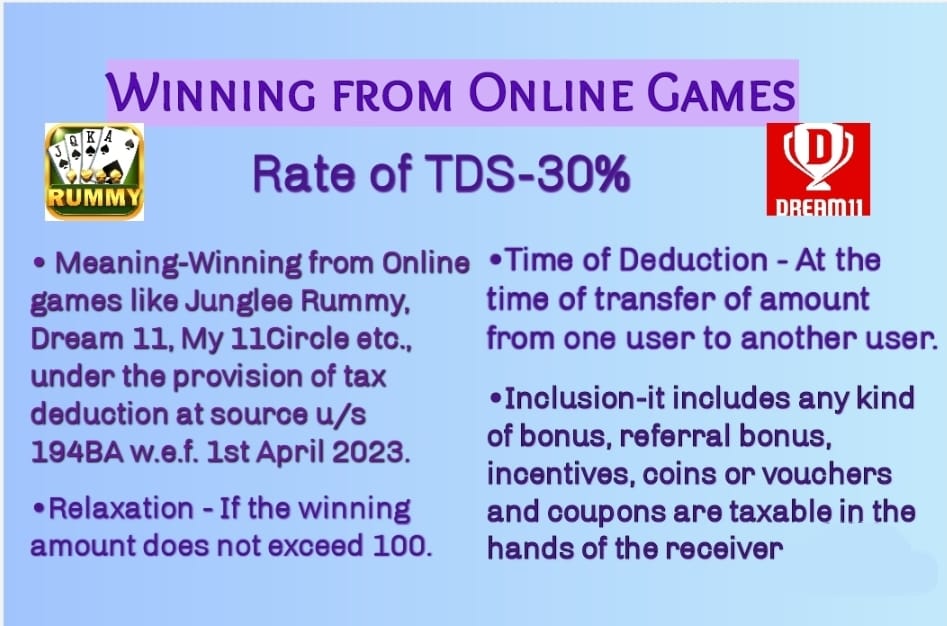

TDS on Winnings from online games - Guidelines - Computation of ...

CBDT Issues Guidelines on TDS for Online Gaming Winnings, Covering Net Winnings, Bonuses, and Withdrawals.

May 26, 2023

Circulars Income Tax

TDS on Winnings from online games - Guidelines - Computation of Net winning - TDS in case a user borrows some money and deposits the same - treatment of bonus, referral bonus, incentives etc. - When the amount is considered as withdrawn - TDS in case of insignificant withdrawal - TDS on net winning in kind - valuation of winning in Kind. - CBDT issues Guidelines

View Source