| Article Section | |||||||||||

|

Home |

|||||||||||

NEW GST STRUCTURE FOR REAL ESTATE W.E.F. APRIL, 2019 |

|||||||||||

|

|||||||||||

NEW GST STRUCTURE FOR REAL ESTATE W.E.F. APRIL, 2019 |

|||||||||||

|

|||||||||||

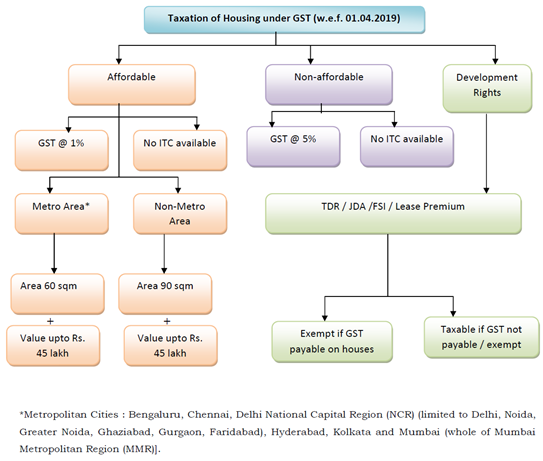

33rd Meeting of GST Council The 33rd meeting of GST Council was held on 20.02.2019 which was later adjourned to 24.02.2019. In a major move, GST Council recommended a much needed breather to real estate sector so much so that it would be beneficial to both – builders-developers as well as buyers and this sector, already reeling under slow down / recession will be able to see demand picking up due to lower GST. The rates of GST on under construction housing segment has been proposed to be reduced to 1% for affordable housing projects and 5% for at non-affordable housing projects but with the rider that no input tax credit shall be allowed. This shall be applicable from April 1, 2019 for which necessary notifications / circulars shall be issued after the scheme is finalized. Similarly, intermediate tax on development rights like TDR, JDA, lease premium FSI etc shall be exempt where such residential property has already suffered GST. For this purpose, ‘affordable housing’ has been defined based on area and city. Recommendations of 33rd GST Council Meeting The 33rd GST Council meeting held on 20.02.2019 and later adjourned to 24.02.2019 made the following recommendations: Extension in due date of Form GSTR 3B

Change in GST rates for Real estate (housing)

[Affordable house will mean a residential house/ flat of carpet area of upto 90 sqm in non-metropolitan cities/ towns and 60 sqm in metropolitan cities* having value upto ₹ 45 lacs (both for metropolitan and non-metropolitan cities)]. *Metropolitan Cities are Bengaluru, Chennai, Delhi National Capital Region (NCR) (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (whole of Mumbai Metropolitan Region (MMR)]. To ascertain the eligibility as ‘affordable housing project’ , it is important to note that both the conditions of area and value must be satisfied. If any of them is not fulfilled, the project will not qualify as ‘affordable housing’. The proposed amendment shall not apply to :

In case of partly commercial and party residential projects, the applicable rate to unit based on its commercial or residential nature shall apply, i.e., 12% for commercial and 5% for residential portion. The amendment is expected to bring in following advantages to all stakeholders : (i) The buyer of house gets a fair price and affordable housing gets very attractive with GST @ 1%. (ii) Interest of the buyer/consumer gets protected; ITC benefits not being passed to them shall become a non-issue. (iii) Cash flow problem for the sector is addressed by exemption of GST on development rights, long term lease (premium), FSI etc. (iv) Unutilized ITC, which used to become cost at the end of the project gets removed and should lead to better pricing. (v) Tax structure and tax compliance becomes simpler for builders. Changes in GST taxation for real estate at a glance

The new rates shall be applicable from 01.04.2019 for which notification has been issued on 07.03.2019. GST exemption on TDR/ JDA, long term lease (premium), FSI:

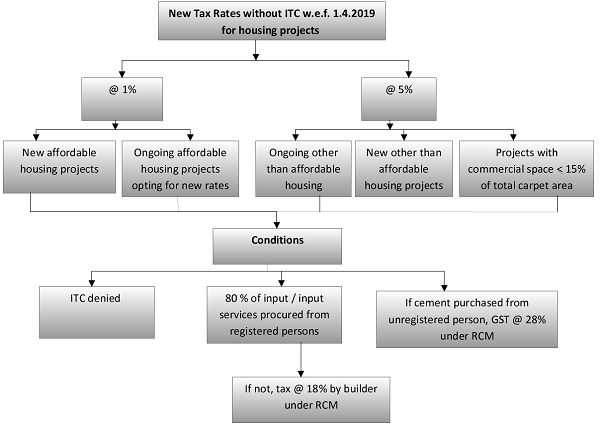

GST Council met for the 34th time since its constitution yesterday (19th March, 2019) for taking crucial decisions on real estate sector. Taking forward the discussions and decisions of 33rd GST Council meeting dated 24.02.2019 GSTC has now taken important decisions in relation to levy of GST on real estate sector including manner of transition to new lower tax regime w.e.f. April 1, 2019. As already announced, GST on affordable housing shall be @ 1% and on other than affordable housing @ 5%. The ongoing projects will have an one-time option to continue under old scheme with ITC or switch over to new one without ITC. The time limit for transition will be discussed with states. However, reversal of ITC will have to be done in proportion to area or space. In the new scheme, 80% of the materials shall be procured from registered dealers except for capital goods, development rights, leases premium etc. This is a stringent condition as on shortfall of purchases from 80%, builders shall be liable to pay GST @ 18% under reverse charge mechanism. In case of cement purchased from unregistered supplier, GST shall be levied @ 28% under reverse charge method. Relief has also been granted to commercial apartments (shops, offices etc) in any residential project for lower GST rate of 5% where carpet area of such commercial space is not more than 15% of the total carpet area of all apartments. In case of Transfer of development rights, FSI and long term lease premium, burden of GST has been shifted to builder under reverse charge with time of supply to be determined on the basis of date of issue of completion certificate. The same time of supply would apply to JDA’s. In case of input tax credit, ITC rules shall be amended to have clarity and provide procedure for monthly and final determination of ITC and its reversal for real estate projects. Salient features of decisions taken by the GST Council in the 34th meeting held on 19th March, 2019 Option for under construction projects

Conditions for the new tax rates:

Applicability of new tax rates: The new tax rates which shall be applicable as follows:

Transition for ongoing projects opting for the new tax rate:

Treatment of TDR/ FSI and Long term lease for projects commencing after 01.04.2019

Election Commission of India has announced the schedule for general elections in India, i.e., from 10th April, 2019 in seven phases with counting taking place on 23rd May, 2019. This also indicates that GSTC may now not be able to take major tax reforms and other tax friendly measures in view of the embargo of election code of conduct. There will now be no meeting till General Elections over except emergency issues. = = = = = = = = = =

By: Dr. Sanjiv Agarwal - March 27, 2019

|

|||||||||||

| |

|||||||||||