| News | |||||||||||||||

|

Home |

|||||||||||||||

|

|

|||||||||||||||

Minutes of the Monetary Policy Committee Meeting, October 4 to 6, 2023 [Under Section 45ZL of the Reserve Bank of India Act, 1934] |

|||||||||||||||

| 20-10-2023 | |||||||||||||||

The forty fifth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during October 4 to 6, 2023. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (October 6, 2023) decided to:

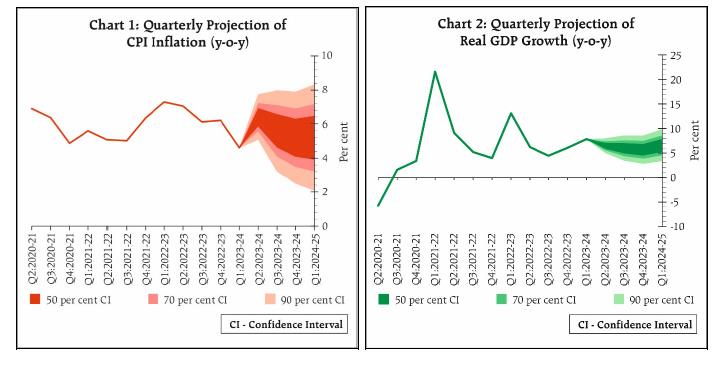

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 6. Global growth is losing momentum. Inflation is easing gradually but remains well above target in major economies. Concerns about higher for longer rates are imparting volatility to global financial markets. Sovereign bond yields have hardened, the US dollar has appreciated, and equity markets have corrected. Emerging market economies (EMEs) are experiencing currency depreciation and volatile capital flows. Domestic Economy 7. Real gross domestic product (GDP) posted a growth of 7.8 per cent year-on-year (y-o-y) in Q1:2023-24 (April-June), underpinned by private consumption and investment demand. 8. South-west monsoon rainfall recovered during September and ended 6 per cent below the long period average. The acreage under kharif crops was 0.2 per cent higher than a year ago. The index of industrial production rose by 5.7 per cent in July; core industries output expanded by 12.1 per cent in August. Purchasing managers’ indices (PMIs) and other high frequency indicators of the services sector exhibited healthy expansion in August-September. 9. On the demand front, urban consumption is buoyant while rural demand is showing signs of revival. Investment activity is benefitting from public sector capex. Strong growth is seen in steel consumption, cement production as well as in imports and production of capital goods. Merchandise exports and non-oil non-gold imports remained in contraction in August, although the pace of decline eased. Services exports improved in August. 10. CPI headline inflation surged by 2.6 percentage points to 7.4 per cent in July due to spike in vegetable prices, before moderating somewhat in August to 6.8 per cent. Fuel inflation edged up to 4.3 per cent in August. Core inflation (i.e., CPI excluding food and fuel) softened to 4.9 per cent during July-August 2023. 11. As on September 22, 2023, money supply (M3) expanded by 10.8 per cent (y-o-y) and bank credit grew by 15.3 per cent. India’s foreign exchange reserves stood at US$ 586.9 billion as on September 29, 2023. Outlook 12. The near-term inflation outlook is expected to improve on the back of vegetable price correction and the recent reduction in LPG prices. The future trajectory will be conditioned by a number of factors like lower area sown under pulses, dip in reservoir levels, El Niño conditions and volatile global energy and food prices. According to the Reserve Bank’s enterprise surveys, manufacturing firms expect higher input cost pressures but marginally lower growth in selling prices in Q3 compared to the previous quarter. Services and infrastructure firms expect a moderation in growth of input costs and selling prices. Taking into account these factors, CPI inflation is projected at 5.4 per cent for 2023-24, with Q2 at 6.4 per cent, Q3 at 5.6 per cent and Q4 at 5.2 per cent, with risks evenly balanced. CPI inflation for Q1:2024-25 is projected at 5.2 per cent (Chart 1). 13. Domestic demand conditions are expected to benefit from the sustained buoyancy in services, revival in rural demand, consumer and business optimism, the government’s thrust on capex, and healthy balance sheets of banks and corporates. Headwinds from global factors like geopolitical tensions, volatile financial markets and energy prices, and climate shocks pose risks to the growth outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent, with Q2 at 6.5 per cent, Q3 at 6.0 per cent, and Q4 at 5.7 per cent, with risks evenly balanced. Real GDP growth for Q1:2024-25 is projected at 6.6 per cent (Chart 2).

