Jurisdiction of proper officer to seize u/s 67 - Seizure of ...

GST

August 21, 2023

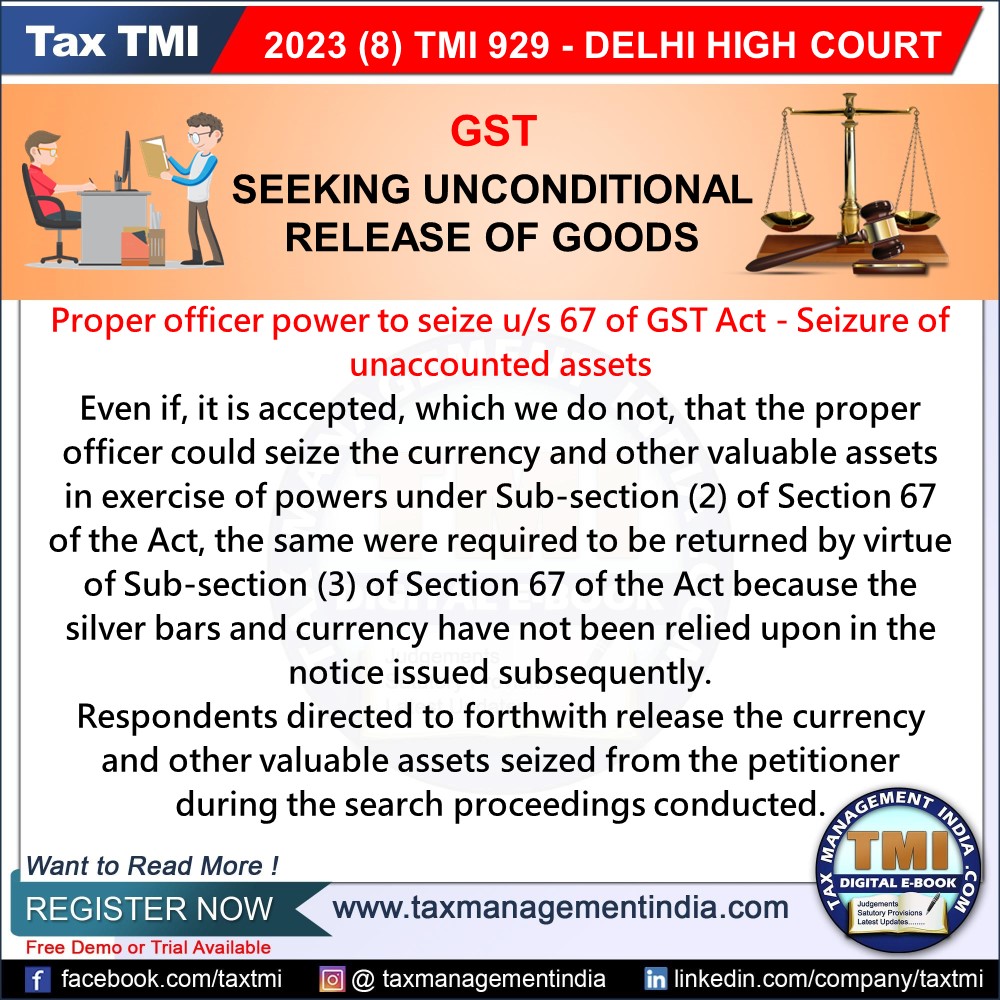

Jurisdiction of proper officer to seize u/s 67 - Seizure of unaccounted assets - The purpose of the Act is not to proceed against unaccounted wealth. The provision of Section 67 of the Act is also not to seize assets for recovering tax. Thus, applying the principle of purposive interpretation, the power under Section 67 of the Act cannot be read to extend to enable seizure of assets on the ground that the same are not accounted for. - HC

View Source