| Article Section | |||||||||||

Departmental approach & Success of Sabka Vishwas - (Legacy Dispute Resolution) Scheme, 2019 (SVLDRS) |

|||||||||||

|

|||||||||||

Departmental approach & Success of Sabka Vishwas - (Legacy Dispute Resolution) Scheme, 2019 (SVLDRS) |

|||||||||||

|

|||||||||||

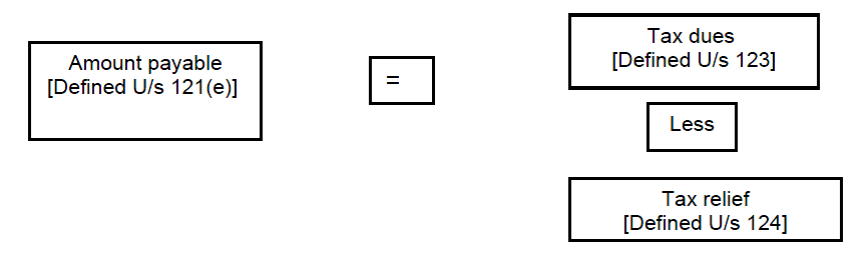

1. SVLDRS 2019 is very liberal amnesty scheme which seeks to close not only those cases which are pending in litigation, rather even those cases which are part of ongoing enquiry where litigation is yet to start. Further it also covers those cases where assessees have lost the case and litigation has attained finality and yet the scheme gives huge amnesty to the assessee in the form of waiver from 100% of Interest, 100% of penalty etc. and significant portion of tax and immunity from prosecution, when they pay only a small part of the tax involved alone under the scheme. 2. The Finance Act (no. 2) of 2019, in Chapter V has given a self-contained SVLDRS elaborating the substantive provisions as well as procedural aspects. SVLDRS 2019 is very liberal amnesty scheme which seeks to close almost all legacy disputes by paying only a small part of the tax involved under the scheme. “Amount payable” under the scheme is defined with perfection as under.

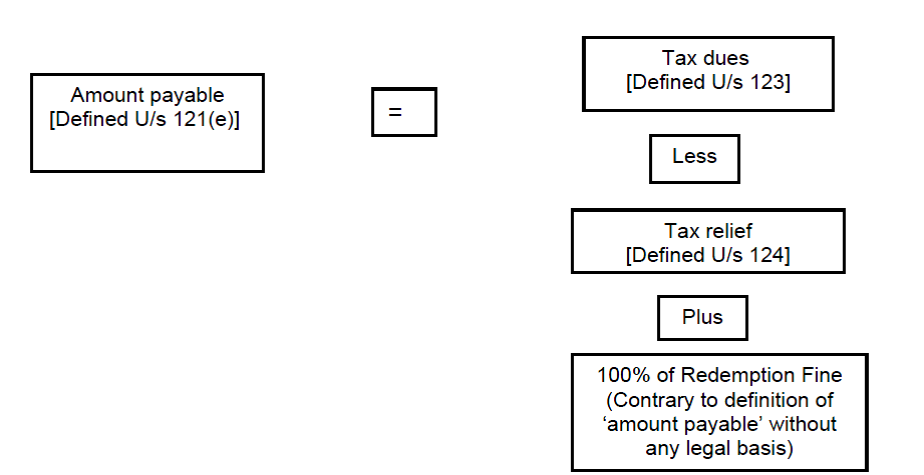

3. However the field formations under CBIC are not able to come out of their revenue bias and continue to act in a manner which is failing the scheme. With respect to SVLDRS Scheme, all over India, trade is facing two major problems. Problem No. 1 4. Wherever the case involves duty as well as redemption fine, the amount payable is being calculated by field formation as under in clear violation of definition of ‘amount payable’ under section 121(e) of the act, which makes it difficult for the trade to opt for the scheme.