14. The MPC observed that the unprecedented food price shocks are impinging on the evolving trajectory of inflation and that recurring incidence of such overlapping shocks can impart generalisation and persistence. Accordingly, the MPC resolved to remain on high alert, given the prevailing environment of elevated global food and energy prices and global financial market volatility. While vegetable prices may undergo further correction and core inflation is easing, the MPC noted that headline inflation is ruling above the tolerance band and its alignment with the target is getting interrupted. Hence, monetary policy needs to remain actively disinflationary. Domestic economic activity is holding up well and is expected to be boosted by festive consumption demand, pick up in investment intentions and improving consumer and business outlook. As the cumulative policy repo rate hike of 250 basis points is still working its way through the economy, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting, but with preparedness to undertake appropriate and timely policy actions, should the situation so warrant. The MPC will remain resolute in its commitment to aligning inflation to the target and anchoring inflation expectations. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 15. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 16. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 17. The minutes of the MPC’s meeting will be published on October 20, 2023. 18. The next meeting of the MPC is scheduled during December 6-8, 2023. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

Statement by Dr. Shashanka Bhide 19. The spell of subdued overall price pressures during Q1: FY 2023-24 with the headline CPI inflation at less than 5 per cent, was broken by the spike in the vegetable prices pushing the headline inflation to 7.4 per cent in July and 6.8 per cent in August, respectively. While the sharp increase seen during July-August appears transitory, pressures on the price conditions remain. 20. The uneven distribution of rainfall in the current monsoon period is a source of concern on food prices, with cereals, pulses and spices experiencing double digit price rise from June to August. While the kharif sown area is estimated to be at roughly the same level as in the previous year, area under some of the key crops such as pulses and some of the coarse grains is lower than in the previous year. Trade and supply management policies of the government would moderate the price effects of any supply-demand mismatches but favourable weather for the rabi season would be crucial for keeping food inflation moderate. 21. The non-food segment of the CPI basket registered moderate price rise during July-August. CPI excluding food and fuel (core CPI) registered a rise of 4.9 per cent, YOY basis, in both July and August, down from 5.2 per cent in June. While clothing and footwear, health, education, and personal care & effects registered a price rise of above 5 per cent in August, the vulnerability of the core to shocks in the petroleum fuel prices remains significant as a range of transport services prices would be sensitive to fuel prices. 22. The recent Enterprise surveys by the RBI point to continued input price pressures in Q3 and Q4 in FY 2023-24 and expectations of higher selling prices, particularly in the manufacturing and infrastructure sectors as compared to the services sector. The overall business situation is also expected by the sample firms to improve in Q3 and Q4 in the manufacturing sector. The Business Inflation Expectations Survey conducted in July by IIM Ahmedabad indicates a rise in the ‘one year ahead’ expected cost-based inflation rate. 23. The RBI’s Inflation Expectations Survey of urban households conducted in September 2023 indicates a decline in median inflation expectations for 3-months ahead and one year-ahead. 24. The RBI’s Survey of Professional Forecasters conducted in September 2023 points to a median forecast of 6.6 per cent headline inflation rate in Q2 followed by lower rates of 5.5 per cent and 5.1 per cent in Q3 and Q4, respectively. The core inflation1 is projected at 4.9 per cent in Q2, followed by 4.7 per cent and 4.6 per cent in Q3 and Q4, respectively. 25. Weak global economic growth and external demand have kept the global price pressures down. The global fuel and energy prices volatility and firming up of some of the food commodity prices are a concern in the short-term, in view of the persistent geopolitical tensions and vulnerability to adverse climate shocks. Financial market volatility has also meant volatile capital flows. 26. Considering these broad trends, CPI headline inflation rate for FY2023-24 is projected at 5.4 per cent, unchanged from the projections in the August MPC minutes. The projections for Q2, Q3 and Q4 are at 6.4, 5.6 and 5.2 per cent, respectively, broadly in line with the August projections. 