| News | |||

|

|

|||

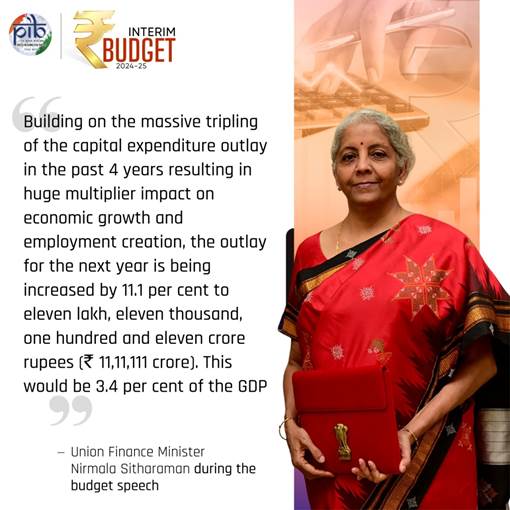

SIGNIFICANT BOOST TO CAPITAL EXPENDITURE; TO BE INCREASED BY 11.1 PER CENT TO ₹ 11,11,111 CRORE; AMOUNTING TO 3.4 PER CENT OF THE GDP |

|||

| 1-2-2024 | |||

FISCAL DEFICIT IN 2023-24 (RE) TO BE 5.8 PER CENT OF GDP; ESTIMATED TO BE 5.1 PER CENT OF GDP IN 2024-25 While presenting the Interim Budget 2024-25 in Parliament today, the Union Minister of Finance and Corporate Affairs, Smt. Nirmala Sitharaman outlined the Capital Expenditure Outlay, Revised Estimates 2023-24 and Budget Estimates 2024-25. Significant boost to Capital Expenditure Outlay Union Finance Minister said that the Capital Expenditure outlay for 2024-25 is being increased by 11.1 per cent to eleven lakh, eleven thousand, one hundred and eleven crore rupees (₹ 11,11,111 crore). This amounts to 3.4 per cent of GDP. In addition, she mentioned that the massive tripling of the CapEx over the last 4 years is resulting in huge multiplier impact on economic growth and employment creation.

Revised Estimates 2023-24 Union Finance Minister said, “the Revised Estimate of the total receipts other than borrowings is ₹ 27.56 lakh crore, of which the tax receipts are ₹ 23.24 lakh crore. The Revised Estimate of the total expenditure is ₹ 44.90 lakh crore”. Talking about the revenue receipts, she said that the revenue receipts at ₹ 30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy. She further mentioned that notwithstanding moderation in the nominal growth estimates, the Revised Estimate of the fiscal deficit stood at 5.8 per cent of GDP, improving upon the Budget Estimate. Budget Estimates 2024-25 In 2024-25, the total receipts other than borrowings are estimated to be ₹ 30.80 lakh crore and the total expenditure is estimated at ₹ 47.66 lakh crore. The tax receipts are estimated at ₹ 26.02 lakh crore. Further, Union Finance Minister said, “the scheme of fifty-year interest free loan for capital expenditure to states will be continued this year with total outlay of ₹1.3 lakh crore”. Smt. Sitharaman said, “the fiscal deficit in 2024-25 is estimated to be 5.1 per cent of GDP”. Adhering to the path of fiscal consolidation as mentioned in her Union Budget speech for 2021-22, she mentioned to reduce it below 4.5 per cent by 2025-26.

Market Borrowings Union Finance Minister said that, during 2024-25, gross and net market borrowings through dated securities are estimated at ₹ 14.13 lakh crore and ₹ 11.75 lakh crore respectively. While talking about the increase in private investments, she said, “lower borrowings by the Central Government will facilitate larger availability of credit for the private sector”. |

|||

9911796707

9911796707