Maintainability of Writ Petition simultaneously while filing the ...

Income Tax

June 26, 2023

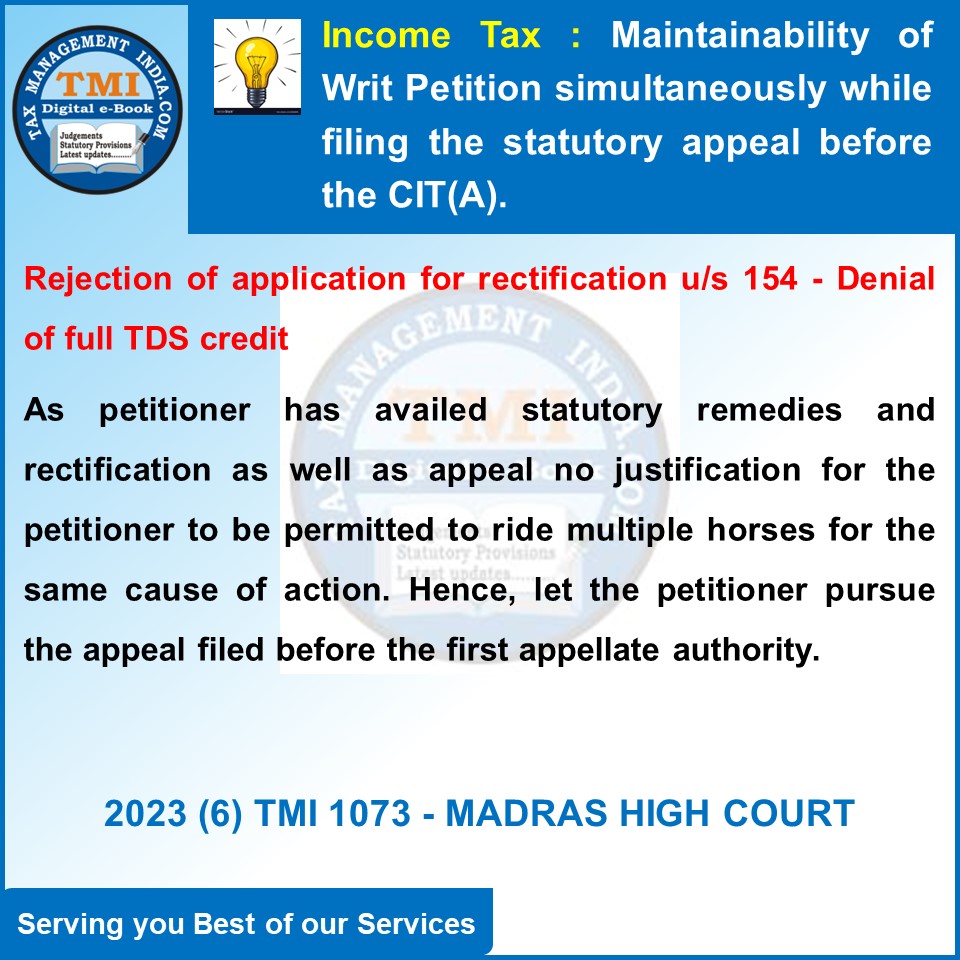

Maintainability of Writ Petition simultaneously while filing the statutory appeal before the CIT(A) - Rejection of application for rectification u/s 154 - Denial of full TDS credit - No justification for the petitioner to be permitted to ride multiple horses for the same cause of action. Hence, let the petitioner pursue the appeal filed before the first appellate authority. - HC

View Source