PROPOSED RETURN PROCESS

PRESENTATION PLAN….

- Basic Features

- Periodicity of Return Filing

- Contents of GSTR-1 Return

- Contents of GSTR-2 Return

- Contents of GSTR-3 Return

- Contents of Compounding Taxpayer Return (GSTR-4)

- Contents of Foreign Non-Resident Return (GSTR-5)

- Contents of ISD Return (GSTR-6)

- Contents of TDS Return (GSTR-7)

- Contents of Annual Return (GSTR-8)

- HSN Codes & SAC

- Typical Invoice Details

- Invoice matching & Credit reversal

- Filing of return

- Revision

BASIC FEATURES….

- Self-assessment of tax liability by the taxpayer

- Common e-Return for CGST, SGST, IGST & Additional Tax

- Separate returns for different categories of taxpayers

- Normal/Regular & Casual Taxpayer (GSTR-1, 2 ,3 & 8)

- Compounding Taxpayer (GSTR- 4 & 8)

- Foreign Non-Resident Taxpayer (GSTR-5)

- Input Service Distributor (GSTR- 6)

- Tax Deductor (GSTR-7)

- Returns by a normal / casual taxpayer to be filed in sequential manner with different cut-off dates to allow auto-population of return & automated matching of invoices

- Payment of due tax is must for filing valid return

- Returns can be submitted with short payment but shall be treated as invalid - not taken into account for invoice matching & inter-Government fund settlement

- Provision for filing revised information

- Differential Tax liability to be captured through Debit Note / Credit Note/ Supplementary invoices / correction mechanism

- Maintenance of electronic Cash Ledger

- Maintenance of electronic ITC Ledger

- Maintenance of electronic Tax liability Ledger

PERIODICITY OF RETURN FILING….

- Normal/Regular taxpayers - monthly return

- 10th day of succeeding month: last date for uploading supply invoice details - GSTR -1

- 15th day of succeeding month: last date for auto-population & uploading purchase details - GSTR-2

- 17th day of succeeding month: last date for finalizing supply & purchase details

- 20th day of succeeding month: last date for filing GSTR-3

- Compounding taxpayers to file quarterly return: by 18th day of succeeding month of the Quarter - GSTR-4

- Foreign Non-resident Taxpayers to file monthly return: within 7 days after expiry of registration - GSTR-5

- Input Service Distributors (ISD) taxpayers to file monthly return: by 15th day of succeeding month -GSTR-6

- Tax Deductors to file monthly TDS return: by 10th of succeeding month - GSTR- 7

- Casual taxpayers to file same return as for normal taxpayer but with monthly periodicity and / or linked to validity period of registration

- UN agencies to file return for the month in which they make purchases - to claim refunds

- Annual Return (GSTR-8)

- All Regular and Compounding taxpayers to file Annual Return

- Last date - 31st December following the end of the financial year

- Simpler Annual Return for Compounding taxpayers & those taxpayers who are not required to get their accounts audited

- Annual Return to be accompanied with a statement showing reconciliation of information as per Returns with information as per annual audited accounts

CONTENTS OF GSTR-1 RETURN….

- Taxpayer details

- Return period details

- Invoice level specified details

- Line-item level data in case multiple tax rate or HSN / Service Accounting Code in one invoice

- only if Taxable Value per invoice is ≥ INR 250000/-

- Aggregate State-wise summary

- All other B2C inter-State taxable supplies having address on record

- Every invoice having Taxable Value of ≥ INR 50,000/- to mandatorily have address of buyer

- All B2C intra-State taxable supplies

- All exempted, nil rated & non-GST supplies (intra- State & inter-State AND B2B & B2C)

- Invoice level details along with shipping bill details

- with payment of GST

- without payment of GST

- Debit Notes / Credit Notes: Details of debit note, credit note & changes in supply information for earlier tax periods with consequential increase/decrease in tax liability

- Details of tax liability on receipt of advance

- Details of subsequent issuance of invoices issued w.r.t. advance receipt

CONTENTS OF GSTR-2 RETURN….

