| Article Section | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Home |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL INCLUSION IN INDIA THROUGH MOBILE BANKING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL INCLUSION IN INDIA THROUGH MOBILE BANKING |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Introduction Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low income groups at an affordable cost. Former UN Secretary-General Kofi Annan said “The stark reality is that most poor people in the world still lack access to sustainable financial services, whether it is savings, credit or insurance. The great challenge before us is to address the constraints that exclude people from full participation in the financial sector. Together, we can and must build inclusive financial sectors that help people improve their lives”. According to the United Nations the main goals of financial inclusion are as follows:

FINANCIAL EXCLUSION: Financial exclusion is where the financial services are not available to the people. The rural people are very much excluded from having the financial services due to non availability of financial services in their areas or it may due to high cost for getting the financial services or non awareness about the availability of financial services. The poor people in rural as well as in urban are not able to get financial services still due to above reasons and also the huge formalities in availing the same. Financial exclusion includes-

Exclusion from the banking system excludes people from all benefits that come from a modern financial system. Financial exclusion problem also includes the problems of financial discrimination and financial exploitation. The following are financially excluded:

The following are the constraints in access to Financial Products:

Global Financial inclusion Worldwide only 50% of the adults population are having an individual or joint account at a formal financial institution. Globally, more than 2.5 billion adults do not have a formal account, most of them in developing economies. Financial inclusion in India The concept was first mooted by the Reserve Bank of India in 2005 and Branchless Banking through Banking Agents called Bank Mitr (Business Correspondent) was started in the year 2006. In the year 2011, the Government of India gave a serious push to the programme by undertaking the ‘Swabhimaan’ campaign to cover over 74,000 villages, with population more than 2,000 (as per 2001 census), with banking facilities. The following are the ways and means adopted by India for financial inclusion:

Small Branches through Business Correspondent Agents (BCA);

The following table shows the summary progress of all banks including Regional Rural Banks during five years period from 2010 - 2014: Table 1 - Summary progress of banks