27. On the growth front, YOY GDP growth in Q1: FY 2023-24 at 7.8 per cent follows sharply higher Q1 growth in the previous two years, reflecting the resilience of growth momentum. However, the growth pattern continues to be uneven across sectors, with the services, which include construction, registering growth rate of 10 per cent while that of industry being lower (4.6 per cent). The GVA from manufacturing, accounting for around 80 per cent of GVA from industry, rose by 4.7 per cent. Within the services, all the major segments registered higher YOY growth rates than the overall growth rate of aggregate GVA. However, one segment, ‘Trade, hotels, transport and communication’ is yet to reach its GVA level of Q1:2019-20. The official estimate of GDP growth for Q1 came slightly lower than RBI’s projection of 8 per cent. 28. The RBI’s recent enterprise surveys indicate expectations of improved demand conditions in Q2 and subsequent two quarters in FY 2023-24, with relatively higher optimism in the manufacturing sector as compared to services and infrastructure sectors. 29. The divergence in growth performance also reflects demand conditions. On the demand side, investment spending increased at a faster rate than consumption with the external demand being a drag for the overall demand growth. During April-July 2023 period, index of industrial production (IIP) data reflects strong YOY growth of ‘infrastructure/ construction sector’ (12.2 per cent) and ‘consumer non-durables’ (6.8 per cent) but weaker growth in ‘consumer durables’ (-2.7 per cent). 30. The RBI’s recent Consumer Confidence Survey of urban households shows cautious optimism. The broader measure of sentiments used in the survey comprising one-year ahead expectations of general economic conditions, employment scenario and household income, reflects improvement over the current period. However, assessment of the current situation is cautious as the increase in ‘non-essential expenditure’ is lower both in the current period and one-year ahead as compared to the previous round of the survey. The high inflation in July-August seems to have moderated optimism in the present round of the survey. 31. The recent high frequency indicators of economic activity reflect continuation of the growth trends at an aggregate level. The PMIs for manufacturing and services remained at high levels in July and August although the index fell in the case of services while it rose for manufacturing indicating expectation of expansion in output in the short term. Non-food bank credit, GST collections and domestic and international air passenger traffic registered double digit YOY growth in August and September. The drag is in the external sector: merchandise exports and imports declined YoY basis, through the current financial year, although the extent of decline has moderated in August. Services imports declined YOY basis in July and August with exports growing at a modest 8.4 per cent in August. Slower YOY growth is seen in the case of new launches and sales of housing units in Q1: FY 2023-24 as compared to the previous quarter. 32. The median projection of GDP growth for FY 2023-24 from the RBI’s September 2023 round of Survey of Professional Forecasters is 6.2 per cent, rising marginally by 0.1 percentage point from the forecast in July. 33. Overall, the demand conditions are expected to sustain the growth momentum observed in the August meeting of the MPC, although the concerns emerging from the uncertain global market conditions pose downside risks. The GDP growth projection for FY 2023-24 has been retained at 6.5 per cent, with the quarterly projections for Q2, Q3 and Q4 also remaining the same as in the August meeting. 34. The growth momentum is projected to be sustained in the present financial year despite the erratic distribution of monsoon and the weak external conditions based on more stable domestic demand conditions. The points flagged in the August meeting regarding the global economic conditions and incomplete transmission of the policy rate actions undertaken are still relevant at this juncture. It is necessary to assess the strength of the growth trajectory and inflation outlook in the medium term keeping in view the fact that the projected headline inflation remains above 5 per cent in the final three quarters of the current financial year. 35. Therefore, I vote: i. to keep the policy repo rate unchanged at 6.50 per cent and ii. to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Statement by Dr. Ashima Goyal 36. The global picture continues to be mixed. The interpretation of the Fed’s communication as ‘higher for longer’ has led to US ten year yields crossing 4.5%, especially as the US fiscal deficit continues to rise. There is fear that firms will be in trouble as they re-finance low interest loans taken during the pandemic. But at the same time the Fed is also saying its actions will be data dependent. Markets should take comfort that rates will not continue to be high regardless of what happens. Chinese excess inventories and deflation are contributing to reducing manufacturing costs in most countries. Global growth is expected to fall in FY24 but a turnaround is possible in FY25. 