- Taxpayer details

- Return period details

- Invoice level inward supply details received from registered taxpayer

- To be auto-populated from GSTR-1 of counterparty supplier

- Recipient to have option to add receipts not declared by counterparty supplier - if in possession of taxable invoice & have received supply of goods / services

- Bill of entry details of import of goods

- Invoice level details of import of services

- Debit Notes / Credit Notes: Details of debit note, credit note and changes in inward supply information for earlier tax periods with consequential increase/decrease in ITC

- Option to declare eligibility for ITC

- Aggregate summary of receipts of exempted, nil rated, non-GST supplies & supplies received from unregistered person

- Details of ITC received from ISD

- Details of cash credit received on account of TDS

CONTENTS OF GSTR-3 RETURN….

- Taxpayer details

- Return period details

- To be auto-populated from GSTR-1 & GSTR-2

- Aggregate values of all B2B outward supplies

- Aggregate value of all B2C outward supplies

- Aggregate value of all exports including deemed exports

- Aggregate value of all inward supplies

- Aggregate value of all imports

- Information about adjustments for earlier periods

- Details of cash credit received on account of TDS

- Details of all liabilities (Tax, interest, penalty, late fee, etc.)

- Details of ITC availed, ITC utilized, credit reversible on account of invoice mismatch and other adjustment

- Details of gross & net tax liability

- Details of payment of tax and other statutory liabilities

- Provision for capturing Debit Entry No. of Cash & ITC Ledger

- A field for return based refund & Bank Account Number

CONTENTS OF COMPOUNDING TAXPAYER RETURN (GSTR-4)….

- Taxpayer details

- Return period details

- Inward supply details

- Auto-populated from GSTR-1 of counter-party supplier

- Option to add receipts not uploaded by counter-party supplier

- Receipts from unregistered dealers to be added

- Includes supply attracting tax payment on reverse charge basis

- Details of import of goods and services

- Details of outward supply: intra-state, exports & non-GST

- Details of all liabilities (Tax, interest, penalty, late fee, etc.)

- Details of payment of tax and other statutory liabilities

- Provision for capturing Debit Entry No. of Cash ledger

- Information on possibility of crossing composition limit before date of next return

CONTENTS OF FOREIGN NON-RESIDENT RETURN (GSTR-5)

- Taxpayer details

- Return period details

- Details of imported goods: HSN details at 8 digit level

- Details of outward supplies

- Details of ITC availed

- Details of tax payable

- Details of tax paid

- Closing stock of goods

CONTENTS OF ISD RETURN (GSTR-6)….

- Taxpayer details

- Return period details

- Details of ITC

- Auto-populated from GSTR-1of counter-party supplier

- Option to add receipts not declared by counterparty supplier - if in possession of taxable invoice & have received supply of goods or services

- Includes supplies attracting reverse charge

- Information about ITC available in the month for Distribution

- Details of credit of CGST, SGST & IGST distributed

- Details of ISD ledger

- Opening and closing balance of ITC

- ITC received, reversed and distributed

CONTENTS OF TDS RETURN (GSTR-7)

- Taxpayer’s details

- Return period details

- Details of Tax deducted

- GSTIN of supplier

- Invoice details

- Payment details

- Amount of TDS on account of CGST, SGST & IGST

- Details of payments of any other amount

CONTENTS OF ANNUAL RETURN (GSTR-8)

- Taxpayers Details

- Details of all expenditure

- Details of all income

- Details of all other tax liability

- Other Reconciliation Statement

HSN Codes & SAC

- HSN Code for goods - in invoice level details

- 4-digit HSN Code mandatory for taxpayers having turnover above ₹ 5 Crore in preceding FY

- 2-digit HSN Code for taxpayers with turnover between ₹ 1.5 Crore & ₹ 5 Crore in preceding FY - optional in 1st Year and mandatory from 2nd Year