Source:RBI Annual Report 2013 -1 4 At present only 0.46 lakh villages out of the 5.92 lakh villages in the country have bank branches. Rural population is 833 million. A bank branch in rural area serves about 22,000 persons. Urban population is 377 million. A bank branch in urban area serves about 6000 persons. Financial inclusion through mobile banking Features of Mobile banking Mobile banking is one of the ways for the reach of financial inclusion. Mobile banking is growing at a remarkable speed around the world. In the process it is creating considerable uncertainty about the appropriate regulatory response to this newly emerging service. Information and communication technologies (ICT) fuel the greatest wave of technical innovation currently spreading across the globe, affecting new areas of social and economic activity. A further feature of mobile banking is the way in which it facilitates the development of relations of trust where previously there was no basis for it. In particular, mobile banking provides an instantaneous and traceable record of transactions that were otherwise anonymous and unverifiable through cash. For example, mobile banking permits the keeping of records and accounts on payments that contribute over a period to the total cost of a delivery of a service. Regular savings for education and health services become possible in a way previously difficult or expensive to monitor. An important feature that mobile payments makes clear is that the payments system can occur entirely outside of the banking system. People communicate directly with each other regarding payments and receipts and an accounting system for recording debits and credits operates independently of banks. There is no requirement for payments to be channeled through a central clearing system. The advantage of this is that it avoids the operation of a banking cartel to clear payments and receipts; it is instantaneous and not subject to the delays of bank clearing systems; and it allows participants to receive immediate records of transactions that enhance trust in the conduct of the parties to a transaction and the organization facilitating the transaction. The bypassing of bank clearing arrangements is therefore a fundamental advantage of a mobile payments system. Significance of mobile banking The significance of mobile banking goes well beyond developing countries and financial inclusion. By providing a clear disaggregation of the components of banking, it throws light on the nature of financial services in general. In particular, it brings out the distinction between payments and banking and suggests that much of the debate on the reform of banking in developed economies in relation, for example, to the separation of commercial and investment banking has been confused. By identifying the different components of financial services so clearly, mobile banking helps to establish where the focus of regulation should lie in all financial systems. Cost of mobile banking The cost of transaction conducted in the branches is ₹ 50/-. The cost of ATM is ₹ 15/-. The net transaction costs of the bank is ₹ 4/-. Mobile banking cost may be the same of internet. The value of both telecommunication and payment networks grows as the number of participants increases. It may also be possible that a larger network has lower unit cost per service provided. Both network effects on value and cost of service mean that networks have to some degree naturally monopoly characteristics. This implies that one large company may be the most efficient way of providing the service. Alternatively, interconnection protocols between different providers may be able to reap the benefits of network externalities, if not necessarily the cost advantages. World bank’s inclusion policy through mobile banking In line with the financial inclusion policy of the World Bank that seeks to provide financial services to “the underserved and the financially excluded” (consisting of 2.7 billion adults in emerging markets), mobile telephony offers a tool that can bridge the gap between financial services and mobile phone usage. The working poor, comprising 60% of the total labor force in emerging markets, will particularly benefit from this financial arrangement. According to the International Fund for Agricultural Development, the use of mobile telephony for the access and use of financial services (money transfers, paying for services, making deposits, withdrawing money, consulting bank account balances, etc.) is particularly useful in rural areas where 30% to 40% of remittances are transferred. It is also highly accessible to rural workers who, under the traditional banking system, would have to travel long distances to be able to reach financial services traditionally located in densely-populated urban areas. However, because of regulatory and legal issues, the use of mobile phones for banking services has yet to be implemented in many parts of the world. For one, the overlap in the scope of regulatory oversight between the finance industry and the telecommunications industry has yet to be addressed. There is also the problem of international oversight for the use of mobile phones in banking and other financial services involving international transactions such as remittance transfers. Differing rules governing financial transactions between donor countries and recipient countries also give rise to diverse complications and challenge. Norwegian telecom group Telenor released a study by Boston Consulting Group called, “Socio-economic impact of mobile financial services,” which found that mobile financial services are expected to improve lives of around 2 billion people in developing countries and boost economies by 2020. Jon Fredrik Baksaas, Telenor chief executive said, “As a global telecommunications operator, we have a unique role to play in the development and expansion of mobile financial services. We believe that mobile financial services will be one of the key drivers for financial inclusion going forward and thus has the potential to be the most powerful tool for economic and social development in emerging economies." Another study by Accenture states that banks generating the highest returns on mobile banking investments achieved ROI (return on investment) by emphasizing customer convenience and accurately measuring how customers use their mobile phones to bank. “The mobile banking channel offers an opportunity for banks to create a meaningful dialogue with their customers, deepening loyalty and broadening the services to which their customers can subscribe. Leading financial institutions that are communicating the value of these services to their customers are generating new revenue,” said Andy Zimmerman, director, Mobility Services, Accenture. Indian Government’s initiative Mobile banking is gaining importance in India with the introduction of iPhones & growth of Android based handsets. Largely, all banks are pushing ahead the idea of mobile banking to their customers after the introduction of electronic banking and considering modern day requirements. Still, the concept of mobile banking is unknown to most of us. Stakeholders in mobile banking in India The account provider may be a bank, but more and more it is a telecommunications company and, in rare cases, a third party.

