Exemption form GST - Education being provided by the applicant - ...

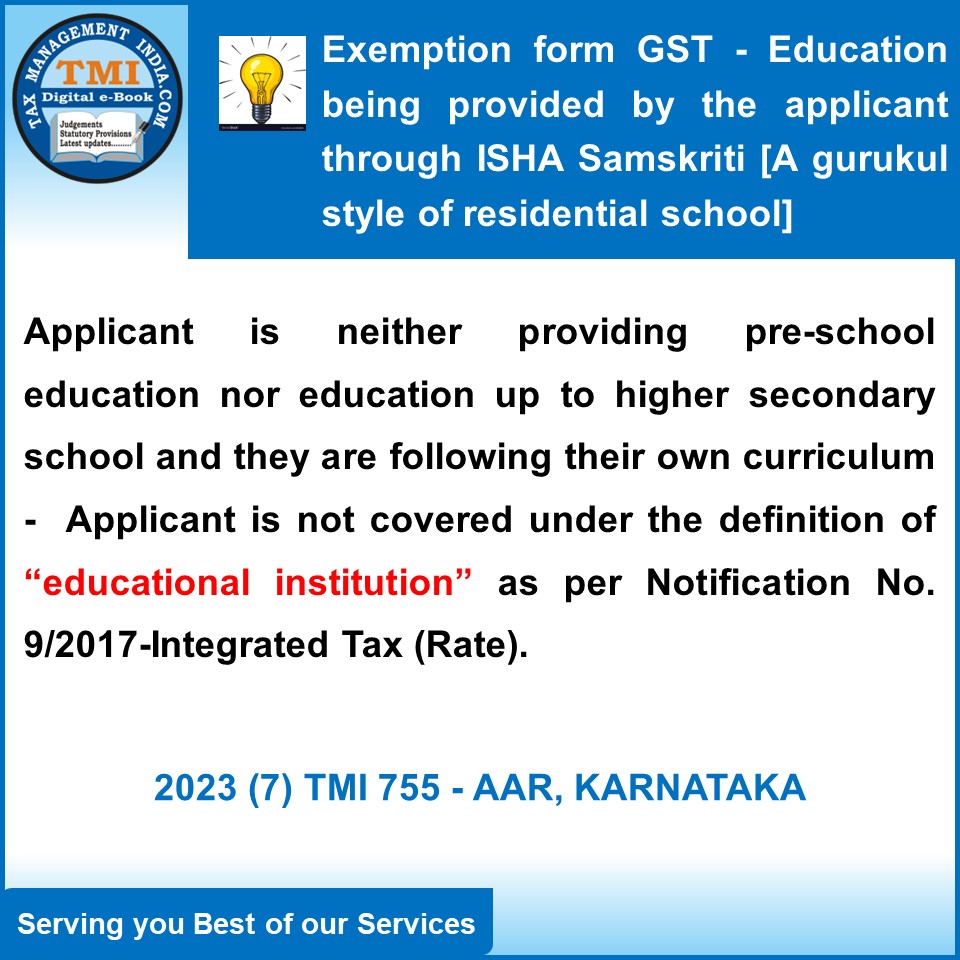

GST Exemption Denied for 'Isha Samskriti' as It Doesn't Qualify as Educational Institution Under Notification No. 9/2017.

July 19, 2023

Case Laws GST AAR

Exemption form GST - Education being provided by the applicant - Running of 'Isha Samskriti' / Gurukul - The Applicant is neither providing pre-school education nor education up to higher secondary school and they are following their own curriculum. In view of the above the Applicant is not covered under the definition of “educational institution” as per Notification No. 9/2017 - AAR

View Source