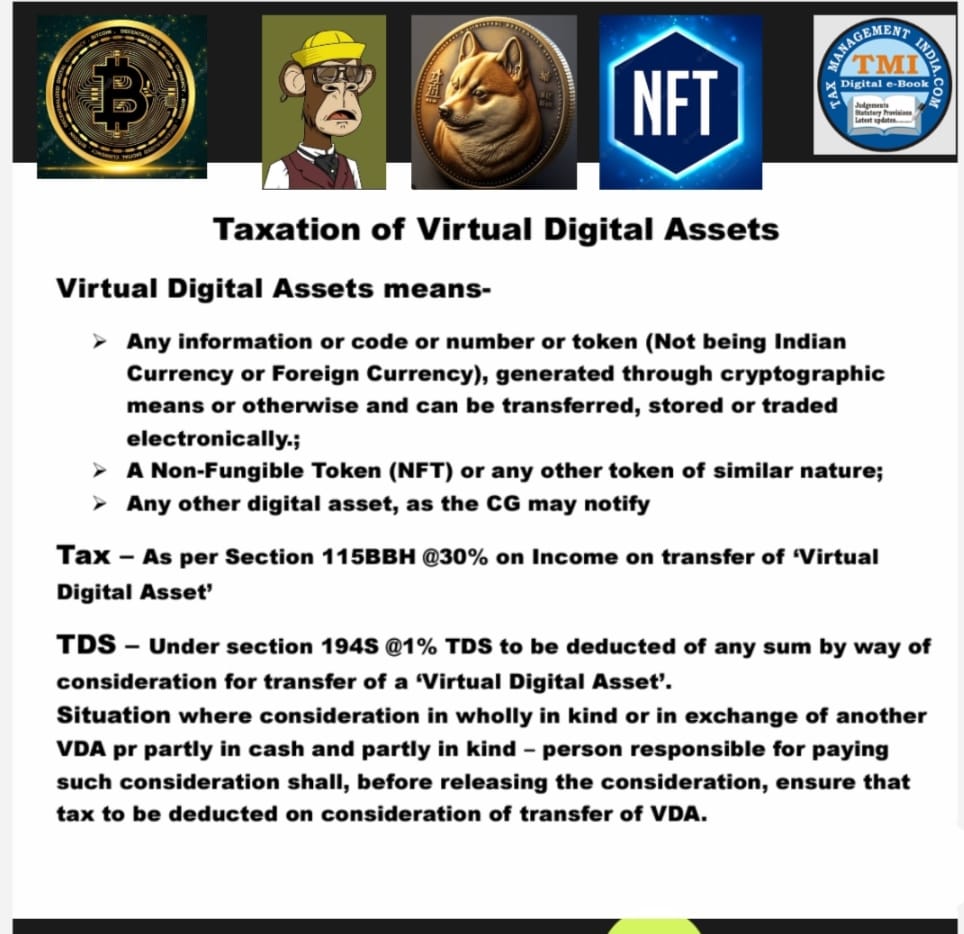

Section 194S : TDS on payment on transfer of virtual digital ...

Tax Deduction Required for Virtual Asset Transfers u/s 194S to Ensure Compliance and Proper Reporting.

June 1, 2023

Manuals Income Tax

Section 194S : TDS on payment on transfer of virtual digital asset - Deduction of Tax at Source (TDS), Collection of Tax at Source (TCS) / Withholding Tax

View Source