- 8-digit level mandatory for exports & imports

- Accounting Codes for services - in invoice level details

- Mandatory for those services for which Place of Supply Rules are dependent on nature of services

- Mandatory for exports & imports

- Service Accounting Code to be prefixed with ‘s’ for differentiating from HSN

Typical Invoice Details

- Buyer’s GSTIN / Departmental ID / Address

- Invoice Number & Date

- HSN Code/Accounting Code

- for each line item of an invoice in case of multiple codes in an invoice

- Taxable Value

- Invoice Value

- Tax Rate

- Tax Amount (CGST & SGST or IGST & / or Additional Tax)

- Place of Delivery/Place of Supply

- only if different than the location of buyer

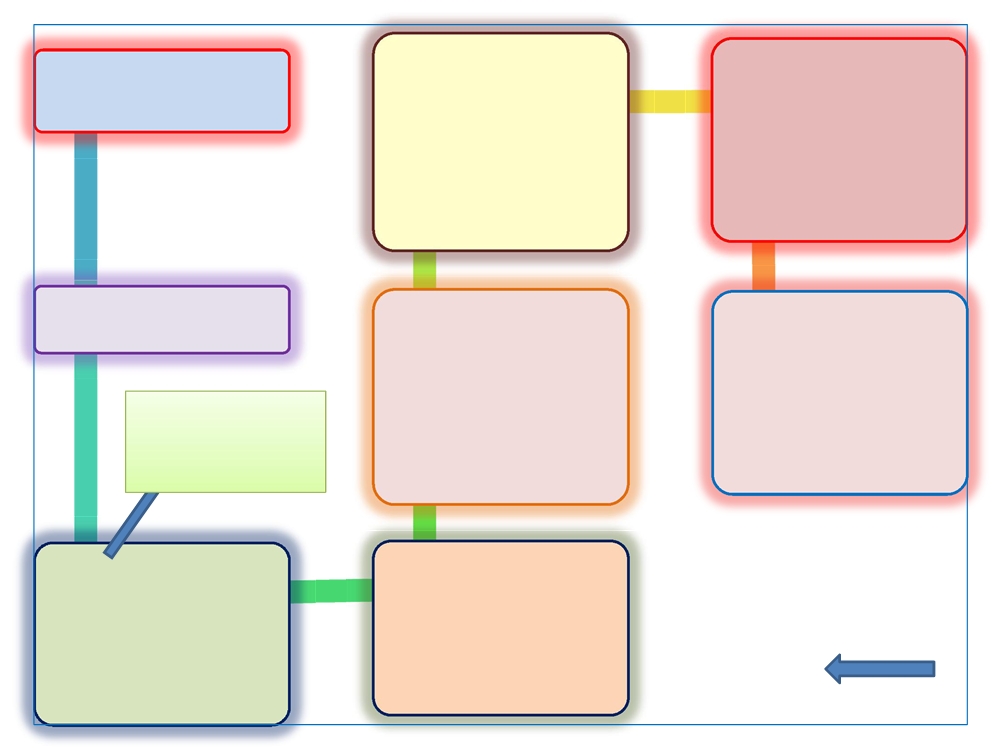

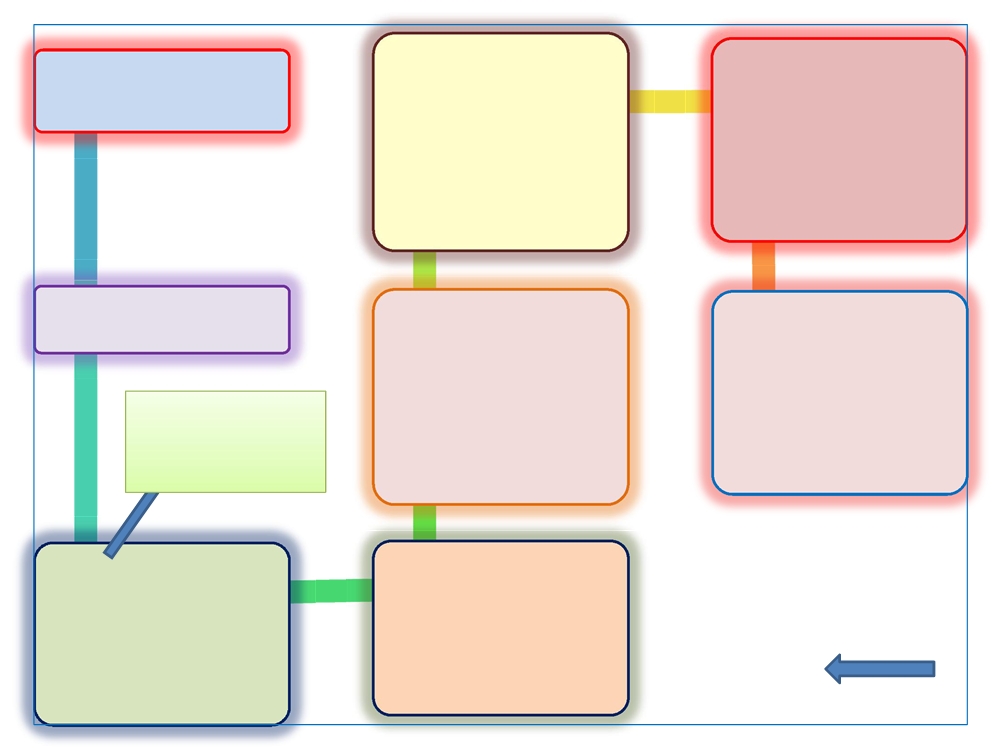

Invoice Matching & Credit Reversal

- B2B supply information given by the supplying taxpayer in GSTR-1 will be auto-populated into GSTR-2 of the counter-party purchaser

- Purchasing taxpayers will be allowed to add invoice details in GSTR-2 & avail credit if he is in possession of valid invoice & have received supply of goods or services

- Counterparty registered taxpayers shall have a 2-day window to reconcile invoice information among themselves prior to filing of GSTR-3

- Credit availed on unmatched invoices shall be auto-reversed in the next to next return period (e.g. mismatched ITC for April to be auto-reversed in return for June)

FILING OF RETURN

- To be filed by taxpayer at GST Common Portal either:

- by himself logging on to the GST System using his own user ID & password; or

- through his authorized representative using the user Id & password (allotted to the authorized representative by the tax authorities), as chosen at the time of registration, logging on to the GST System

- Filing may be done through TRPs / FCs also

- Filing may be done either directly or by using Applications developed by accounting companies / IT companies which will interact with GST System using APIs