While ensuring that 7.5 crore under privileged households that do not have access to banking would be brought under the ambit of financial inclusion through a campaign launched by Prime Minister Narendra Modi in August, 2014. Efforts will also be made to expand the mobile telephony to make banking available on all kinds of mobile phones and all the under-privileged households will be provided with two bank accounts. The Reserve Bank of India has given approval to 32 banks for providing mobile banking facility and of these 21 banks has started providing these services. All banks are now allowed to offer mobile banking service to their customers subject to a daily cap of Rs 50,000 per customer for both funds transfer and transactions involving purchase of goods and services. The key players in the mobile banking market in India are ICICI Bank, HDFC Bank, SBI Bank, Axis Bank, Canara Bank, Syndicate Bank, Bank of Baroda etc. With mobile banking, customers can perform any financial and non financial transactions, make payments, and check account information which is time-saving and advantageous. Challenges As much as one enjoys using services offered through mobile banking, the fact remains that issues crippling the service are also high. Mobile banking does not raise any new security concerns, but it is better to ensure adequate security. Benefits Growth-oriented banks will benefit the most from the opportunity of mobile banking. Besides, telecommunications companies also have a wide leverage in mobile banking. A few months ago, Reliance Communications launched its new mobile banking service in association with State Bank of India. This service permitted reliance GSM subscribers to access their State Bank of India account anytime, just using their handset. Mahesh Prasad, President-Wireless Business, Reliance Communications, commented during the launch, “Consumers use their cell phones to play games, read news headlines, surf the Internet, do online trading, share documents, write blogs, do chatting, listen to music, book a ticket for movie, etc. And still consumers continuously keep demanding more and more from their phones. This mobile banking service is yet another useful service for our customers; they can now avoid those long queues at the SBI branches.” The State Bank of India (SBI) has emerged a surprise market leader in mobile banking, accounting for half of all mobile transactions in the country. The bank has over 1.15 crore mobile banking users, which is larger than the mobile banking customer base of large banks in the West. Only a couple of Chinese banks have more mobile banking customers. The number is expected to rise dramatically as the ratio of mobile banking customers rises from 4.5% at present to 12% in two years and possibly 60% after three years as the bank completes its channel integration. "Message-based banking, where you don't even need smart phones, has just been launched (in India). I do believe that once this is understood by people, there will be an explosion of activity in the mobile space. This is what the future holds," said SBI chairman Arundhati Bhattacharya. She said mobile banking will also play a large part in the role of the yet-to-be-launched payment banks with which SBI plans to have tie-ups. Table No. 2 - Mobile transactions In lakhs

