Offence u/s 276CC r.w.s 278E - Prosecution proceedings against ...

Company Directors Face Legal Action for Not Filing Tax Returns, Minimum Sentence Imposed u/s 276CC.

June 17, 2023

Case Laws Income Tax DSC

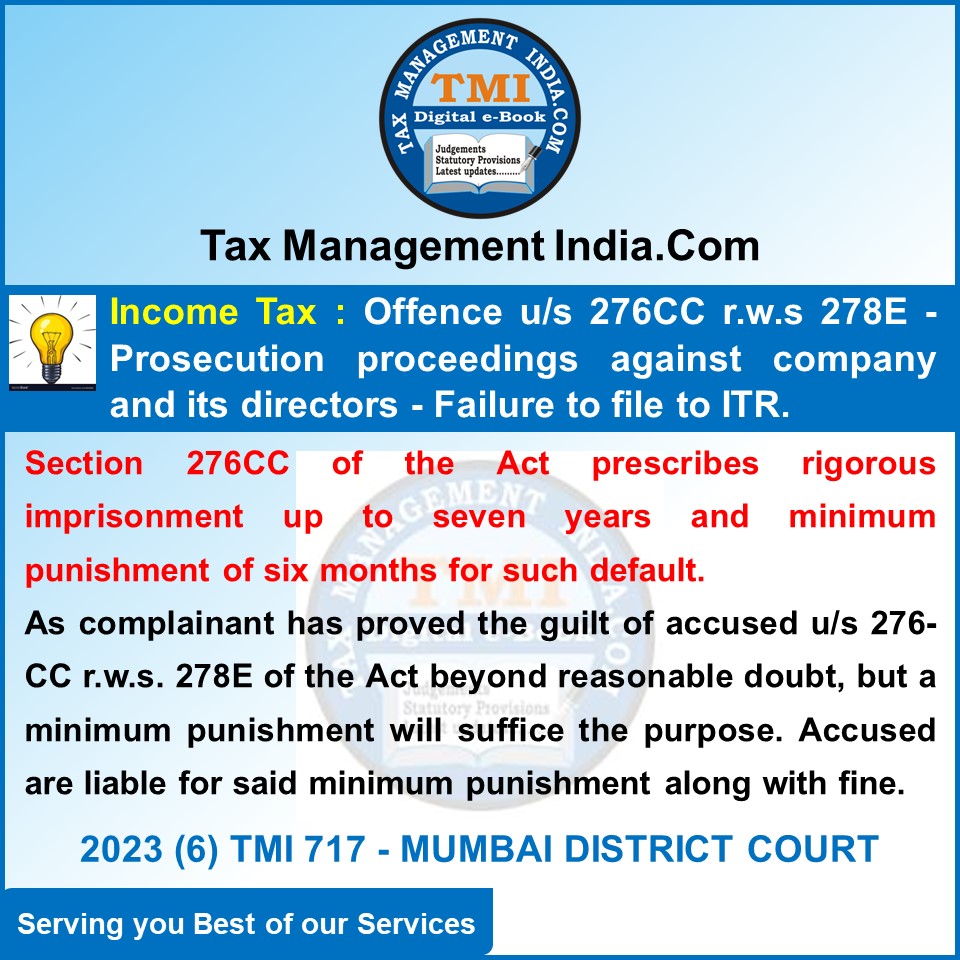

Offence u/s 276CC r.w.s 278E - Prosecution proceedings against the company and its directors - Failure to file to ITR - Section 276CC of the Act prescribes rigorous imprisonment up to seven years and minimum punishment of six months. However, considering the circumstances of the case and request of the accused and their advocate, a minimum punishment will suffice the purpose. Therefore, the accused are liable for said minimum punishment along with fine. - DSC

View Source