37. Indian growth trends also continue to be mixed. Some export dependent industries have slowed. Pent-up demand is waning for services but remains robust. Many indicators point towards a revival in private investment post recovery, but some surveys suggest election uncertainty may delay projects. This is unlikely, however, in sectors that are close to full capacity utilization with robust domestic demand. 38. There are some indicators of strong domestic demand. PMIs continue to be high. Confidence has improved for consumers and firms. The current account deficit (CAD) is up from -1.2% of GDP in FY22 to -2% in FY23. This equals the excess of investment over savings. Household physical savings is measured as identical to household physical investment savings in India, so it is the net financial savings that affect the CAD. These are down to 5.1% of GDP in FY23 from around 7% of GDP pre-pandemic. A post pandemic surge in net financial savings did not last and they fell to 7.2% of GDP in FY22. 39. Gross household financial savings remain high, however. It was household financial liabilities that increased from 3.8% of GDP in 2021-22 to 5.8% of GDP in 2022-23, by a similar 2.1% fall in net financial savings. The rise in financial liabilities implies a rise in household physical investment and shows the interest sensitivity of demand in India, with a youthful population borrowing to acquire assets. In FY23 households shifted towards such borrowing since real rates became positive only towards the end of the year. Pass through to bank deposit rates was more delayed but this is happening now and bank deposits are rising. We need to wait and see if the share of financial savings rises again after post-pandemic disturbances. As investment and income rises, savings also tend to rise. Already in Q4 FY23 net financial savings rose to 7% of GDP from 4% of GDP in Q3 FY23. 40. There are signs of a revival in investment now after more than a decade. Sharp financial tightening in 2011 and 2017 punctured such past revivals and led to persistent slowdowns. So it is important to ensure a sustained and sustainable revival this time. There is no excess lending or an infrastructure boom this time, but a healthy gradual rise. 41. Indian household debt is low by international standards, but a sudden rise can be a concern. It is best to restrain over-enthusiasm in good times and thus avoid a crash. Prudential tightening, such as raising LTV ratios or risk weights, would be preferable to raising policy rates more. There is already some reversal of remissions given in the pandemic times. After the firm-lending based NPAs most banks are trying to increase retail loans. These are secured or based on cash or salary flows. But it will help to make sure lending continues to be risk-based and internal assessments are robust. 42. Despite the large inflation spikes to vegetable and crude oil prices, there is favourable news on inflation. The monsoon is ending near normal, spikes have passed with no second-round effects as core inflation continues to soften. The government is undertaking many supply-side measures to reduce inflation. 43. The headline inflation forecast of 5.4 for FY 24 gives a comfortably positive real repo rate. Therefore I vote for a pause in the repo rate, and also vote for the stance on withdrawal of accommodation in order to signal the MPC’s determination to reach its 4% target. This stance rules out a rate cut. It allows a rise but that will not be required unless there are second round effects from the repeated supply shocks. So far there are no signs of such pass through. The guidance therefore is that future moves will be data-dependent. 44. Liquidity has been tight in the past 2 months so that the weighted average call rate (WACR) has often been above the repo rate. This first happened in end-September 2022 suggesting withdrawal of pandemic –time excess liquidity was adequate. After that the WACR has spent more time at the top than at the bottom of the LAF corridor. Endogenous short term liquidity adjustments at the edges keep the WACR within this band. 45. Since March 31, 2014 average annual growth of broad money was 10%, less than nominal income growth, although reserve money growth varied widely over the pandemic and demonetization periods. Over December 2009 to February 2014, prior to the adoption of inflation targeting, average annual broad money growth was 15.0%. 46. But fine-tuning of liquidity is not as yet adequate to keep the WACR at the MPC mandated repo rate. Moreover, shocks can be so large that short-term liquidity is unable to compensate. Then durable liquidity must be adjusted. OMO purchases or sales that affect durable liquidity may be required depending on liquidity conditions. 