| Article Section | |||||||||||

SCRUTINY AND ROVING ENQUIRY SHOULD BE AVOIDED INSTEAD RECONCILIATION OF FIGURES IN DOCUMENT CAN BE SOUGHT FOR MANY SORT OF DIFFERENCES. |

|||||||||||

|

|||||||||||

SCRUTINY AND ROVING ENQUIRY SHOULD BE AVOIDED INSTEAD RECONCILIATION OF FIGURES IN DOCUMENT CAN BE SOUGHT FOR MANY SORT OF DIFFERENCES. |

|||||||||||

|

|||||||||||

Need of reconciliation: Certain figures appearing in ITR, PLBS and other sources of information may be compiled and presented in different manner and composition of figures can be different. For example, amount of turnover, inventory, import and export, bank balances, balances in books of two parties having dealing. Difference can be due to variety of reasons. All such differences can be reconciled and reasons can be found. Over a period of more than one year there can be reconciliation and clearing of differences by further documents. For a simple example for a general person in case of bank balance on clearing of issued but not presented cheques and cheques deposited but not credited by bank etc. Roving enquiry: However, for such simple differences which can be reconciled, in case of scrutiny assessment the Assessing Officers insist not only for reconciliation statements but also bank statement and bank account of entire period, and can start roving enquiry which are generally not result oriented from the point of view of revenue, but causes lot of wastage of time. Additions based on difference: Examples have come across that merely because balance shown by other party is different ignoring reason for difference explained by parties. Import Export Data: Roving enquiry for difference in amount of purchase and amount of import in import / export data is not uncommon: In case amount of import and export data as per assesse and as per custom department there can be difference for several reasons. However, instead of asking a reconciliation long questionnaires are issued causing lot of futile enquiry, compilation of documents and examination by tax authorities and enquiry from third parties also. This only cause wastage of valuable time of tax authorities, representatives of assesse and most costly time of assesse who carry business and provide opportunities of jobs to others and pays huge taxes to exchequer. Unfortunately tax authorities are in habit of doubting business men on most of occasions and for various transactions. That is why attempts are made to brand everything bogus. Cases of difference in amount of purchase and Imports: In case of such difference, though case is selected for limited scrutiny, yet roving enquiry is made by tax officers and that too without mentioning the source of information and amount of import found in such record. The content of notice are on following lines: Your return of Income for Assessment Year 2018-19 has been selected for Limited scrutiny for the following issue(s): 1. Purchases shown in the ITR is less than the Invoice value of Imports shown in the Export Import Data With respect to the purchases made by imports, kindly submit the below specified details: 1) Document of registration with regional licensing authority and import export code. 2) Details of goods Imported by you. 3) Please provide below details regarding imports: Copy of ledger of purchase account highlighting import purchase. Details of import made during the year in the following format-. Invoice no. and date Name of the party, email address and country Description of item Invoice value and Quantity imported Assessable value for custom Duty paid (Rs.) TDS paid Mode of Transportation and amount paid for transportation

4) Please provide details of Customs duty, integrated goods and service tax return filed for relevant year and social welfare surcharge paid. 5) Details of the party [Name of the party, email address and country] from which imports have been made and payment details along with supporting documentary evidences.

Unquote: From the contents of the notice it is clear that it is for limited scrutiny and reason for scrutiny is difference between amount of import, which AO might have from some reports or source of information in his possession. But such amount has not been mentioned. The amount looked in by AO in ITR for purchases and import has not been compared and difference is not pointed out. Furthermore, in this case the amount of purchases has been shown as less than import figure, this can be for many reasons. In such cases tax authorities should first of all call for reconciliation, then only if reconciliation is not found satisfactory, further enquiry should be launched. Merely for difference first of all selection of case for scrutiny is not proper and roving enquiries are not at all desirable. On consideration of entire notice, and DIN and information available with reference to DIN preliminary reply as part compilation is suggested on following lines:

