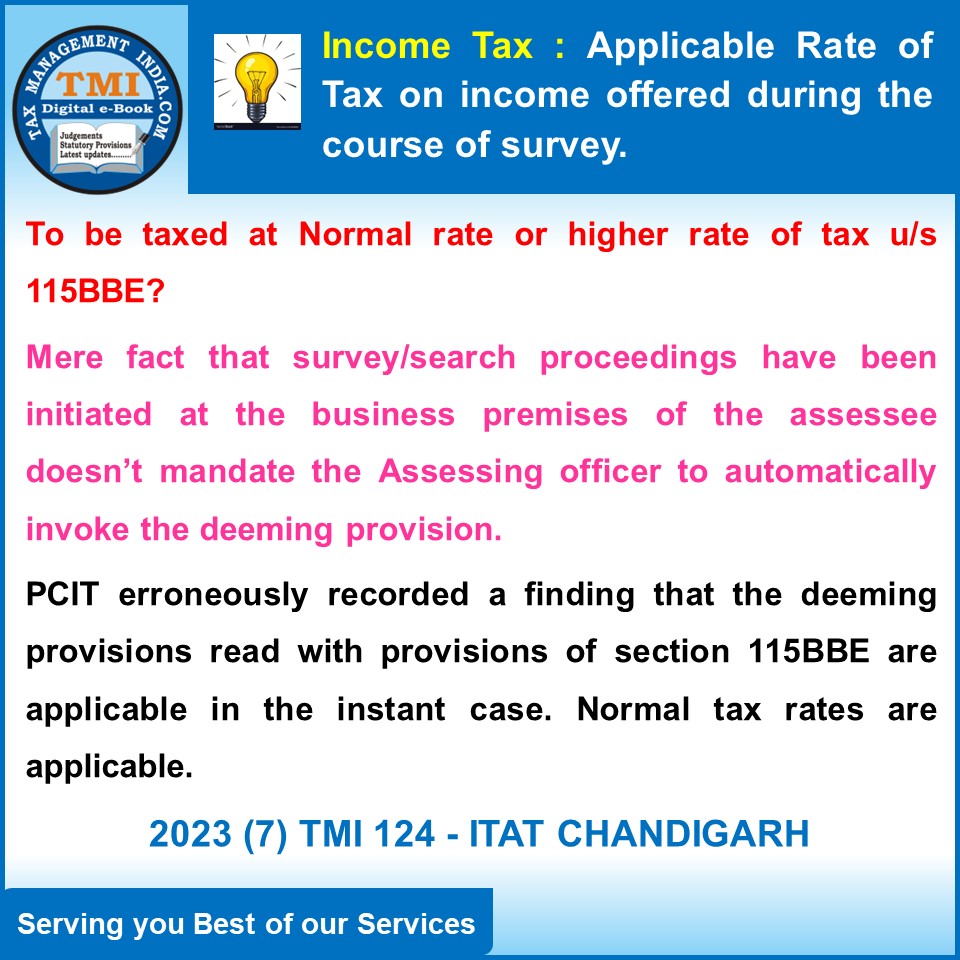

Revision u/s 263 - income offered during the course of survey - ...

Section 263 Revision: Business Income Assessed at Normal Tax Rate, Not Section 115BBE's Higher Rate, Revision Order Overturned.

July 4, 2023

Case Laws Income Tax AT

Revision u/s 263 - income offered during the course of survey - Applicable rate of tax - the explanation offered by the assessee during the course of survey regarding the source of such income and thereafter, has assessed the income under the head “business income”. The view so taken by the Assessing officer is after due application of mind and therefore cannot be held as unsustainable in the eyes of law. - normal tax rate are applicable and the tax rate as per section 115BBE not applicable - Revision order set aside - AT

View Source