Determination of GST / Assessment under GST - To be followed by ...

GST Act Sections 73 & 74: Broader Scope Beyond Returns Scrutiny. Initiation Possible via Audit or Credible Info.

June 30, 2023

Case Laws GST HC

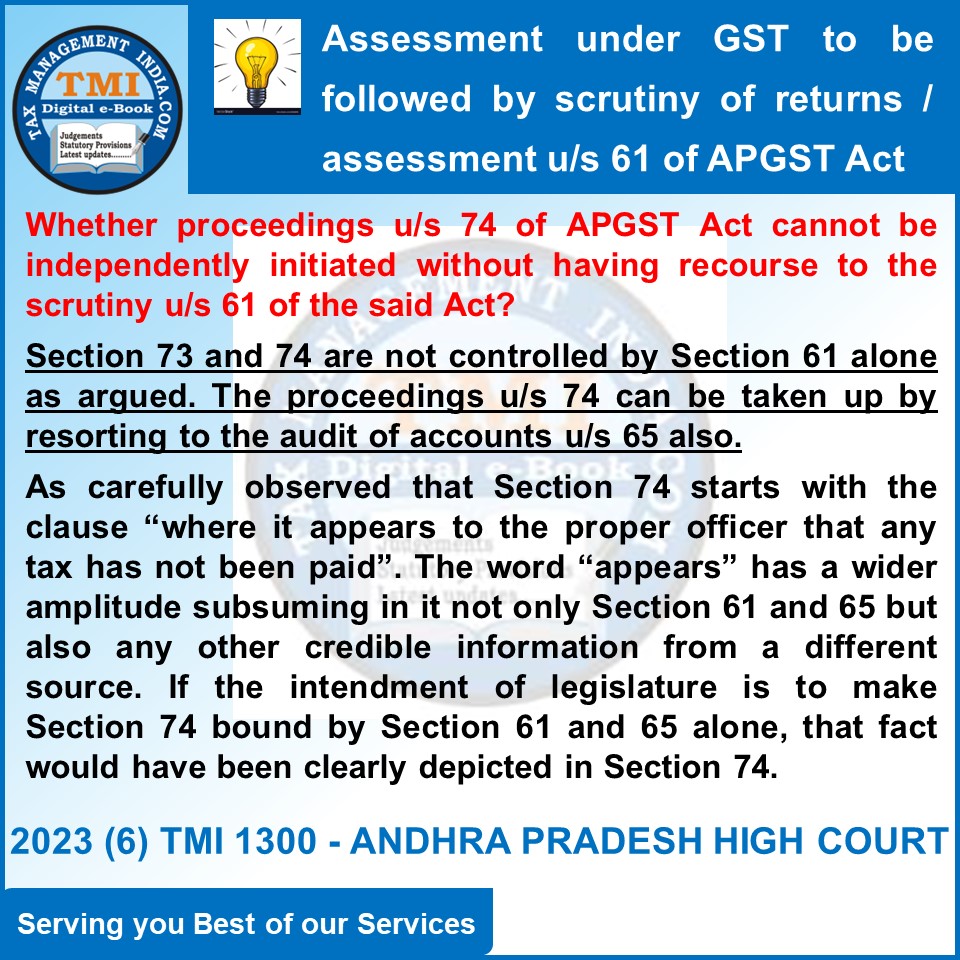

Determination of GST / Assessment under GST - To be followed by scrutiny of returns / assessment u/s 61 or not? - Section 73 and 74 are not controlled by Section 61 alone as argued by the petitioner. The proceedings u/s 74 can be taken up by resorting to the audit of accounts u/s 65 also - It should be carefully observed that Section 74 starts with the clause “where it appears to the proper officer that any tax has not been paid”. The word “appears” has a wider amplitude subsuming in it not only Section 61 and 65 but also any other credible information from a different source. If the intendment of legislature is to make Section 74 bound by Section 61 and 65 alone, that fact would have been clearly depicted in Section 74. - HC

View Source