47. Research finds that quantity (of money) as well as rates matter in Indian conditions. Both too much and too little liquidity has adverse effects. Liquidity aligned to stance increases the impact of a change in the Repo Rate2. But due to a large informal sector and many financial institutions with no recourse to liquidity windows, large liquidity deficits lead to liquidity hoarding and more leakages3. We have seen as liquidity tightens banks with surplus become reluctant to lend to those with deficits or participate in longer tenor VRRR despite profit opportunities. They prefer using RBI’s overnight windows. Impediments to developing an active overnight inter-bank call money market have to be addressed. 48. Analysts are again concerned about falling interest differentials with the US. But markets seem to understand that Indian macros are relatively more stable today. In September despite a 46 bps rise in US 10 year yields, Indian 10 year G-secs rose only 5 bps. The IMF gave the average spread for emerging markets at 200 bps in 2022. India still exceeded that at 280 bps in September. Despite narrower differentials, ECBs and other debt inflows continue. Even so, they are a small and therefore a manageable share of Indian markets. In addition, index inclusion is around the corner. More than higher Indian rates it is lower country risk, a stable currency and higher expected growth that keeps FPI here. There is the lure of high US risk free rates, but since higher Indian rates cannot compensate for this, the latter are best aligned to the domestic cycle. Statement by Prof. Jayanth R. Varma 49. Since the August meeting, the risks to inflation have increased, but only slightly. First, the official end of season report on the Monsoon confirmed that the rainfall was only 94% of the Long Period Average. This small shortfall coupled with the spatio-temporal dispersion in the rainfall could cause some volatility in food prices. However, the effect is more likely to consist of a few short lived inflation spikes rather than a sustained rise in inflation. The second factor is the indication in recent months of a possible geopolitical realignment of the two largest OPEC+ producers. This has imparted considerable volatility to crude oil prices in recent weeks. A sharp fall in crude prices while the MPC meeting was in progress suggests that a slowing world economy does place a limit on the upswing in crude prices. Therefore, I think that the impact of OPEC+ geopolitics would be limited to slowing the pace of decline in inflation, and is unlikely to cause a reversal of this trajectory. 50. Turning to growth, the outlook has improved modestly because of increasing consumer confidence as indicated in the RBI surveys. This increased confidence must also be seen in the light of household financial savings data released by the RBI in September. The data shows that consumers have incurred financial liabilities and reduced net financial savings to support consumption. This willingness to consume at the cost of reducing savings is very important because it is household consumption that has been propping up the economy in the face of headwinds from fiscal consolidation, weak external demand and tepid capital investment. It is possible that this consumer confidence could become a self fulfilling prophecy as robust consumption demand stimulates growth, generates income and strengthens household balance sheets. Even if that does not happen, global experience suggests that a debt fuelled consumption boom can last several years before petering out. Either way, the medium term growth outlook looks somewhat stronger than it did during the last meeting, though several headwinds still remain. 51. The changes in the outlooks for both inflation and growth are quite modest, and the real repo rate is already quite high. I, therefore, support the decision to keep repo rate unchanged. In my view, the real interest rate based on projected inflation is high enough to glide inflation towards the target within a reasonable period. 52. As regards the stance, I continue to have the same reservations as in the past. Successive meetings that promise to withdraw accommodation while actually keeping rates unchanged do not enhance the credibility of the MPC. I would much prefer a stance in which words are consistent with the actions. Moreover, at this point of time, the guidance that the market really needs is not about how high the terminal repo rate would be, but about how long the rate would be maintained at a high level. It would therefore be useful for the MPC to communicate its intention to keep real interest rates high enough for as long as is necessary to drive projected inflation close to the 4% target on a sustainable basis. Statement by Dr. Rajiv Ranjan 53. At this juncture, three global trends, among many others, need to be closely watched – rising crude oil prices, rising US yields and rising US dollar. On the domestic front, the containment of food price pressures, particularly vegetable prices, which is reversing, is an important assumption behind retaining our inflation projection at 5.4 per cent during 2023-24. Core inflation (CPI excluding food and fuel) continued to register further softening to 4.9 per cent. In fact, almost all exclusion and trimmed mean measures of inflation have registered a decline in recent months, a marked change from 2022-23 wherein core inflation remained sticky at highly elevated levels. The sequential saar momentum for core inflation was at 4.5 per cent in August with 3-month moving average below 4 per cent as per data available till August. Threshold diffusion indices4 of CPI also indicate a significant slowdown in the rate of price increases across CPI core in the financial year so far. Sustained deflation in WPI non-food manufactured product inflation is also a comforting factor for core inflation. Moreover, moderation of services inflation to close to 4 per cent continues to be a relief as they tend to be stickier as seen in advanced economies. 