Reopening of assessment - determination of the 'income ...

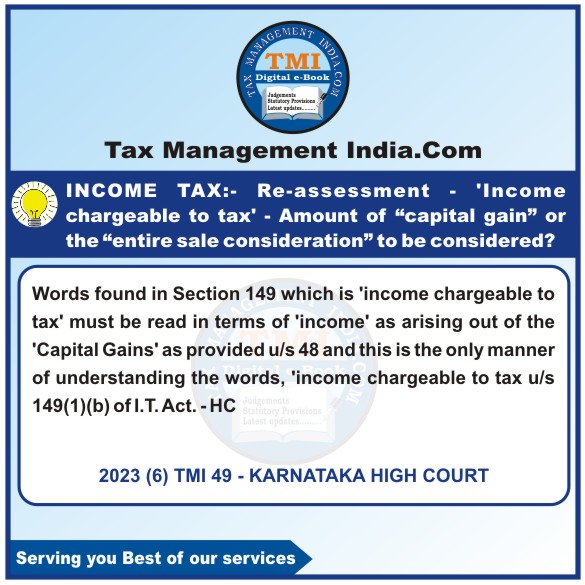

Clarifying 'Income Chargeable to Tax' for Reopening Assessments: Focus on Capital Gains, Not Total Sale Consideration u/s 149.

June 1, 2023

Case Laws Income Tax HC

Reopening of assessment - determination of the 'income chargeable to tax' - The amount of “capital gain” is to be considered or the “entire sale consideration” to be considered - In the present case, the words found in Section 149 which is 'income chargeable to tax' must be read in terms of 'income' as arising out of the 'Capital Gains' as provided under Section 48 and this is the only manner of understanding the words, 'income chargeable to tax under Section 149(1)(b) of I.T. Act. - HC

View Source