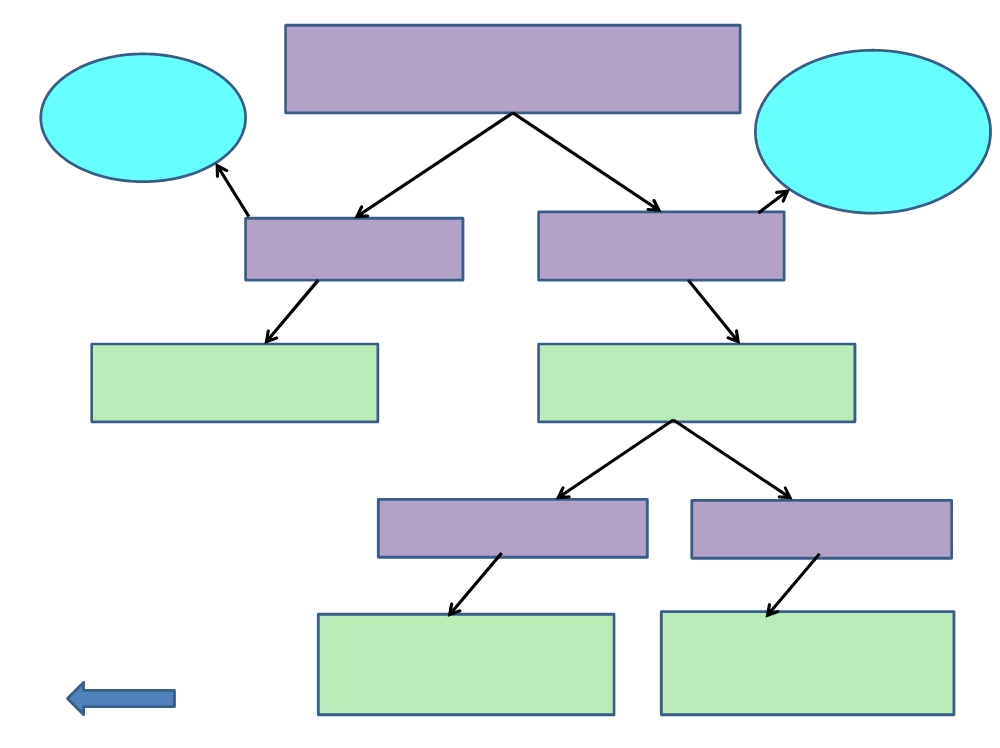

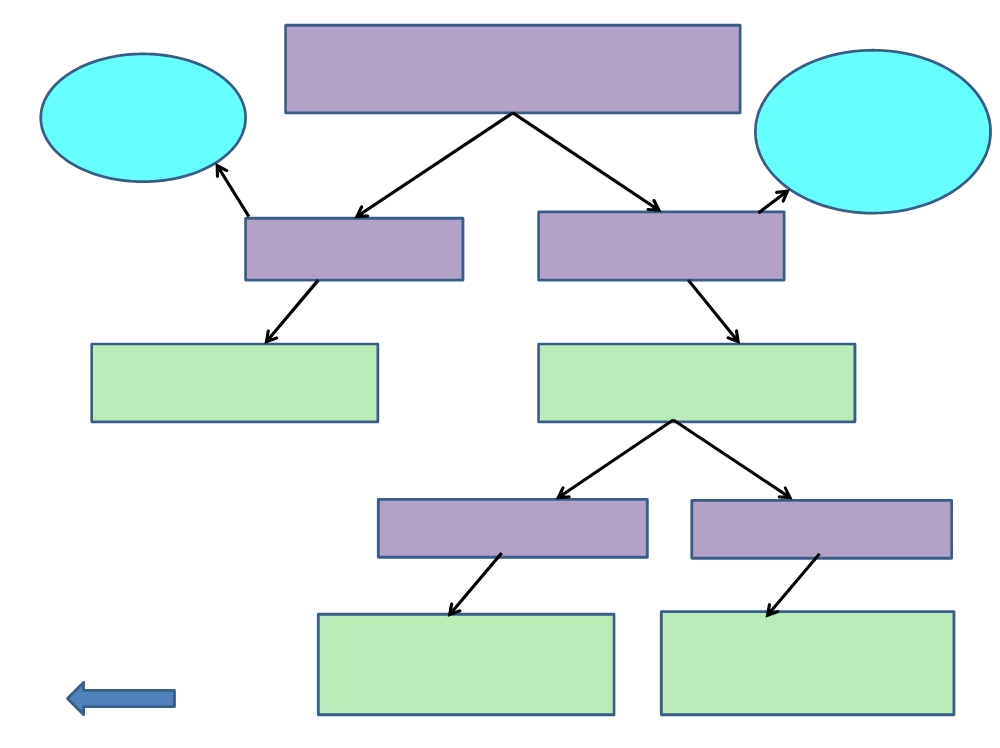

- Steps for filing Return

REVISION

- Revision of information permitted

- Changes in Tax liability / ITC amount to be handled through

- Debit- Credit Notes

- Revision of supply invoices

- Post sales discount

- Volume discount

- Amendments / Corrections