| Article Section | |||||||||||

|

Home |

|||||||||||

THEIR LORDSHIPS OF THE SUPREME COURT NEED MORE CAREFUL ASSISTANCE OF SECRETARIES, COURT OFFICERS INCLUDING COUNSELS FOR PARTIES. |

|||||||||||

|

|||||||||||

THEIR LORDSHIPS OF THE SUPREME COURT NEED MORE CAREFUL ASSISTANCE OF SECRETARIES, COURT OFFICERS INCLUDING COUNSELS FOR PARTIES. |

|||||||||||

|

|||||||||||

Team work: For good productivity and efficiency team work is very essential. Productivity and efficiency of all members in team is important. Inefficiency of any team member can effect on work of all. Many work are completed step wise step. Each step is important. For example:

Adjournments must be avoided. It is noticed that adjournments also take long time of courts. Adjournment petitions are also heard and decided by judges. Therefore, AOR / Counsels of parties must attempt to avoid steps for seeking adjournments. However, it appears that all take adjournments very easily and parties are generally confident that adjournment will be allowed. Case documents must be filed timely: Attempt should be made to file documents relied on timely and within a reasonable time after filing of appeal or petition. In fact, while preparing appeal or petition, most of related documents are reviewed, therefor right from that stage preparation of documents to be filed can be started and can be filed. Even brief notes, written submissions can be filed. Respondents must also file documents relied on and in rejoinder to documents of appellant timely. A case study: Author was searching for cases before the Supreme Court by way of SLP of Income-tax department against judgment of the Rajasthan High Court in case of Chambal Fertilisers Ltd decided vide judgment in D.B. Income Tax Appeal No. 52/2018 and D.B. Income Tax Appeal No. 68/2018 Dated: - 31 July 2018 reported as CHAMBAL FERTILISERS AND CHEMICALS LTD., PR. COMMISSIONER OF INCOME TAX, KOTA. VERSUS JCIT, RANGE-2, KOTA., M/S. CHAMBAL FERTILIZERS AND CHEMICALS LTD., GADEPAN, DISTT. KOTA. - 2018 (10) TMI 589 - RAJASTHAN HIGH COURT. The search was very difficult and one cannot be sure about full search results. Experience as gained on earlier occasions was again faced and author had to search with different criterion and information. Though links for comprehensive searches with different criterion are provided but many criterion which are most relevant did not result into any result or accurate result. In this regard readers can refer to the following article: In which experience of search on some earlier occasions was discussed with relevant webpages. Unfortunately, it is observed that there is no improvement so far search relating to Chambal Fertilizer is concerned. Search results indicating more assistance of lordships is required: On free text search with Chambal Fertiliser for period 01012019 to 10052020 no result was found. On similar search with Chambal the result found is as per picture below:

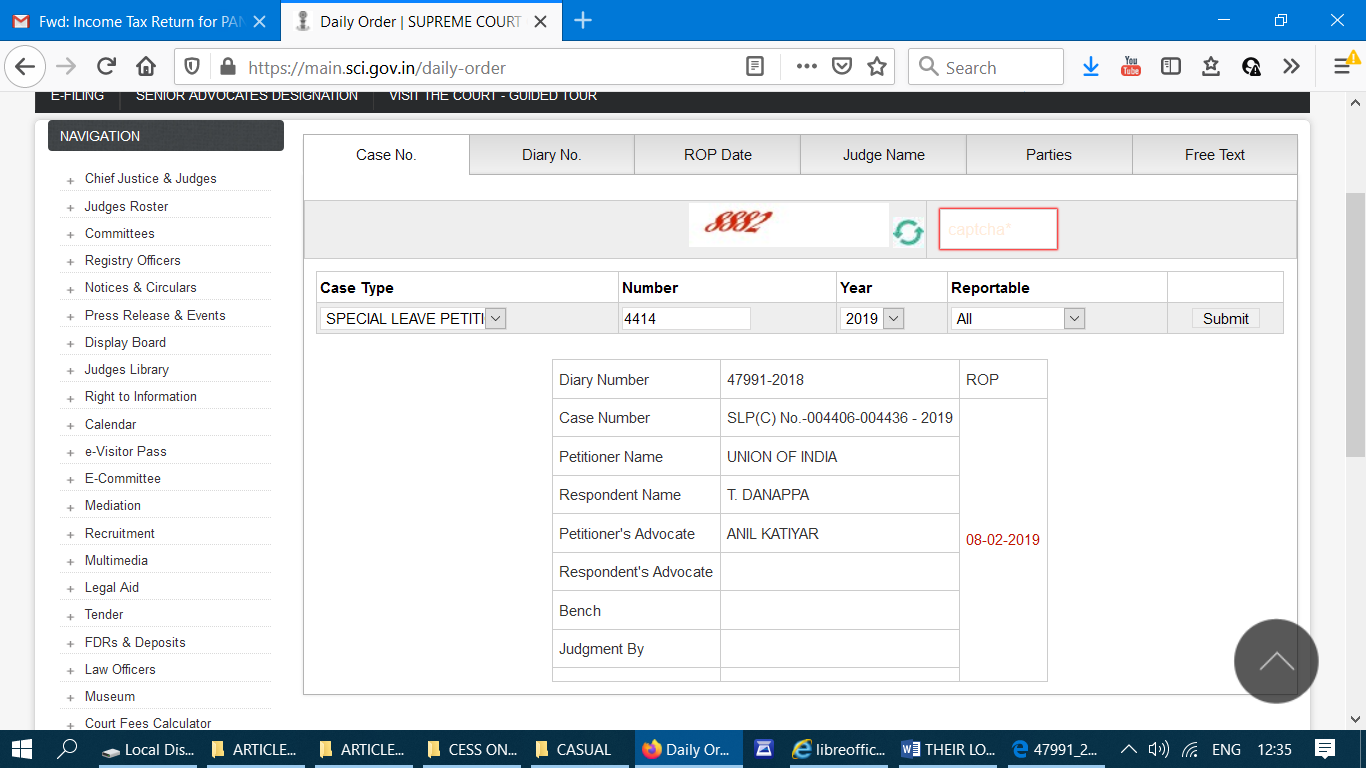

This page contain more orders in drop list but all are not printed. On search of SLP (civil) no, 4414 of 2019 irrelevant result was found in form of order dated 08.02.2019 the search page and result are shown below:

Order passed but not informed: PETITION(S) FOR SPECIAL LEAVE TO APPEAL (C) NO(S). 14729- 14731/2012 in case of THE ADDITIONAL COMMISSIONER PETITIONER(S) VERSUS M/S.TULIP STAR HOTELS LTD. RESPONDENT(S) WITH SLP(C) NO. 33060/2018 (III) (FOR ADMISSION AND I.R. AND IA NO.174333/2018-CONDONATION OF DELAY IN FILING) Were dismissed vide order dated 07.02.2019.

Yet we find that in subsequent orders of the Supreme Court it has been ordered to fix some cases after disposal of above SLP for example see order dt. 02.12.19 in which it is ordered “ List the matter after the decision of this Court in SLP (C) No.14729-31/2012.”

This shows that honourable lordships of the Supreme Court need more careful people to assist them. The question is how order in relevant appeals which was passed dt. 07.02.2019 were not placed before their lordships about ten month later on 02.12.2019. Particularly when we find that the petitioner (Pr. CIT) and respondent (Chambal Fertilisers Ltd were represented by presence of four and six learned counsels/ AOR. Is this not indicative that the counsels have not played their role, as court officers, and also as counsels of their respective clients, properly and caused wastage of time of Court and money of their clients? Or it is deliberate practice to keep matters pending for earning money? Question wrongly framed in petition before the Supreme Court: Another instance of careless ness is a question which is patently wrong in case being SPECIAL LEAVE PETITION (CIVIL) Diary No.6047/2019 (Arising out of impugned final judgment and order dated 31-07-2018 in DBITA No.52/2018 passed by the High Court Of Judicature For Rajasthan At Jaipur). The case is JOINT COMMISSIONER OF INCOME TAX RANGE II Petitioner(s) VERSUS CHAMBAL FERTILIZERS AND CHEMICALS LTD. Respondent(s) As per order dated 11.03.2019 of the Supreme Court.

