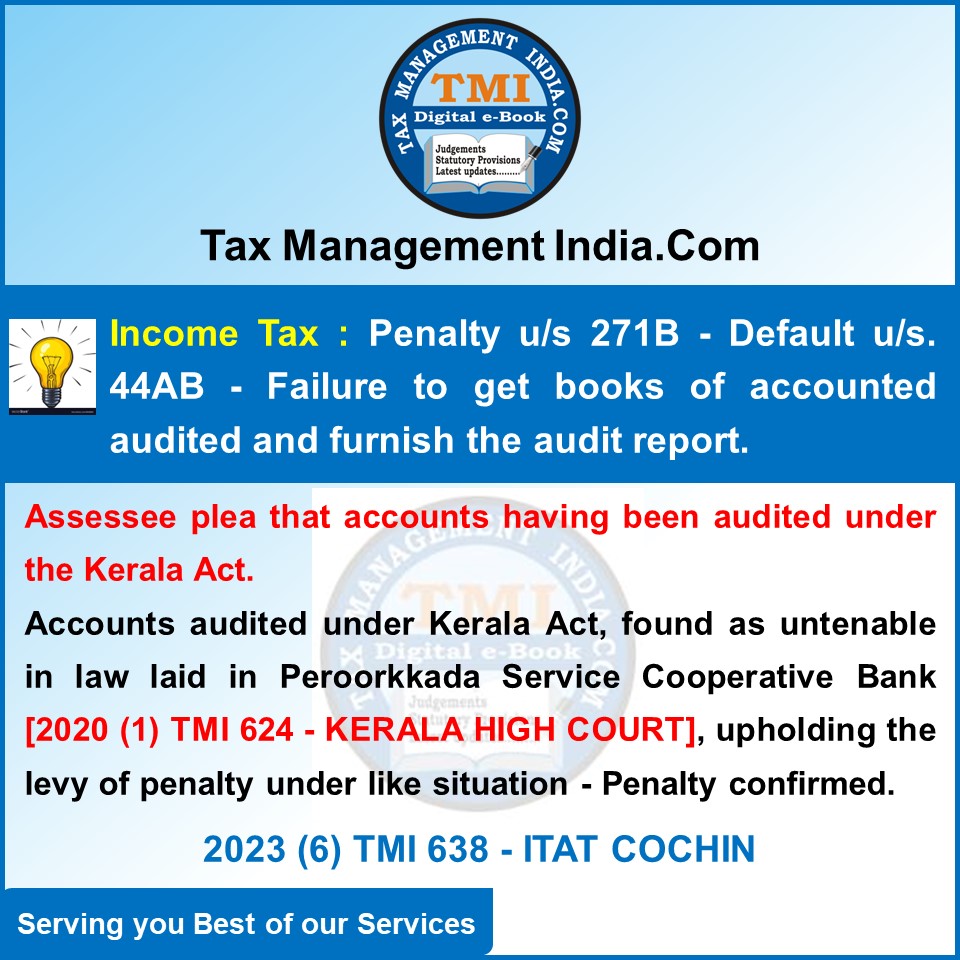

Penalty u/s 271B - default u/s. 44AB - failure to get books of ...

Penalty Imposed for Failure to Audit Books u/s 44AB; Plea of Kerala Act Audit Rejected, Penalty Confirmed.

June 16, 2023

Case Laws Income Tax AT

Penalty u/s 271B - default u/s. 44AB - failure to get books of accounted audited and furnish the audit report - reasonable cause - Assessee plea that accounts having been audited under the Kerala Act - Levy of penalty confirmed - AT

View Source