Complaint u/s 276C (2) r.w.s. 278B - Allegation of willful ...

Directors Challenge Tax Evasion Liability Amid Company Liquidation; Seek Dismissal u/ss 276C(2), 278B, and 179.

June 21, 2023

Case Laws Income Tax HC

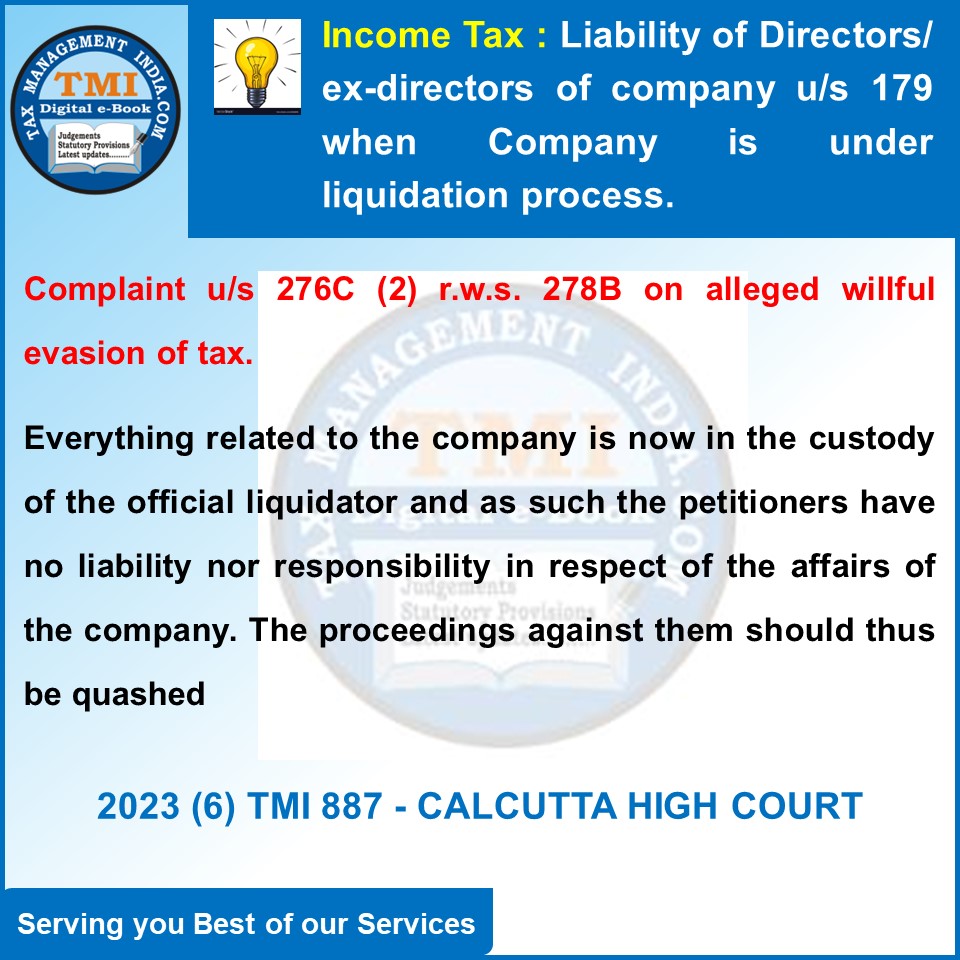

Complaint u/s 276C (2) r.w.s. 278B - Allegation of willful evasion of tax - Liability of Directors / ex-directors of company u/s 179 - Company is under liquidation process - Everything related to the company is now in the custody of the official liquidator and as such the petitioners have no liability nor responsibility in respect of the affairs of the company. The proceedings against them should thus be quashed. - HC

View Source