| Article Section | |||||||||||

|

Home |

|||||||||||

SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019 |

|||||||||||

|

|||||||||||

SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019 |

|||||||||||

|

|||||||||||

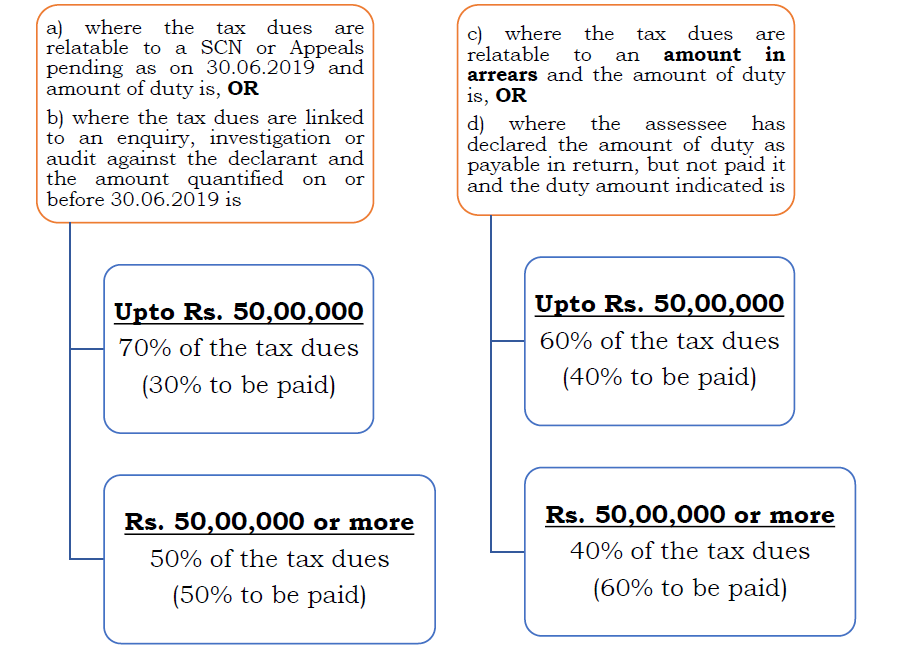

SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019 (Chapter V of the Finance Bill, 2019) Our Finance Minister placed the finance budget on 5th of July 2019, which was the 1st Finance budget of this new Government. In this, she introduced a new amnesty scheme in the name of ‘Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019’. In a way to introduce this scheme during her speech, she said that: GST has just completed two years. An area that concerns me is that we have huge pending litigations from pre-GST regime. More than 3.75 lakh crore is blocked in litigations in service tax and excise. There is a need to unload this baggage and allow business to move on. I, therefore, propose, a Legacy Dispute Resolution Scheme that will allow quick closure of these litigations. I would urge the trade and business to avail this opportunity and be free from legacy litigations. This scheme is being introduced for resolution and settlement of legacy cases of Central Excise and Service Tax. The proposed Scheme covers past disputes of taxes, which have got subsumed in GST namely Central Excise, Service Tax, Cesses, etc. All persons are eligible to avail the scheme except a few exclusions including as those convicted under the act in the case for which he intends to make declaration and those who have filed an application before the Settlement Commission. The relief under the scheme varies from forty percent (40%) to seventy percent (70%) of the tax dues for cases other than voluntary disclosure cases, depending on the amount of tax dues involved. The scheme also provides relief from payment of interest and penalty. For voluntary disclosures, the relief is regarding waiver of interest and penalty on payment of full tax dues disclosed. The person discharged under the scheme shall also not be liable for prosecution. The Scheme provides for method of payment of tax dues, arrears and restrictions regarding the manner of payment etc. The Scheme shall become available from a date to be notified. The procedural details and rules regarding the Scheme shall be notified in due course. For easy understanding and clarity, I have prepared these FAQ’s about the scheme. 