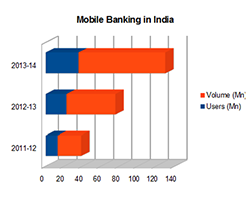

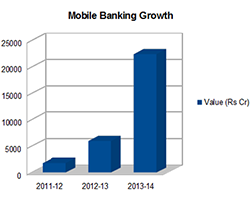

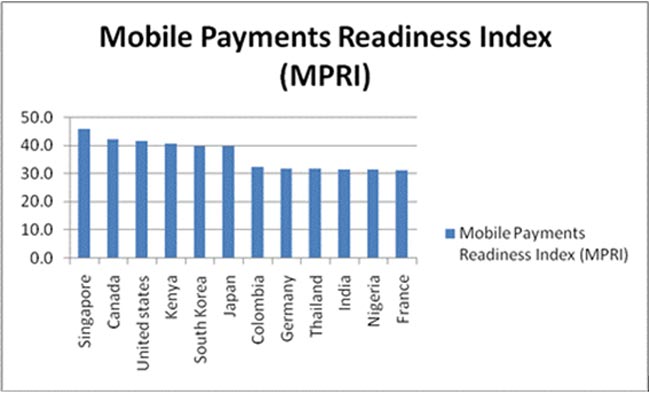

Source: Times of India - 15.09.2014 One in 25 mobile users in the country used mobile banking services last year and even though the value of transactions through the mobile rocketed almost four times, the growth in number of users and the volume of transactions slowed down in FY14 over FY13, as per data collated by the Reserve Bank of India. The value of money exchanged through mobile banking rose to ₹ 22,438 crore ($3.7 billion) during the year ended March 31, 2014, recording growth of around 275 per cent, as per a presentation by RBI deputy governor Harun R Khan. As many as 35.53 million customers used m-banking services in the country during the period of total mobile subscribers of 904.5 million. This means around 4 per cent of mobile subscribers used mobile banking against 2.6 per cent the previous year and just 1.4 per cent in FY12. The growth in value of transactions was equally strong in the previous year rising 229 per cent in FY13 over FY12. This accelerated last year. However, the growth in the number of m-banking users grew at a slower pace. The m-banking users rose 57.84 per cent as against 73.7 per cent the year ago. At the same time the volume of m-banking transactions, which had more than doubled in FY13 to 53.31 million, grew at a relatively slower rate of 77.66 per cent to 94.71 million last year. This implies the existing users are gaining confidence to transact larger amounts. RBI’s Khan said that despite a very high mobile density in the country, the potential for leveraging on this technology for offering financial services is largely yet untapped. He pointed out that the data underscores the need for active collaboration between banks and telcos - irrespective of the channel through which such services are provided, such as SMS, applications and unstructured supplementary service data (USSD). He noted that from a regulatory perspective TRAI has set the ceiling tariff for USSD-based mobile banking services and RBI has taken steps to provide accessible, convenient as well as cost effective services to mobile banking customers. Khan said there is a need to create more public awareness through a sustained centrally orchestrated common marketing campaign for popularizing USSD and that banks need to see mobile banking channel as a cost saving avenue (reduction of cash handling charges) rather than revenue generation vertical. Banks have gradually moved from offering non-financial services to financial services on mobile phones - the evolution curve has been: alerts (on ATM withdrawals, credit card purchases etc), cheque book request, payments (of utility bills), debit and credit statements, fund transfer, opening fixed deposits, cash management at low end (up to ₹ 50,000 per day) etc. In future more services will be added. The Reserve Bank of India has allowed use of 'semi closed wallet' by mobile companies. Via semi closed wallet accounts, people can send and spend money through the mobile network, but can't withdraw cash. Airtel, Vodafone and Idea are offering such services. To expand mobile banking reach, HDFC Bank has started Hindi mobile banking service and a 'net safe light' virtual card - both were started last month. The latter helps a user to store a limited value on his mobile. Say a credit card limit is ₹ 2 lakh but a user wants to buy books online worth ₹ 2,000. He can create a new limit on his card using net safe light and use the code generated for online shopping. This creates a security layer for the user - he uses the card for online payments without worrying about it being misused as the limit is only ₹ 2,000. Mobile banking in India is set to explode - approximately 43 million urban Indians used their mobile phones to access banking services during quarter ending August, 2009, a reach of 15% among urban Indian mobile phone user. Most Popular Banking Service on Mobile Checking account balances is the most popular banking service used by urban Indians with almost 40 million users followed by checking last three transactions, 28 million and status of cheques with 21 million users. Mobile banking is popular among the ₹ 1 to 5 lakhs per year income group with almost 60% of mobile banking users falling in the income bracket, an indicator of adoption of this service by younger generation. Most Popular Bank ICICI bank maintains its position as country biggest private lender on mobile screen as well with 17.75 million users. HDFC accounts for second most subscribers with 9.1 million subscribers followed by State Bank of India with 6.13 million subscribers. Currently there is no cap on per-day transactions for encrypted transactions in banking channels, including mobile banking. These limits are set by individual banks depending on their risk perception of the respective channels. However, for unencrypted transactions, such as those through SMS, the RBI has set a limit of ₹ 5,000 per day. Mobile Payments Readiness Index With mobile phone penetration of over 80 per cent, India has a huge potential for mobile banking. But on the global landscape, mobile payments have a long way to go in India. According to the MasterCard Mobile Payments Readiness Index (MPRI),