As per the order the following substantial question has been pressed and admitted. The question is as framed at page 60 of paper book: “Whether the Hon’ble High Court and the ITAT under the facts and circumstances of the case have erred in holding that the education cess is disallowable expenditure u/s 40(a)(ii) of the I.T. Act? On plain reading of the question one would feel that this question can be raised only by assesse and not by the revenue. Whereas the appeal has been preferred by revenue through JOINT COMMISSIONER OF INCOME TAX RANGE II as Petitioner. The fact is that in case of Chambal Fertiliser Ltd The Tribunal disallowed claim for cess and on appeal of assesse, the High Court allowed the same. The judgments are reported at CHAMBAL FERTILIZERS & CHEMICALS LIMITED VERSUS ADDITIONAL COMMISSIONER OF INCOME TAX, RANGE-2, KOTA AND DEPUTY COMMISSIONER OF INCOME TAX, CIRCLE-2, KOTA VERSUS CHAMBAL FERTILIZERS & CHEMICALS LIMITED 2016 (10) TMI 1115 - ITAT JAIPUR and CHAMBAL FERTILISERS AND CHEMICALS LTD., PR. COMMISSIONER OF INCOME TAX, KOTA. VERSUS JCIT, RANGE-2, KOTA., M/S. CHAMBAL FERTILIZERS AND CHEMICALS LTD., GADEPAN, DISTT. KOTA. -2018 (10) TMI 589 - RAJASTHAN HIGH COURT, respectively. Therefore, the revenue has preferred the appeal before the Supreme Court. As per the question framed by revenue in their petition The High Court and the ITAT both have held that the education cess is disallowable expenditure u/s 40(a)(ii) of the I.T. Act. This again shows gross negligence of the team of counsels of the revenue. This is also pertinent that on 11.03.2019 revenue was represented by presence of three learned counsels and respondent was represented by presence of four learned counsels. Even if there was a mistake in petition, the counsels of revenue should have pointed out the mistake and corrected the question by proper prayer and petition with leave of honourable Supreme Court. The counsels of respondent seems to have adopted strategy to pray for dismissal of appeal, at the time of final hearing , for the reason that question is not arising out of proceedings before lower courts. Daily orders: Daily orders are sometimes found with case number or with Diary number. As discussed earlier, with search of SLP ( C ) no. 4414 of 2019 order in some other appeals are tagged. In search of case no. SLP Civil 6655 of 2019 the following result is found:

Case of Addl CIT Vs. Tulip Star Hotel P. Ltd On search of cases being SLP (Civil) 14729- 14731 we find various orders as follows:

From this list we find that first order was dated. 30.04.2012 and last is dated 07.02.2019. The list shows 15 orders only, there are likely to be more orders. This is because there were three SLP and 3 COD petitions. In the list at some places two orders of same date are shown. At some places only one order is shown. In fact there can be three orders ( for three SLP) and another order on COD. It is noticed that in case of every hearing number of advocates have appeared for applicant and respondent both. In most of cases the order was to re-fix cases on request of counsels of applicant. It is also worth to note that the Tribunal had relying upon the judgment of the Supreme Court in the case of SA BUILDERS LTD. VERSUS COMMISSIONER OF INCOME-TAX - 2006 (12) TMI 82 - SUPREME COURT held that the assessee was entitled to the deduction of interest on the borrowed funds. Noting the same factual position the Delhi High Court dismissed appeal of revenue. Revenue wanted a review ( or to distinguish the same) . Ultimately SLP was dismissed for non-prosecution by revenue. This shows that revenue has un-necessarily indulged into litigation and caused wastage of valuable time of honourable judges of the Supreme Court. Conclusions: From above discussions with examples it is clear that matters are taken very casually even by very senior counsels and even before the Supreme Court. This lead to frivolous or un-necessary initiation of litigation and the same is pursued in a manner that cases are kept pending for long time. This causes loss of time of honourable courts including the Supreme Court. This causes brain drain for the nation. This causes in a way siphoning of public funds on frivolous litigation which seems to have been dragged over years and decades in many cases. When the situation is so grim and undesirable even before the Supreme Court, what can be expected at lower courts? For small cases we can, for example take cases before Rent Controller in Kolkata, for fixation of fair rent. When law was amended and formulae for fixing fair rent was placed in law, tenants have raised various frivolous contentions to oppose fixation of fair rent. Thereafter tenants through their advocates dragging cases. Cases filed in the year 2004 were expected to be settled within 6-12 months. However, most of them are still pending for last fifteen years. As per information, disposal has only been in cases which are settled out of court. Professionals engaged in management of litigation must not be money minded, they must also be productive to some extent. Earning money by promoting frivolous litigation should not be aim of learned professionals.

By: DEVKUMAR KOTHARI - May 14, 2020

|

|||||||||||

| |

|||||||||||

9911796707

9911796707