1. What is Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019? It is amnesty scheme, which is being introduced for resolution and settlement of legacy cases of Indirect Tax enactments like Central Excise, Service Tax, Coffee Act, etc. 2. What are the laws / indirect tax enactments, to which the scheme shall be applicable? This Scheme shall be applicable to the following enactments, namely:- a) the Central Excise Act, 1944 or the Central Excise Tariff Act, 1985 or Chapter V of the Finance Act (Service Tax), 1994 and the rules made thereunder; b) the Agricultural Produce Cess Act,1940; c) the Coffee Act, 1942; d) the Mica Mines Labour Welfare Fund Act, 1946; e) the Rubber Act, 1947; f) the Salt Cess Act, 1953; g) the Medicinal and Toilet Preparations (Excise Duties) Act, 1955; h) the Additional Duties of Excise (Goods of Special Importance) Act, 1957; i) the Mineral Products (Additional Duties of Excise and Customs) Act, 1958; j) the Sugar (Special Excise Duty) Act, 1959; k) the Textiles Committee Act, 1963; l) the Produce Cess Act, 1966; m) the Limestone and Dolomite Mines Labour Welfare Fund Act, 1972; n) the Coal Mines (Conservation and Development) Act, 1974; o) the Oil Industry (Development) Act, 1974; p) the Tobacco Cess Act, 1975; q) the Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines Labour Welfare Cess Act, 1976; r) the Bidi Workers Welfare Cess Act, 1976; s) the Additional Duties of Excise (Textiles and Textile Articles) Act, 1978; t) the Sugar Cess Act, 1982; u) the Jute Manufacturers Cess Act, 1983; v) the Agricultural and Processed Food Products Export Cess Act, 1985; w) the Spices Cess Act, 1986; x) the Finance Act, 2004, 2007, 2015, 2016; y) any other Act, as the Central Government may, by notification in the Official Gazette, specify. 3. Who is eligible to file declaration under this scheme? All persons are eligible to file declaration under this scheme electronically, except the following: a) who have filed an appeal before the appellate forum and such appeal has been heard finally on or before 30.06.2019; b) who have been convicted for any offence punishable under any provision of above laws for the matter for which he intends to file a declaration; c) who have been issued a show cause notice (SCN), under above law and the final hearing has taken place on or before 30.06.2019; d) who have been issued SCN for an erroneous refund or refund; e) who have been subjected to an enquiry or investigation or audit and the amount of duty involved in the said enquiry or investigation or audit has not been quantified on or before 30.06.2019; f) a person making a voluntary disclosure (i) after being subjected to any enquiry or investigation or audit; or (ii) having filed a return under the indirect tax enactment, wherein he has indicated an amount of duty as payable, but has not paid it; g) who have filed an application in the Settlement Commission for settlement of a case; h) persons seeking to make declarations with respect to excisable goods set forth in the Fourth Schedule to the Central Excise Act, 1944; 4. What are the RELIEF available to the declarant in this scheme? The relief available in this scheme is as below:

