty forgone is payable along with interest. The high interest liability, sometimes even higher than the customs duty, was a detriment in the squaring off of the past liabilities. The interest rate for late payment of customs duty was 18% between April, 2011 to 01.03.2016 (13% between 12.09.2003 to 31.03.2011), and it has been 15% thereafter. Thus, there is equivalent interest liability (to the duty liability) for almost every five and a half to six years, which is quite high. The government has offered to slash and cap this interest liability to make it easier for the importers to discharge their liabilities and settle the defaults. The older the imports, greater the latent benefit under the scheme. There will be no input credit or refund of any duty paid under the Amnesty Scheme (earlier, in pre-GST era, CENVAT credit of CVDs was available under rule 3 (1) (vii) of the CENVAT Credit Rules, 2004, and SAD was refundable to traders; anyway, interest is not payable on this part in the offered scheme). Net-net the scheme does not reward the defaulter, but, at the same time, offers concessions on interest liability to facilitate the settlement of defaults. Overall, it is better to opt for the scheme to avoid compulsive recovery later.

(Disclaimer: The view expressed are the personal views of the author, and are not an advice, legal or otherwise. For proper appreciation, the actual legal provisions must be referred to)

TaxTMI

TaxTMI  TaxTMI

TaxTMI