| News | |||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

MCA operationalises Central Processing Centre (CPC) for Centralised Processing of Corporate Filings |

|||||||||||||||||||||||||||

| 16-2-2024 | |||||||||||||||||||||||||||

12 forms/applications will be processed at CPC from 16.02.2024; followed by other forms from 01.04.2024 onward On the lines of continuous endeavor to provide Ease of Doing Business in pursuance to Union Budget Announcement 2023-24, Central Processing Centre (CPC) has been established to process forms filed as part of various regulatory requirements under Companies Act and Limited Liability Partnership Act (LLP Act) in a centralised manner, requiring no physical interaction with the stakeholders. From 16.02.2024, 12 forms/applications as listed below shall be processed at CPC, followed by other forms from 01.04.2024 onward. Later, forms/applications filed under LLP Act are also proposed to be centralised. Based on filing trends, it is expected that about 2.50 lakh forms will be processed through CPC annually, once it is fully operational.

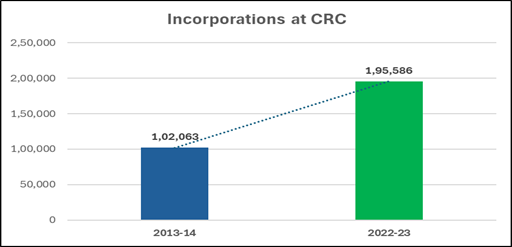

As of now, 4,910 forms have been received by CPC after commencing operations. The forms shall be processing a timebound and faceless manner. Processing of applications at CRC and C-PACE also does not require any physical interaction with the stakeholders. The Central Registration Centre (CRC), Centralised Processing for Accelerated Corporate Exit (C-PACE), and CPC will ensure speedy processing of applications and forms filed for incorporation, closure and for meeting regulatory requirements so that the companies are incorporated, closed, can alter and raise capital, and are able to complete their various compliances under the corporate laws with ease. After the establishment of CPC, jurisdictional Registrar of Companies (RoC), will have to focus more on their core functions of inquiries, inspection and investigation for ensuring robust corporate governance. Further Steps towards Ease of Doing Business Over the past many years, the Ministry of Corporate Affairs has taken several steps towards Ease of Doing Business. An important part of the EoDB has been initiatives taken towards ease of entry in terms of quicker incorporation of companies. Central Registration Centre (CRC) was established for centralised, expeditious, transparent processing of applications filed for companies and LLPs for incorporation in Non-STP (Straight Through Processing) mode. This has yielded desired results. While during FY 2013-14, 1,02,063 Companies and LLPs were incorporated, during FY 2022-23, 1,95,586 Companies and LLPs got incorporated, registering an increase of about 92%.

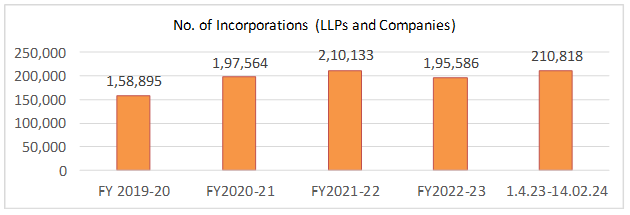

Incorporation of LLPs and companies till 14.02.2024 this financial year has been not only more than the previous Financial Year 2022-23, but also the highest as compared to any of the previous financial years. Following ease of entry, it was announced in the Union Budget Speech 2022-23 to establish Centralised Processing for Accelerated Corporate Exit (C-PACE) for expeditious voluntary closure of companies under the provisions of Section 248(2) of Companies Act, 2013 from more than 2 years to less than 6 months. Accordingly, C-PACE was established and operationalised on 01.05.2023. Under C-PACE, applications filed for voluntary closure of companies are getting processed in Non-STP within an average time of less than 4 months (about 100 days) compared to an average time of more than 18 months earlier. C-PACE has processed and closed 12,441 companies so far. Only 3,368 applications are pending with C-PACE, the lowest as compared to any previous year. |

|||||||||||||||||||||||||||

9911796707

9911796707