54. There was also further progress on anchoring of household inflation expectations with 3-month ahead and 1-year ahead inflation expectations having seen a cumulative decline of 170 bps and 110 bps respectively since September 2022. Important point to note is that the sharp jump in vegetable prices have not deterred anchoring of inflation expectations with relatively less impact of food inflation on persistence of core inflation. But this has to be watched carefully. Going forward, waning of transitory food price shocks, the ongoing transmission of past monetary policy actions, improvement in supply chains, strong supply side intervention by the Government, and likely lower rate of increase in selling prices by firms (as per the RBI enterprise surveys) is expected to moderate inflation to 5.2 per cent in Q4 2023-24 and further to 4.3 per cent in Q4 2024-25. If these projections hold, the alignment of inflation to the target could be underway. But we need to guard against risks from recurring weather related events and rise in global energy prices. 55. On the growth front, with GDP growth at 7.8 per cent for Q1:2023-24 and our nowcast of around 6.5 per cent for Q2, it seems to be tracking our projection of 6.5 per cent for the full financial year. The third quarter would also be buoyed by festival related demand. On the supply side, manufacturing activity is gaining traction with corporate results in Q2 expected to be aided by strong demand and easing input cost pressures. The negative deflator (around -2.5% for July-August) and base effects will also extend support to the real GVA growth in the manufacturing sector in Q2. PMI future activity index in September signalled elevated level of confidence for manufacturing. Survey results show that optimism on demand for manufacturing goods is high and consumer confidence outlook has also improved significantly. Services sector growth continues to remain robust. 56. Broad-basing of economic activity is also reflected in the data on household savings. Though net financial savings of households moderated to 5.1 per cent of GDP in 2022-23, mainly due to significant rise in financial liabilities of households both from bank and non-bank sources (5.8 per cent of GDP from 3.8 per cent in 2021-22), the gross financial savings increased in absolute terms by 13.9 per cent in 2022-23 over the previous year. Moreover, household borrowings reflect higher spending on real estate, vehicles, consumer goods, among others. This implies that the overall savings of households is expected to hold steady with compositional shift in favour of physical savings.5 This would be growth supportive either through direct addition to gross capital formation or by assisting upturn in private capex. Higher investment and income would reinforce higher savings as we have seen in Q4:2022-23 when the net household financial savings normalised to its long-term average of 7.0 per cent from a low range of 4.0 to 4.6 per cent in the first three quarters of 2022-23. 57. The concerns regarding statistical discrepancy on the expenditure side estimates at 2.8 per cent of GDP for Q1:2023-24 (-3.4 per cent of GDP in Q1:2022-23) are unfounded. This discrepancy varies from negative to positive ranging from -4.8 per cent to 6.4 per cent in the new GDP series during Q1:2011-12 to Q1:2023-24 and it eventually evens out. In the pre-pandemic period (Q1:2011-12 to Q3:2019-20), on an average, the share of discrepancy in GDP was 0.9 per cent, while in the post pandemic period (Q4:2019-20 to Q1:2023-24), it has averaged -0.4 per cent. As per the global practice, the production approach of compiling national accounts statistics (NAS) is considered to be firmer and the NAS presents discrepancy with the expenditure approach of GDP compilation explicitly in its regular releases (Sources and Methods, NSO, 2012), adhering to the recommendations by the system of national accounts (SNA 2008). Nevertheless, there is a need to improve GDP estimates from the expenditure side so that evolving dynamics of demand side components are captured appropriately. 