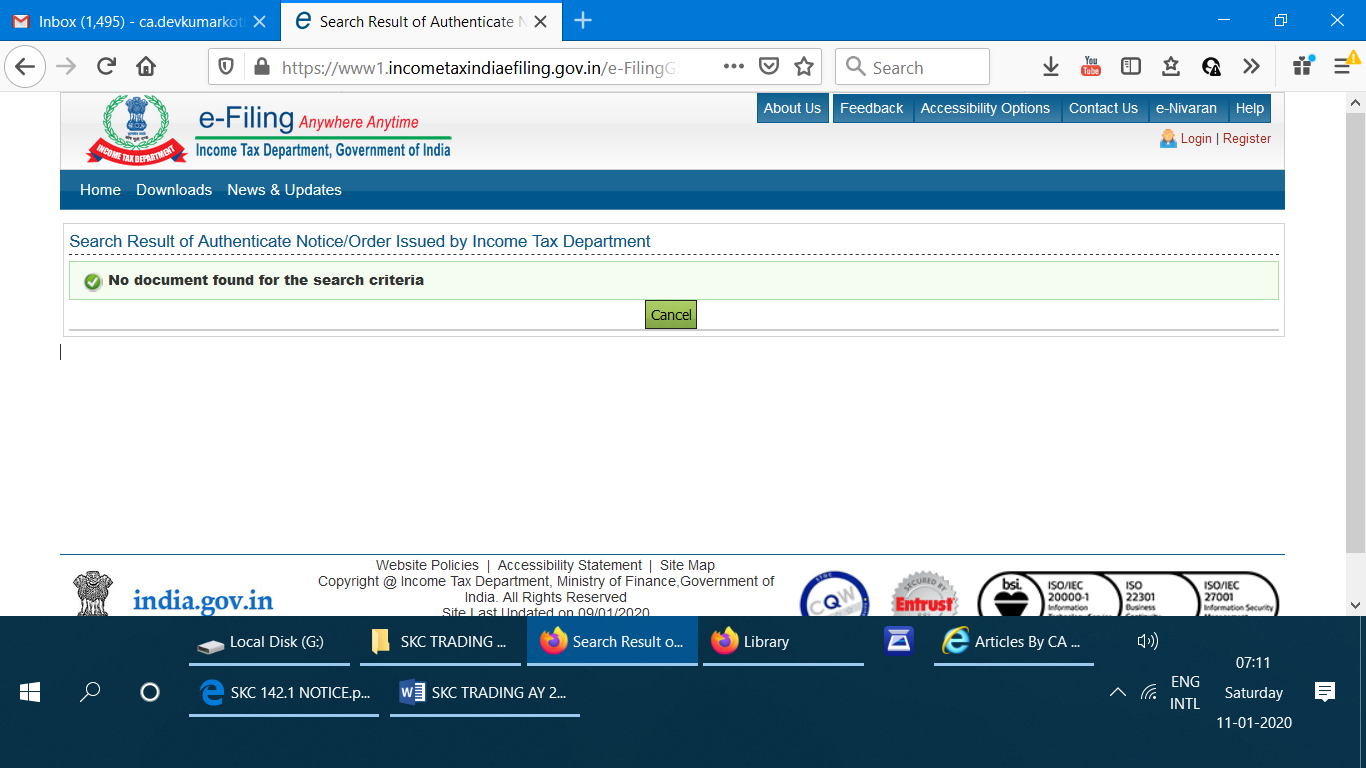

From: assesse To, AO , Additional / Joint / Deputy / Assistant Commissioner of Income Tax, National e-Assessment Centre, Delhi. Online submission through my account in e-proceeding. Note dates are written in DDMMYYYY manner for easy data entry. We can promote this style with help of government departments. Sirs, PAN: AY: 2018-19. DIN & Notice No : ITBA/AST/F/142(1)/2019-20/ ……… Dated: …… date of compliance fixed …… Thank you very much for providing opportunity of hearing. We have to depend on many persons for making compliance of long details asked by you. Therefore, real working time allowed is very short. We are unable to understand what is DIN no. in the above mentioned DIN & Notice no. We would like to learn more about DIN, because persons associated with us find it difficult to check DIN on website. In search with our PAN, AY, and date of notice we could not find document because, the result is as follows:

Thus no document was found with PAN, AY, and date for notice We preferred to search with above criterion so that we can get information about DIN specific to us because with DIN this assurance cannot be ascertained- DIN may belong to someone else. We suppose there may be teething problems but we are also curious about it. Because unless a valid document is available with search facility specific for assesse that is by PAN, assessment year and date of document received, it may not belong to us and as per statement of honourable FM it may be non est or void. We suggest that DIN can be combination of PAN number and date of issue or simply with PAN and can be made available through a link in my account so that assesse is also fully satisfied about genuineness of DIN. Coming to your notice, assuming it to be valid one, we submit that as per your notice read with annexure thereto we find that our return of Income for Assessment Year 2018-19 has been selected for Limited scrutiny for the following issue(s): “1. Purchases shown in the ITR is less than the Invoice value of Imports shown in the Export Import Data” Therefore, we understand that reconciliation of two amounts referred in above sentence should meet requirement of limited scrutiny. We request you to kindly inform us amount of Invoice value of Import referred in above sentence in your notice, and source thereof with which you are comparing the amount of purchases shown in the ITR . This we need because this amount can be computed in different manner for different purposes. Difference can be due to many reasons like including or excluding items like: (a) custom duty, (b) face value or cost of import licence used , (c) Foreign Exchange valuation on different dates like date of invoice, or date of actual import or deemed import, (d) or date of payment or date of foreign exchange purchase or forward booked etc., and also valuation of imported material by Custom Authorities on the day of invoice , date of import or deemed import or clearance or some other date and also timing differences in consideration of purchase and import in accounts and in import export data The amount of purchases shown in ITR and P.L. Account can also be different due above reasons and also due to different methods of grouping costs as indicated above and also because some more costs like transportation, clearing and forwarding cost, brokerage etc. included or shown separately. On receipt of information from you about amount of import considered by you we will be able to reconcile the two figures. Kindly inform us the same as soon as possible so that we can undertake exercise of reconciliation to your utmost satisfaction. In view of above we request you to kindly re-fix the case allowing us 30 days’ time after you inform us the amount of import value as considered by you with which we need to reconcile figure of purchase mentioned in ITR. Yours faithfully , Assesse

Result orientation in enquiry and scrutiny: To save valuable time of all concerned and more particularly of tax authorities only relevant enquiry should be made and relevant documents should be asked. It is practice of many officers to call for unrelated documents which causes loss of time of all and also damages to environment because papers are lost un-necessarily. Each small contribution of saving of anything and service can be helpful in saving environment because water and energy is required at all stages from production to consumption.

By: DEVKUMAR KOTHARI - January 13, 2020

|

|||||||||||

| |

|||||||||||

9911796707

9911796707