Problem No. 2 5. The cases in which show cause notice did not demand duty and proposed confiscation of goods and proposed penalty only, because duty issue was settled before issuance of show cause notice, are being rejected under the scheme with a stand that cases not demanding duty are outside the purview of scheme in complete violation of eligibility criteria given under Section 125 of the Act. Analysis with respect to Problem No. 1 6. ‘Amount payable’ under the scheme is categorically defined under Section 121(e) as “Tax Dues less Tax relief” and it has to be mechanically calculated because “Tax Dues” as well as “Tax Relief” both are defined under section 123 and 124 respectively. It should also be noted that “Tax Dues” is defined under section 123 with reference to tax alone. Therefore it should be noted that amount payable under the scheme is certain percentage of the ‘tax dues’ and no other amount. Any stipulation of payment of any amount which is not part of the ‘tax dues’ as defined in Section 123 shall be contrary to provisions of the scheme. 7. Once the ‘amount payable’ is paid, the designated committee shall issue a discharge certificate under section 127(8) of the Act, and such discharge certificate shall be conclusive under Section 129(1) of the Act. Section 129(1)(c) specifically prohibits re-opening of the matters covered under the scheme in any other proceeding under the Indirect Tax enactments and thus, it also covers a proceeding for imposition as well as recovery of redemption fine, because that is also part of indirect tax enactment. Though the word redemption fine is not specifically mentioned in the enactment, yet by virtue of Section 129(1) (c) immunity extends to each and every type of Civil or Criminal Liability including redemption fine. This understanding has been correctly reflected in Question no. 28 of CBIC’s first FAQs on SVLDRS and various e-Flyers and publicity materials issued by CBIC from time to time. It is again emphasized by us that our submissions are primarily based on interpretation of Finance Act (No. 2), 2019 which clearly does not require payment of redemption fine and our reference to FAQ and flyer is secondary and in support of interpretation of the act placed as above. 8. When declaration is filed at the portal with respect to cases involving redemption fine, portal calculates the amount payable correctly, as tax dues minus tax relief. Further the FAQ’s, flyer materials & other publicity material issued by CBIC in very clear terms says that under the scheme, there is immunity from fine which will include redemption fine. However, field formations are taking a stand that all those FAQ’s, flyer & publicity material stands withdrawn. We have not come across any official communication by CBIC or circular by CBIC by which those FAQ’s & publicity materials are withdrawn. Further, under the law redemption fine can’t be included in the expression “amount payable” which is clearly defined in the Act. 9. Under indirect tax enactments, the disputes revolve around tax dues. When taxes are not paid or there is a design to evade taxes, as a consequential action of the tax evasion, liability of interest, penalty & redemption fine arises. The top priority for government is to collect tax. In general no power is given to any authority other than legislature to grant concession with respect to tax liability. Interest is a second priority and liability of interest is mechanical. When Settlement Commission under CBIC was started, it was given power to grant immunity from interest but not from duty. Today there is no power vested with any authority to grant waiver of interest and its calculation is mechanical by applying the rate fixed under legislative mandate. Penalty is a third priority, where quantum of penalty itself is discretionary at the hand of the decision making authorities. Once that penalty is imposed and confirmed in the judicial process, in the recovery process nobody is vested with power to give waiver of penalty. Redemption fine (RF) is last priority & option is always given to assessee to pay or not to pay RF. Government never compels anybody to pay redemption fine. In case of seized goods, before adjudication assessee may volunteer to execute a bond binding himself to pay redemption fine & take the goods before adjudication of the dispute. Similarly after adjudication where seized goods are confiscated and in lieu of confiscation RF is imposed, assessee may choose to pay redemption fine and get the goods released. An assessee not interested in getting the goods released cannot be compelled to pay redemption fine at all. 10. SVLDRS is a scheme for getting rid of legacy disputes under indirect tax enactment. Government has given a scheme where it is realising certain percentage of ‘tax dues’ alone which is a top priority for government and giving waiver of 100% of penalty, interest & fine. The interpretation that 100% of interest & penalty is waived, certain percentage of tax is also waived; but 100% of redemption fine is recoverable, is a perverse interpretation and goes against the objective of the scheme. Analysis with respect to Problem No. 2 11. Section 125(1) gives eligibility to make declaration under the scheme and elaborates on exclusion under the scheme. It says that all persons shall be eligible to make a declaration, except category (a) to (h) listed under Section 125(1). Therefore, unless the department fits a case into one of the exceptions listed under Section 125(1) of the act, case cannot be declared to be ineligible to make declaration. To be more precise, the SVLDRS Scheme does not stipulate that a person who has been issued SCN where duty is not demanded, is ineligible to make declaration under the scheme. Government does not want to keep alive the litigations not involving tax. 12. The litigation with respect to erroneous refund has been specifically excluded under Section 125(d), but there is no exclusion for SCNs not demanding duty. Further it is submitted that many of these cases does involve dutiable goods and duty, however the duty amount stands settled before issuance of SCN and that is why there is no demand of duty in SCN. Solution 13. The CBIC must come out of its revenue bias and must intervene under section 133(1) of the Finance (No.2) Act 2019 and must issue directions to field formation to settle cases in accordance with the scheme to make it successful and to end legacy disputes. -- Pramod Kumar Rai Advocate Athena Law Associates

By: Pramod Kumar Rai - December 26, 2019

Discussions to this article

Is there a hope of date extension for the said scheme?

|

|||||||||||

| |

|||||||||||

9911796707

9911796707