58. Given that inflation expectations are backward looking in emerging markets including India, occurrences of multiple large adverse supply shocks run the risk of a drift in inflation expectations from underlying trend, which could eventually stall the ongoing disinflation process. Such supply shocks are challenging and test the inflation fighting credibility of central banks. Though transitory relative price changes in the economy that may spur temporary bouts of inflation may be looked through, monetary policy also needs to be watchful to see that large and frequent supply side shocks does not trigger generalised increase in prices.6 Past such instances in India, as in 2020, do give credence to MPC’s judgement with regard to optimal response to supply shocks with an objective to anchoring inflation expectations, rather than inflation per se. Besides, the sustained fall in core inflation as mentioned earlier vouches for its transitory nature going ahead. 59. Overall, with growth and inflation broadly moving in anticipated direction, monetary policy needs to hold on while earnestly persevering with disinflationary approach and remaining watchful with readiness to act if the situation demands. This calls for continuation of withdrawal of accommodation stance for monetary policy so as to facilitate further transmission of the cumulative policy repo rate hike of 250 basis points on the economy. Thus, I vote for pause in repo rate and continue with the stated stance. Statement by Dr. Michael Debabrata Patra 60. Within the dual mandate given to the MPC by the RBI Act, price stability is accorded primacy. Only when price stability is secured on an enduring basis against all threats to it can attention turn to the objective of growth. Without price stability, growth cannot sustain – the benefits of expanding GDP and employment will be frittered away by the erosion of purchasing power, hurting those the most that eke out livelihoods just to meet the costs of food, shelter and bare essentials. 61. The fight against inflation in the wake of the war in Ukraine has been arduous and herculean; by comparison, the moderation of inflation from the high reaches to which it had surged in the first quarter of 2022-23 has been grudging and underwhelming. The anchoring of inflation expectations is incomplete and muddied by uncertainty, going by the increase in variability of median expectations of households and the underperformance of revenues of businesses relative to their profits. There is also growing evidence that inflation is undermining growth – people are not increasing discretionary spending in view of high inflation and this is slowing sales growth of corporations. 62. As the economy negotiates the rapids of the second and third quarters of 2023-24, the trajectory of inflation is being buffeted by price shocks related to perishables. Surprisingly, they are producing inordinately high and painful spikes in the headline that are unacceptable from the point of view of the overall welfare of our societies. When headline inflation faces price pressures from perishables like vegetables, the standard operating procedure of monetary policy is to look through the transitory impact of their first round effects and await mean reversion. Increasingly, however, these so-called transitory shocks test our buffers and policy responses, given their unanticipated nature. Moreover, these so-called transitory shocks recur with high intensity and disturbing force. Price pressures accumulate in the inflation formation process, imparting hysteresis to inflation expectations and potentially to actual inflation outcomes. This would be unfortunate at a time when our surveys show that in September 2023, households’ inflation perceptions have fallen by 50 basis points (bps) since July 2023, with expectations of lower price and inflationary pressures across most product groups and categories of respondents. 63. Inflation prints for September and October will need to be monitored carefully to look out for the moderation that our projections anticipate. If we tame inflation durably, we will prepare the ground for a long innings of strong and stable growth. Our projections anticipate that growth will gather positive momentum from the second quarter onwards. Monetary policy can contribute by remaining sufficiently disinflationary without being overly restraining. Accordingly, I vote for maintaining status quo on the policy repo rate and persevering with the stance of withdrawal of accommodation in this meeting of the MPC. Statement by Shri Shaktikanta Das 64. Global economic activity is decelerating under the impact of tight financial conditions, though it is proving to be more resilient than expected earlier. Headline inflation is moderating, but it remains above target levels in major economies. Monetary policy settings could remain tighter for longer in major advanced economies. Growth remains uneven in many of these countries. 