The index also points out that consumers in India have not yet fully embraced mobile payments. Only 14 per cent of Indian consumers are familiar with both P2P and m-commerce transactions, and 10 per cent are familiar with POS transactions. RBI Guidelines Banks are permitted to offer mobile banking services after obtaining necessary permission from the Department of Payment & Settlement Systems, Reserve Bank of India. Recognizing the potential of mobile banking, Reserve Bank of India issued the first set of guidelines in October 2008. The guidelines defined mobile banking as undertaking banking transactions using mobile phones by bank customers that would involve credit/debits to their accounts. Mobile Banking services are available to bank customers irrespective of the mobile network. Customers need to first register for Mobile Banking with their bankers and download the Mobile Banking application on their mobile handsets. The services shall be restricted only to customers of banks and/or holders of debit/credit cards issued as per the extant Reserve Bank of India guidelines. Only Indian Rupee based domestic services shall be provided. Use of mobile banking services for cross border inward and outward transfers is strictly prohibited. Banks may also use the services of Business Correspondent appointed in compliance with RBI guidelines, for extending this facility to their customers. Banks are permitted to offer mobile banking facility to their customers without any daily cap for transactions involving purchase of goods/services. However, banks may put in place per transaction limit depending on the bank’s own risk perception, with the approval of its Board. The October 2008 RBI guidelines fixed the norm of daily cap of ₹ 5,000/- per customer for funds transfer and ₹ 10,000/- per customer for transactions involving purchases of goods and services. The 24.12.2009 guidelines gave a raise in the daily cap transaction limits for fund transfer and for purchase of goods and services to ₹ 50,000/- Transactions up to 1,000 could be facilitated without end to end encryption of messages. It was permitted to provide cash-outs to the recipients through ATMs or BCs subject to a cap of ₹ 5,000 per transaction and a maximum of 25,000 per month per customer. From 04.05.2011 transaction up to ₹ 5,000 can be facilitated without end to end encryption of messages. From 22.12.2011 Transaction cap limits for funds transfer and for purchase of goods & services of 50,000 per customer per day removed. Banks may place their own limits based on their risk perception with the approval of their Board. Ceiling on cash-outs to the recipients through ATMs or BCs raised to 10,000 per transaction subject to the existing cap of 25,000 per month. Mobile Banking (Quality of Service) Regulations, 2012 The Telecom Regulatory Authority of India (TRAI) has issued Mobile Banking (Quality of Service) Regulations 2012 prescribing quality of service standards for mobile banking to ensure faster and reliable communication for enabling banking through the mobile phones. The salient features of the Regulations are as under:

Focus on customers The following are the areas to be focused on the benefit of the customers:

