Additional income disclosed during the course of survey - To be ...

Income Tax

September 13, 2023

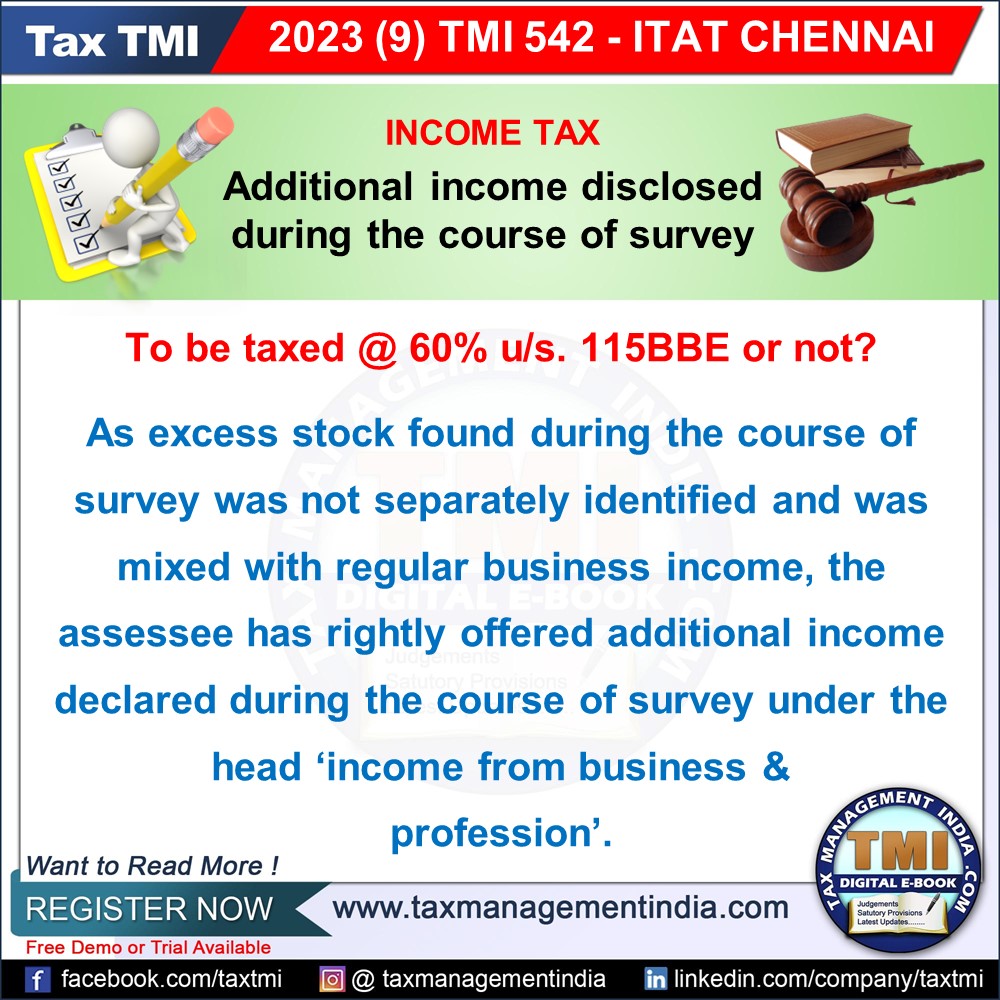

Additional income disclosed during the course of survey - To be taxed @ 60% u/s. 115BBE or not - the AO and the Ld.CIT(A) are erred in assessing additional income declared towards excess stock found during the course of survey u/s. 69B r.w.s. 115BBE of the Act - AO directed to assess the income under the head ‘income from business & profession’ as declared by the assessee. - AT

View Source