65. Against the backdrop of this challenging global environment, domestic economic activity in India has exhibited resilience, with growth projected at 6.5 per cent during 2023-24. India is poised to become the new growth engine of the world backed by its strong domestic macroeconomic fundamentals and buffers. The judicious policy mix pursued during the recent years to deal with multiple and unparalleled shocks has fostered economic stability. Balance sheets of banks and corporates are strong and healthy. Construction; travel and transportation; and financial, real estate and professional services continue to maintain strong performance. The upcoming festival season is expected to give further impetus to households spending. Private sector investment is gathering pace with easing input cost pressures. Consumer outlook surveys have turned more optimistic. Business sentiment among manufacturing, services, and infrastructure companies is also optimistic. Both manufacturing and services PMI readings indicate a healthy expansion in these sectors. The external sector has remained eminently manageable, despite global headwinds. 66. The heightened inflationary pressures during July-August 2023, following the spike in vegetables prices, has once again shown that headline inflation remains vulnerable to recurring and overlapping food price shocks. Adverse weather events – unseasonal rains, skewed monsoon rainfall and unprecedented heat waves – have been major sources of food inflation pressures in recent years. Moreover, the intensity of food price shocks triggered by such events has increased, with the month of July registering the highest month-over-month increase in food prices in the current CPI series (2012=100). Such recurring supply side shocks are making episodes of high inflation more than transient. The spike in vegetable prices has likely corrected substantially in September and inflation is expected to fall significantly below the upper tolerance level of 6 per cent. The moderation in inflation in September would also be aided by the sharp reduction in household LPG prices in end-August. The projections suggest that throughout much of Q3:2023-24, food inflation pressures may not see a sustained easing, but ample buffer stocks of food grains, softening edible oil prices, and government’s proactive supply side interventions are expected to keep check on unusual price spikes of key food items. Even as headline inflation experienced considerable volatility, a silver lining has been the declining core inflation, supported by declining cost-push pressures and ongoing transmission of past monetary policy actions. 67. Going forward, inflation outlook continues to be beset with uncertainties, especially from adverse weather events, the playout of El Niño conditions, uncertainties in global food and energy prices and volatility in global financial markets. Inflation expectations of households – both three months and a year ahead – have, however, moved together to single digit for the first time since the COVID-19 pandemic. In this situation monetary policy must remain actively disinflationary to ensure that ongoing disinflation process progresses smoothly. 68. Liquidity in the banking system is expected to remain adequate in the coming months to meet the productive requirements of the economy with expected pick-up in government spending, although festival-related currency withdrawals may provide some counterbalance. The Reserve Bank has maintained a flexible and adaptive approach to liquidity management. It will remain nimble footed and ensure that liquidity is actively managed by undertaking whatever operations are necessary from time to time, including open market operation sales (OMO-sales). Needless to state, the timing and quantum of such operations will depend on the evolving liquidity conditions. 69. To sum up, domestic economic growth is maintaining the momentum. Our fundamental goal is to align inflation with the 4.0 per cent target and anchor inflation expectations. Recurring incidences of large and overlapping supply side shocks bring with them the risks of generalisation of inflation impulses, possible loss of monetary policy credibility and de-anchoring of inflation expectations. Monetary policy has to remain extra alert and ready to act, if the situation warrants. The hard earned macroeconomic stability has to be preserved. Accordingly, I vote for keeping the policy repo rate unchanged in this meeting of the MPC and continuing the focus on withdrawal of accommodation. (Yogesh Dayal) --- 1 Defined as excluding food and beverages, pan, tobacco and intoxicants and fuel and light. 2 Goyal, Ashima and Deepak Kumar Agarwal. 2020. ‘Policy Transmission in Indian Money Markets: The role of liquidity’, The Journal of Economic Asymmetries, 21 June e00137 https://doi.org/10.1016/j.jeca.2019.e00137. 3 Goyal, Ashima and Abhishek Kumar. 2018. ‘Money and Business Cycle: Evidence from India’. The Journal of Economic Asymmetries. 18. November. https://doi.org/10.1016/j.jeca.2018.e00105 4 Threshold diffusion indices capture the dispersion of price increases in CPI basket beyond the specified seasonally adjusted annualised rate (SAAR) thresholds of 4 per cent and 6 per cent. 5 Physical savings data will be released by NSO in end-February 2024. |

|||||||||||||||

9911796707

9911796707