In a bid to extend the banking services to the unbanked population in India, 10 mobile companies signed agreement with the National Payments Corporation of India (‘NPCI’) - the payments gateway backed by the government to facilitate these services. The gateway will use telecom companies’ unstructured supplementary services data (USSD) channel via a simple and interactive text messaging system which allows credit and debit card transactions as well. While USSD technology provides session based communication and enables a number of applications, the current plan is to restrict the system to basic banking services like low value bill payments, fund transfers, balance inquiries for savings accounts, change of PIN, mini-statements, and cheque book request through text messages from ordinary mobile phones without requiring internet access. TRAI stated that the communication channel should be available to anyone with a mobile phone and bank account, with each transaction costing the user ₹ 1.50. Telecom companies already offer wallet services and the USSD system will widen the scope of mobile banking transactions. Wallet services enable subscribers to carry out transactions like prepaid mobile recharges, utility bill payments and money transfers, while the USSD system enables inter-bank transactions as telecom companies can access NPCI’s centralized system, which is linked to the banks. The Inter-Ministerial group on delivery of basic financial services through a comprehensive frame work envisaged the creation of "Mobile and Aadhaar linked Accounts" by Banks. The basic financial transactions on these accounts can be executed through a mobile based PIN system using "Mobile Banking PoS". Mobile banking through mobile wallet was launched in 2012. Under this service, RBI has authorized 3 telcos and 5 non-telcos to launch this service. Three Telcos, Airtel under brand name Airtel Money, Vodafone under Brand name Vodafone m-pesa and Idea vide Idea Money are active in the space. They control over 80,000, 70,000 & 8,000 agents respectively. Around 60% of this Bank Mitr (Business Correspondent) is in rural areas. Mobile wallet service provided by commercial banks e.g., ICICI in case of m-pesa service used for money transfer, bill payment and cash withdrawals. The customer base of customers availing such services is around 70 lakhs. Mobile telephony and prepaid wallets would also be utilized for coverage of households under the Financial Inclusion campaign. The mobile-phone revolution that is transforming the country could also turn into a banking revolution in terms of reach and transaction. Today, the number of mobiles in India is 918 million as on 31.07.2014. The reach of mobile to the remote village and its usage by the common man has become order of the day and rural area contributing 41.18% of the total connections. The coverage of mobile phones and the use of such instruments by all section of the population can be exploited for extending financial services to the excluded populations. It enables the subscribers to manage their financial transactions (funds transfer) independent of place and time. The subscriber can approach a retailer of mobile network for withdrawal/deposit of money and the transaction takes place using SMS messages. The Mobile Banking services are generally available through a java application on Blackberry, Android, iPhones and Windows mobile phones. Various banking services like Funds Transfer, Immediate Payment Services, Enquiry Services (Balance enquiry/ Mini statement), Demat Account Services, Requests for Cheque Book, Bill Payments, etc. may be carried out through mobile banking. There are transaction limits for mobile banking and these services are free of charge. The mobile banking services are also available over SMS. The basic financial transactions from the Bank accounts can be executed through a mobile based PIN system using "Mobile Banking". Mobile banking through mobile wallet was also launched in 2012. Mobile telephony and prepaid wallets would also be utilized for coverage of households under the Financial Inclusion campaign. Immediate Payment System (IMPS) Immediate Payment Service (IMPS) was launched by NPCI on 22 November, 2010. It offers an instant, 24 x 7, interbank electronic fund transfer service through mobile phones as well as internet banking & ATMs. In the are four stakeholder i.e. (i) Remitter (Sender), (ii) Beneficiary (Receiver), (iii) Banks & (iv) National Financial Switch - NPCI. In order to remit fund through IMPS, the sender should use mobile banking to send money, the receiver mobile number should be registered with his bank and the money is credited to receivers account instantly. For registration the Remitter must register for mobile banking and get Mobile Money Identifier (MMID) & Mobile Banking PIN (MPIN) for initiation of a transaction. MMID is a 7 digit number, to be issued by the bank to the customer upon registration and the Beneficiary must register his/her mobile number with the bank account and get MMID. A remitter can initiate an IMPS transaction by sending an SMS to his bank typing the Beneficiary Mobile Number, Beneficiary MMID and Amount. The receiver will get an SMS confirmation for the credit of his account. Payments Corporation of India (NPCI), is facilitating the Interbank Mobile Payment Service (IMPS). Conclusion In tribal hilly areas of the country, the telecom network is not reliable. It has been assured by Department of Telecom and Bharat Sanchar Nigam Limited that the ongoing telecom connectivity problems would be resolved by mutual consultations. Department of Telecom is separately seeking the approval of the Government to cover all villages in North East and difficult areas with telecom connectivity. Banks would also work to utilize the National Optical Fibre Network (NOFN) when it reaches the Panchayat level. Reference: 1. www.trai.gov.in 3. Mobile Banking and Financial Inclusions - The Regulatory lessons - Michael Klein, Colin Mayor 4. H.R. Khan - Customizing mobile banking in India - issues and challenges; 5. The Journal of Political risk, Vol. 2 No. 1, January 2014 6. tele.net September 2014 journal 7. Pradhan Mantri Jan-Dhan Yojana brochure 8. times of India

By: DR.MARIAPPAN GOVINDARAJAN - February 21, 2015

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707