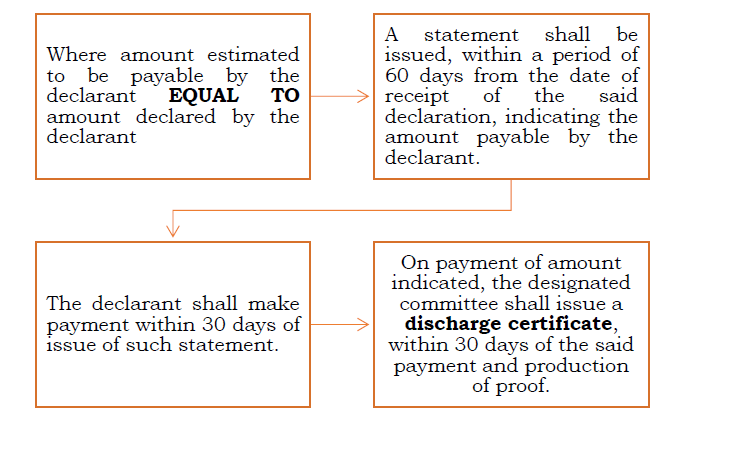

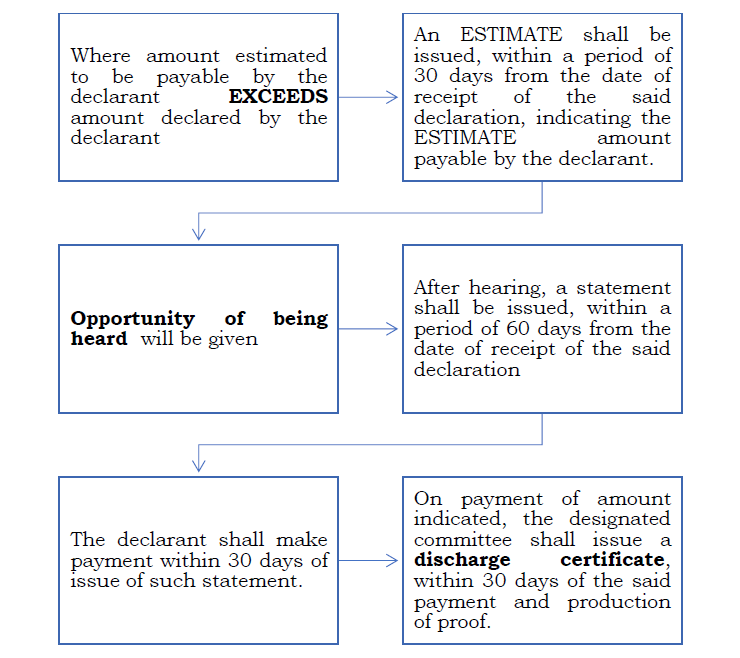

e) where the tax dues are relatable to a show cause notice for late fee or penalty only, and the amount of duty in the said notice has been paid or is nil, then, the entire amount of late fee or penalty; f) where the tax dues are payable on account of a voluntary disclosure by the declarant, then, no relief shall be available with respect to tax dues. 5. What will happen to the pre-deposit already made by declarant in relation to the SCN or Appeal for which he wishes to avail this scheme? The amount paid as pre-deposit at any stage of appellate proceedings under the indirect tax enactment or as deposit during enquiry, investigation or audit, shall be deducted by the authority while issuing the statement indicating the amount payable by the declarant, after allowing relief as above. Provided that if the amount of pre-deposit or deposit already paid, exceeds the amount payable by the declarant, the declarant shall not be entitled to any refund of such excess paid deposit. 6. What is the meaning of TAX DUES for the purpose of this scheme? The meaning of tax dues for this scheme is: a) Where single appeal is pending as on 30.06.2019 – Total amount of duty disputed in appeal; b) Where More than one appeal is pending, arising out of single order (Incl. Dept. Appeal) as on 30.06.2019 - Total amount of duty disputed in both appeal; c) Where and SCN has been received on or before 30.06.2019 - the amount of duty stated to be payable the said SCN; d) Where an enquiry or investigation or audit is pending against the declarant - the amount of duty payable which has been quantified on or before 30.06.2019; e) Where the amount has been voluntarily disclosed by the declarant - Total amount of duty stated in the declaration; f) Where an amount in arrears relating to the declarant is due, the amount in arrears. 7. What is the process for making payment and closure of case under this scheme?

8. Is there ANY OTHER RELIEF available under this scheme? In addition to the relief from payment of specified percentage of amount of tax dues as stated above, the declarant shall be eligible for following reliefs: a) On receipt of discharge certificate issued under this scheme with respect to the amount payable, it shall be conclusive as to the matter and time period stated therein; and b) the declarant shall not be liable to pay any further duty, interest, or penalty with respect to the matter and time period covered in the declaration; c) the declarant shall not be liable to be prosecuted under the indirect tax enactment with respect to the matter and time period covered in the declaration; d) no matter and time period covered by such declaration shall be reopened in any other proceeding under the indirect tax enactment. 9. What are the restrictions or primary conditions of this scheme? Restrictions laid down under this scheme is the amount paid/payable: a) shall not be paid through the input tax credit account under the indirect tax enactment or any other Act; b) shall not be refundable under any circumstances; c) shall not, under the indirect tax enactment or under any other Act,- (i) be taken as input tax credit; or (ii) entitle any person to take input tax credit, as a recipient, of the excisable goods or taxable services, with respect to the matter and time period covered in the declaration. This publication contains information for general guidance only. It is based on the statutory/ legal position and administrative interpretations as on the date of the note. The note is issued for easy understanding of the changes taken into effect. We had taken due care in preparation of it but not responsible for any adverse consequences.

By: Ashwarya Agarwal - July 8, 2019

|

|||||||||||

| |

|||||||||||

9911796707

9911796707